Compulsory Liquidation: Definition

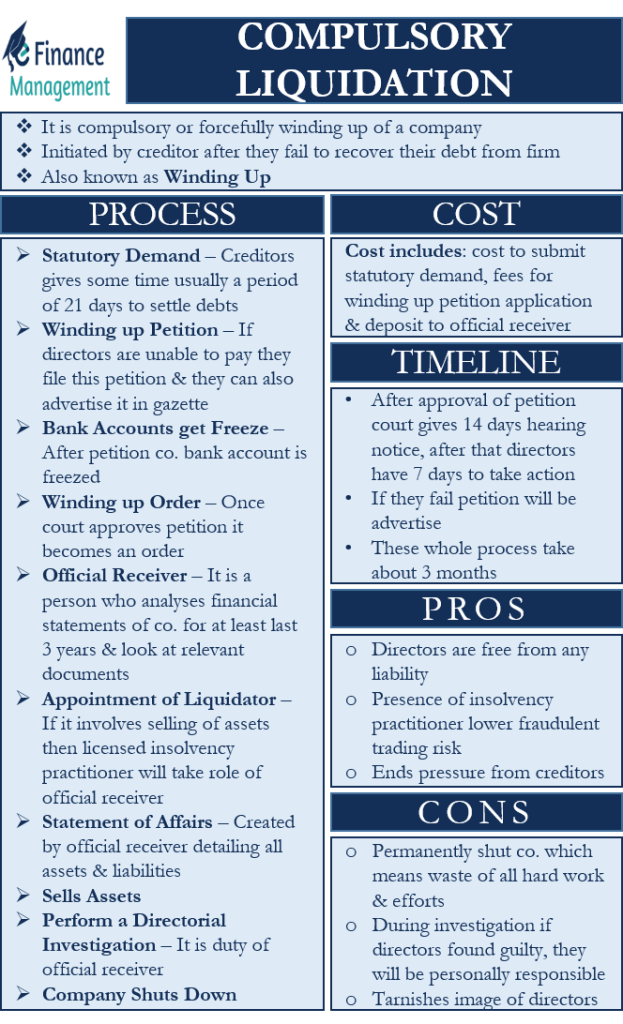

Compulsory Liquidation, as the word suggests, is the compulsory or forceful winding up of a company. Such liquidation is thrust upon or initiated by a creditor or a group of creditors. And these creditors either have failed in their attempt to recover their dues and/or are of the firm opinion that the company will not be able to pay off their dues. Therefore, they issue a Winding up Petition to safeguard their interest and to avoid further erosion in the value of company’s assets. And the court orders the liquidation if it also believes that the company will not be able to pay the debt.

When a court forces this liquidation, it results in business ceasing operations, directors are relieved from their duties, the directors lose control over the company and assets, the staff becomes redundant, and the assets are sold to pay back the creditors. Once the entire process of winding up is complete, the name of the company is also struck off the register. And that is the formal end of a company.

Another name for this liquidation is ‘winding up.’ It is usually the last resort of creditors to get their money back. A company can face such liquidation if it is unable to pay its debt. Or again where the court is also of the view that winding up will be just and equitable and in the interest of various stakeholders.

Why do Directors Avoid it?

Creditors usually spend a considerable amount of time and money to issue the liquidation petition. This means creditors are more hostile towards the directors.

Another worry for the directors is that the creditor-appointed liquidator would closely examine their role in bringing the company to the brink of insolvency.

Thus, if one is a director and believes that the company could get insolvent, then one should take some early action to avoid this liquidation. These actions could help one to replace Compulsory Liquidation with voluntary liquidation.

Also Read: Liquidation

Process of Compulsory Liquidation

Following is the generally adopted process for this sort of liquidation:

Statutory Demand

Before initiating the liquidation petition, creditors usually do give directors some time to settle all the debt. This period is usually of 21 days. If the debt remains unpaid even after the statutory demand period, the creditors can then move ahead with the petition.

Winding up Petition

If the directors are unable to pay the debt during the notice period, then creditors can move ahead with the petition. Also, the creditors can advertise the petition in the Gazette.

