A merger is a process in which a company combines with another company to form a single entity. There are many types of mergers; one of them is a reverse merger.

What is Reverse Merger?

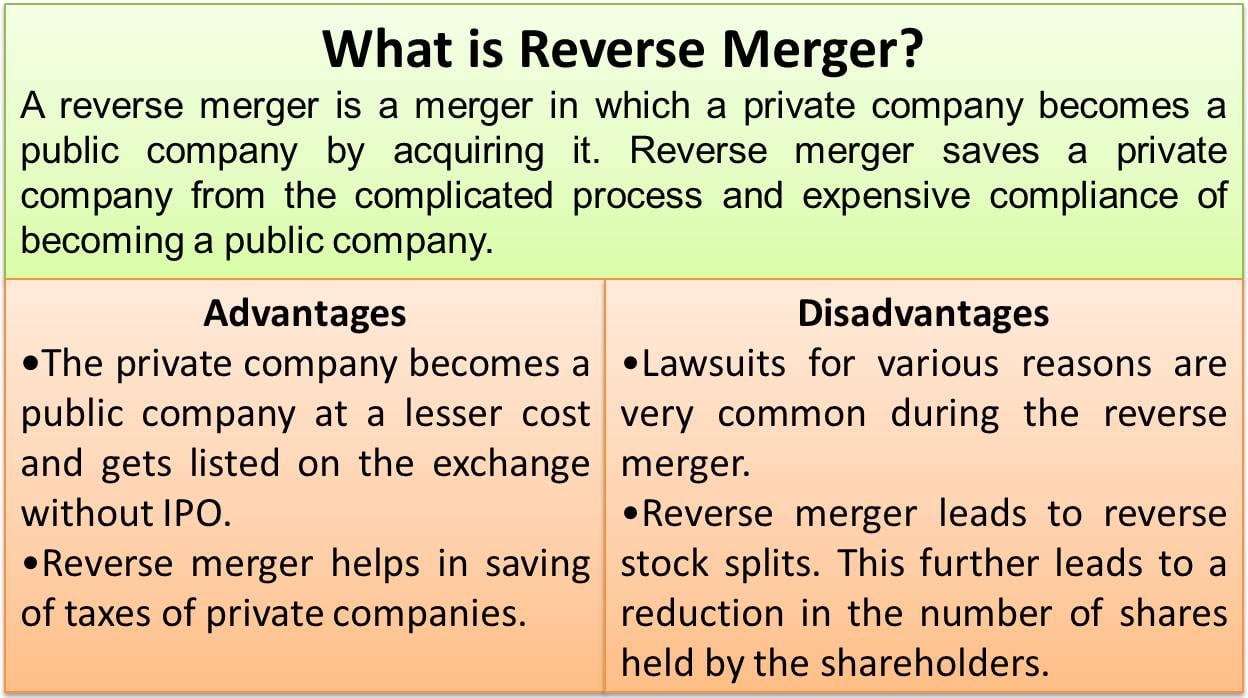

A reverse merger is when a private company becomes a public company by acquiring it. It saves a private company from the complicated process and expensive compliance of becoming a public company. Instead, it acquires a public company as an investment and converts itself into a public company.

However, there is another angle to the concept of a reverse merger. When a weaker or smaller company acquires a bigger company, it is a reverse merger. In addition, when a parent company merges with its subsidiary or a loss-making company acquires a profit-making company, it is also termed a reverse merger.

Let us understand why companies opt for this type of merger.

Why Reverse Merger?

This merger is like solving a basic math question of 1+2 or 2+1, where the answer would be the same. There are many regulations and compliance on private companies converting to public companies.

Also Read: Reverse Merger Process

Hence, this merger is an easy way for a private company to convert into a public company.

Another reason for opting for this merger is to save taxes. The losses of smaller companies can be carried forward when they become a combined entity. This results in companies having to pay lesser taxes. The listing of a company on the exchange via IPO is a long task that is full of compliance. Therefore, large companies opt for this merge with smaller companies that are listed on the exchange. This way, the company gets listed on the exchange and becomes a public company without an IPO.

Reverse Merger Process

There is a detailed process for a reverse merger. Broadly, the stages of reverse mergers include the following:

- Identification of a Suitable Shell Co.

- Recruiting Financial Staff

- Financial Audits

- Transaction Documents like a letter of intent, agreement, super 8-k

- Issuance of Stock Certificates

Let us now see its advantages and disadvantages.

Advantages of Reverse Merger

- The private company becomes a public company at a lesser cost and gets listed on the exchange without IPO.

- This type of merger does not create a negative impact on the competition in the market. The chances of reverse mergers being put on hold due to negative impact are very less.

- It helps in saving taxes of private companies.

Disadvantages of Reverse Merger

- Lawsuits for various reasons are very common during the reverse

- Often, the promises made during mergers do not come true, leading to almost no value increase for the shareholders.

- It leads to reverse stock splits. This further leads to a reduction in the number of shares held by the shareholders.

- It leads to inefficiency in operations as the private company’s managers do not have the expertise to run a public company.

Conclusion

Such a merger has become a popular mode of business restructuring. It benefits not only the company but also the shareholders. It results in efficient use of available resources and safeguards the interest of different stakeholders. This merger adds value to the business and enhances its future sustainability. If all the legal compliance is followed, a reverse merger should not be viewed with suspicion. Even though the process of this type of merger can be time-consuming, but it can unlock tremendous business value.

Very good notes.