Everyone knows what a budget is, and almost everyone has a budget. A budget is basically a financial plan that helps estimate the revenue and expenses for an upcoming period. One can prepare a budget for a month, quarter, year, or multi-year. Both at the personal and company level, preparing budgets are very useful in the planning process. It is seen that successful companies spend a great of time and resources in preparing and monitoring budgets. This is because their planning process depends heavily on different types of budgets, be it a master budget or other types of budgets. It won’t be wrong to say that you can’t have a good plan without a proper budget or budgets. Let’s take a look at why budgets are useful in the planning process.

Why are Budgets Useful in Planning Process?

The following points will tell why budgets are useful in the planning process:

Helps to Stay Focused

A budget assists you in assessing the long-term objectives, as well as helps to attain them. Once you have a budget, you feel incline to stick to it, and thus, it keeps a check on your expenses. Moreover, it also enables you to track the progress so that you can take corrective actions, if any, timely.

Checks Overspending

Typically, if we do not have a budget, we may overspend. Moreover, in the absence of a budget, one may take a debt to complete the spending. But, if you have a budget, you know what revenues to expect, and thus, you plan your expenses accordingly as well.

Prepare for Emergency

The future is uncertain. You never know when you may come across any unforeseen situation that could eat up all your savings and force you into debt. But, if you have a budget, it helps you to prepare for such situations by putting aside some money towards the emergency fund. This way, you create a reserve pool and backup. This backup can be of use in an emergency situation. Moreover, this pool will give you the confidence to keep you floating and work objectively.

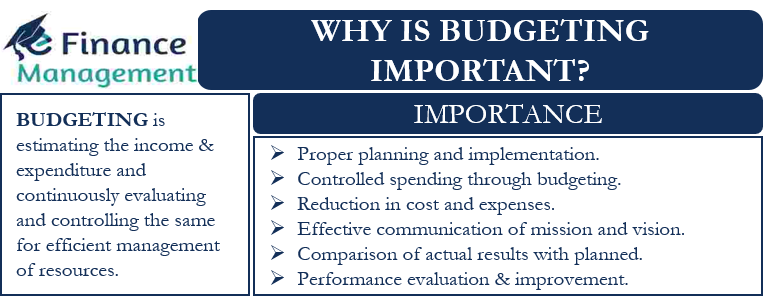

Also Read: Why is Budgeting Important?

Flags Bad Spending

In a budget, you lay out all your expenses. This way, you can check the expenses that you may not need. Also, if you compare a budget of one period with another, you can identify the expenses on which you are spending more now. Or identify the expenses that are not in line with the company’s objectives. Thus, you can decide whether increased spending is needed or not.

Communication

Yes, if a company has a budget, it becomes very easy for it to communicate its plans within the company. Within the company means the department managers, factory employees, and others. This way, they are aware of what the company expects from them. Moreover, it also helps to evaluate their and their department’s performance.

Unify Departments

Preparing a budget requires a contribution from all the departments. Since each department depends on the other departments, it leads to coordination between them. Sometimes it may also lead to clashes, but those get resolve pretty quickly with proper monitoring by the top management.

Evaluation

Like financial statements (profit and loss account and balance sheet), budgets can also help a company evaluate its performance. A company can compare its current budget with that of earlier years to determine the positive and negative variations and areas of concern.

Also Read: Budget Models

Moreover, companies can use the budget to monitor their current performance. This is possible by comparing their actual performance with the budgeted performance. Similarly, companies can evaluate the performance of the departments, managers, and other executives. We can say that budgets help a company to set benchmarks. And then compare the actual performance with the set benchmarks to identify the variances, if any.

Help to Get Financing and Attract Investors

If a business has a habit of maintaining and following budgets, it speaks well for them when they reach out to lenders. Preparing a budget assures lenders that the borrower has the ability to develop a business plan and execute it as well.

Usually, lenders and investors want to see all details of your finances. So, if you keep budgets, it becomes easy for lenders to assess your financial health. Moreover, if you are a new business, a budget can help you present your financial plans.

Similarly, an investor is unlikely to put their money in a company that isn’t clear on its financials.

Taxes

A budget includes all the revenue, income, and expenses of a company. This helps a company to get an idea of its tax liability. Also, a budget helps a company prepare its payroll taxes.

Acts as Financial Report Card

Since budgets include every financial detail of a company, it works as its Financial Report Card. This means that stakeholders can get an idea of a company’s financial health by going through the budget.

Decision Making and Strategic Planning

Budgets have everything that management (or a manager) needs to make strategic decisions. Since budgets help to monitor, evaluate and compare the performance of all internal entities, it gives management all the information it needs to make better decisions.

Plan for Future Projects

If a company plans to take up any future project, then a budget can help prepare for it. A company can make provisions in the current budget, such as setting aside funds for a future project. Moreover, it can also ask the departments to start preparing for that future project by including it in their budget. These things will ensure that a company is better prepared when it actually takes up that project.

Final Words

A business without a budget is like flying blind. This means the business will continue to operate without knowing the revenue and expenses to plan for. Usually, such businesses don’t stay active for long.

In a nutshell, we can say that a budget helps to assess the available capital, as well as estimate the revenue and expenses. This way, a manager can evaluate the business performance and ensure that they have enough resources to continue growing. Moreover, it also assists the management in focusing on cash flows, lower costs, as well as improving profits and returns on investment (RoI).

Learn more about Budgeting