Bank Accounts get Freeze

After the creditor issues the petition, the bank immediately freezes the account of the company. Moreover, since all financial institutions have information on the petition, it becomes very difficult for the company to secure further funds or any other facilities.

Winding up Order

Once the petition is heard and the court approves the petition, the court order will become a winding-up order for all practical purposes. After the court issues the order, the company shuts down and enters compulsory liquidation.

Official Receiver

The official receiver usually analyses the financial statements of the company for at least the last three years. Also, the official receiver looks into the management accounts, invoices, and other relevant documents to ascertain the role of directors in bringing the company to the brink of insolvency.

Appointment of Liquidator

If the liquidation involves the selling of assets, then a licensed insolvency practitioner (IP) will take over the role of the official receiver.

Statement of Affairs

After taking over, the liquidator must create a Statement of Affairs. This statement details the assets and liabilities of the company.

Sells Assets

The liquidator has the responsibility to sell the various assets of the company. Further, to distribute the proceeds so received from the sale of the assets.

Perform a Directorial Investigation

The liquidator must investigate whether or not directors acted in good faith. The liquidator needs to submit its findings to the Insolvency Service.

Company Shuts Down

After the liquidator pays the creditors and all other formalities are over, the liquidation process completes. Now, the company’s name is struck off the register.

Reversal of the Process

After the liquidation process starts, it is possible to stop it if:

- The company manages to clear all its debts in full.

- If the debt listed in the statement of affairs is under dispute.

- If the company reaches an agreement with the creditors. The creditors can then withdraw their winding-up petition.

- Suppose the company assures the court of paying the debt in full if it gets sometimes. Then also looking at the realistic status of the case the court may adjourn the petition for the time being. So that the company can arrange to pay the debts in full in the given time frame. And this way the liquidation process can be avoided.

However, if the liquidation is complete, it is impossible to reverse it. This is because a company ceases to exist, and its name is struck off the register on the completion of liquidation.

Cost and Timeline of Compulsory Liquidation

Talking the cost of this liquidation, it varies on a case-by-case basis. The total cost, however, includes three main components. These are: cost to submit the Statutory Demand, fees for Winding up Petition Application, and Deposit to Official Receiver.

Now, let us talk about the timeline. After the court approves the petition, it will give a hearing date. Usually, the court provides a minimum 14 days hearing notice to the company. Once the court announces the date, the directors have seven days to take necessary action. If they fail to take any satisfactory action within seven days, then the petition will be published.

Even now, the court can dismiss the petition if the company can pay its debt or reach a consensus with the creditors. If there is nothing of this sort, then the court will issue the winding-up order.

Overall, we can say that it could take about three months from the submission of the Winding up Petition to the start of the liquidation procedure. In addition, the insolvency practitioner can take up to a year to liquidate the firm.

Advantages of Compulsory Liquidation

On the face, it could be difficult to find any benefits of this liquidation for the company and its directors. But there are a few advantages of this liquidation, and these are:

- Once the liquidation process is over, the directors are free from any liability. They can make a fresh start, join another business, and so on.

- The presence of a licensed insolvency practitioner reduces the risk of wrongful or fraudulent trading.

- Once the process starts, it ends the pressure from creditors.

Disadvantages of Compulsory Liquidation

These are the disadvantages:

- The liquidation will permanently shut the company. This means all the hard work and effort go waste.

- A liquidation process always triggers an investigation into the role of directors. If directors are found of any misconduct, they may be held personally responsible for the debt.

- Liquidation always tarnishes the image of the directors. This could potentially reduce their business prospects and make their CVs less attractive.

Impact on Directors

After the court orders liquidation, directors lose control over the company and its assets. Moreover, they are free from their roles and responsibilities. Also, they can not use the company’s assets for their benefit or to make payments to creditors.

Still, the official receiver can take the directors’ help in selling the assets. The directors also must fully cooperate with the official liquidator. If they do not co-operate, they may face prosecution.

Almost every insolvency involves an investigation into the role of the directors. The insolvency practitioner mainly wants to ensure that there is no fraud on the part of directors and that they acted in good faith and followed all laws.

If they discover any misfeasance, then they may penalize the directors. The penalty may include a fine, responsible fully or partly for the debt, or even disqualification.