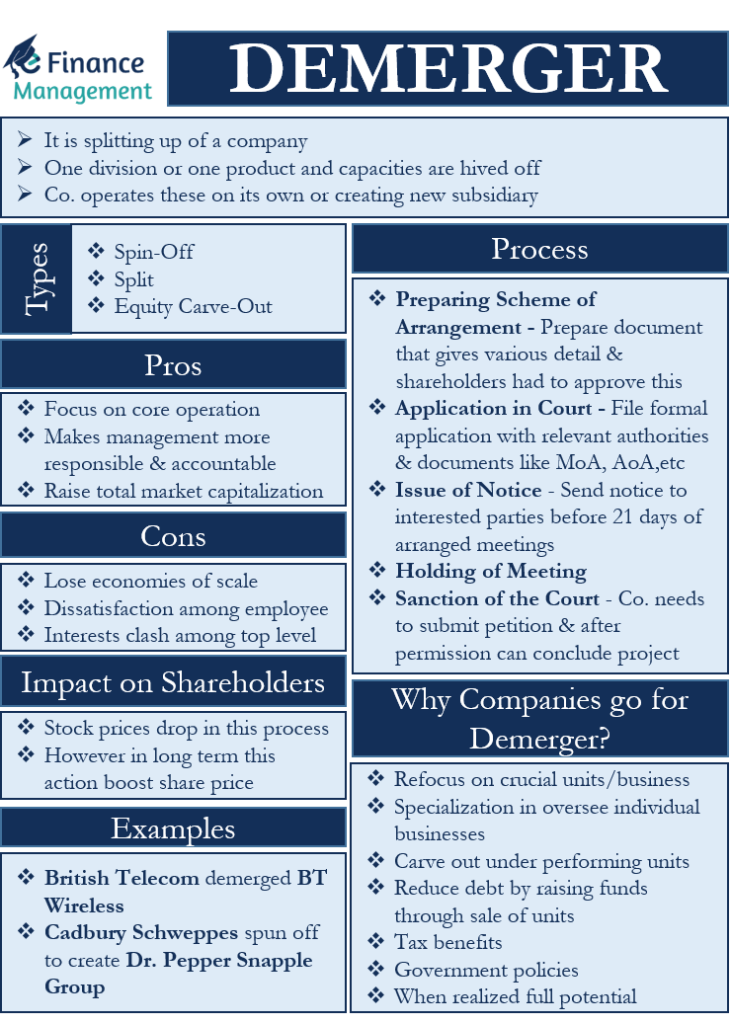

The demerger is the opposite of a merger, and thus, it means the splitting up of a company. In simple words, one division or one product and those capacities are hived off. It is primarily a corporate restructuring strategy, where a company divides its business into various components. The company either operates these components on its own or by creating a new subsidiary. Or sells some or all components to another company.

Usually, a big diversified firm may choose to focus on its core operations. And thus, it may transfer its other secondary or non-related businesses to another company or create an independent company. In this case, we say that the company is going for a demerger. A company may also select this corporate strategy to invite or prevent an acquisition or raise more funds by selling business that does not seem to fit its core business.

A company that sells its components is referred to as a “demerged company,” and the new entity that gets created due to the selling is referred to as the “resulting company.”

Why do Companies go for Demerger?

Following are some of the popular reasons why companies go for demergers:

- It allows a firm to refocus its efforts on the units or businesses that it feels are more important or would add to the shareholder value.

- Demergers also give firms a chance to have specialists oversee individual businesses.

- Such a strategy gives firms a chance to carve out businesses that are not performing as per the expectations or are dragging down the overall company’s results. Or wherever new opportunity and upcoming idea needs focussed attention, the management may also think of going for demerger.

- Demerging can also help a business reduce debt by raising funds by selling a segment or a unit.

- Companies may go for demergers to create tax benefits.

- Government policies can also encourage or force a company to go for a de-merger – size, monopoly-like situations, etc.

- Management can also use such a strategy if they are aware of something about a unit that others do not know about it yet. So, the management would want to divest that unit before someone else finds out about it. In such a case, insiders benefit the most from de-mergers.

- If any segment of a company is showing incredible growth in a short period, then the management may de-merge that segment. Such an action would help that segment to realize its full potential.

Types of Demerger

Following are the type of demergers:

Spin-Off

In this, a parent company makes a segment or unit a separate entity. For instance, Company A has two businesses – mobiles and mobile screens. Now, if Company A spinoff its mobile unit, it would create a separate entity suppose, Company B. Now, both companies would exist as separate legal entities.

Also Read: Divestitures

In a spin-off, the parent company usually gets a stake in the new company that equals to the equity they give up in the original firm. In cases where the selling firm retains some part of the spun-off identity, it is called a partial de-merger.

Split

If a company splits its business into separate companies and the original company ceases to exist, then it is a split. In the above example, if Company A splits its mobiles and mobile screens business into two new entities, Company B and Company C, then it is a split. In a split, Company A would not exist.

Separately, a split can be of two types – split-up and split-off. In a split-up, a new holding company and subsidiaries are created from the original company. But, in a split-off, the original company creates a new company and then sells it to an outsider.

Equity Carve-Out

If a company sells some or full equity in a business unit to an external party or a strategic investor, then we call it an equity carve-out. A point to note is that spin-offs and splits do not involve selling to a third party. Also, spin-offs and splits do not result in an infusion of cash. In equity carve-out, the parent company exists, but the parent company has no stake or control over the new entity. It is owned or controlled by an outsider.

Also Read: Conglomerate Merger

De-merger Process

Below are the major steps in a de-merger process:

Preparing Scheme of Arrangement

A company prepares this document to give all details of the demerger to the stakeholders. For instance, the document includes the share swap ratio, transfer of employees, transfer of assets and liabilities, and more. All stakeholders need to approve the scheme of arrangement in the meeting.

Application in Court

A company needs to file a formal application for a de-merger with the relevant authorities. It needs to back the application with more documents, including Memorandum and Articles of Association, Audited balance sheets, list of Shareholders and Creditors, Scheme of Arrangement, Document showing the Board approving the plan, etc.

Issue of Notice

The company needs to send a notice of its action to the interested parties. This notice is generally sent 21 days before the date of the meeting. Moreover, the notice must accompany the proposed scheme of arrangement and proxy forms.

Holding of Meeting

A company needs to hold a meeting in accordance with the court guidelines. And, all votes in support or against the action must be properly recorded.

Sanction of the Court

Finally, a company needs to submit a petition to the court to permit the de-merger. Once the court authorizes the de-merger, the company can move ahead to conclude the process.

Demerger Process on Balance Sheet

A company usually follows the below steps to carry out a de-merger:

- The company needs to find and list the value of all the assets that are related to the resulting firm, or that will be part of the de-emerged entity.

- Similarly, the value of the liabilities also needs to be found and listed.

- After verification, these values need to move out of the parent company’s balance sheet and be added to the resulting company’s balance sheet. The transfer takes place at the current written-down value.

How does it Impact Shareholders?

Usually, a company’s stock price drops in the event of a demerger. This is because the assets that a firm once had no longer exist on its balance sheet. Thus, it reduces the book value of the balance sheet.

However, in the long term, such an action could boost the share price of the company. The company can now have full attention and focus on its core strength and operations, and all the capabilities could be used to drive that further. The distraction and the distribution of resources to other segment is no more there. So, it would eventually lead to a win-win situation for both firm and investors.

Examples of Demerger

British Telecom, in 2001, demerged its mobile phone unit, BT Wireless. The company took this action because it was struggling due to BT Wireless’ high debt levels.

In 2008, Cadbury Schweppes spun off its U.S. beverages unit to create a new entity called Dr. Pepper Snapple Group.

Pros and Cons of Demerger

Let us discuss first the benefits of a demerger:

- The biggest advantage of the demerger is the focus the entity can have on its core operations without any distractions. And all other resources at its command can be put for growing the core operations.

- When there is a split-off, the management of each firm becomes accountable for its actions. This allows the management to be more responsible for boosting the shareholder value.

- Demergers can also help companies to raise the total market capitalization. If the demerged entity performs as per the expectations, it will boost the market capitalization of the parent company as well.

Now let us discuss the disadvantages of a demerger:

- The parent firm may lose the advantage of economies of scale. This is because, after the de-merger, the parent company gets smaller in size.

- In a de-merger, employees also had to demerge. Some employees remain with the parent company, while some have to join the resulting company. If the employee split is as per their consent, then everything is okay. However, at some or other stage, some sort of dissatisfaction does happen. And that becomes a de-motivating factor for them. In such a case, they may even quit their job, besides their reduced efficiency.

- Management could also witness a clash of interests. This is because a de-merger may increase the number of top-level managers. So, it is possible that the views of the new managers may not always be in-line with the other managers.

Final Words

Demergers are a very effective corporate strategy that could offer several benefits to both the parent company and the resulting company. This strategy could help the management to unlock value, as well as streamline its operations. Of course, there may be instances where the demerger is part of a tax planning exercise to avoid or reduce or evade the tax burden by transferring part of its assets and liabilities. Thus, it is important that relevant authorities properly scrutinize the demergers.