What is Sales Quantity Variance?

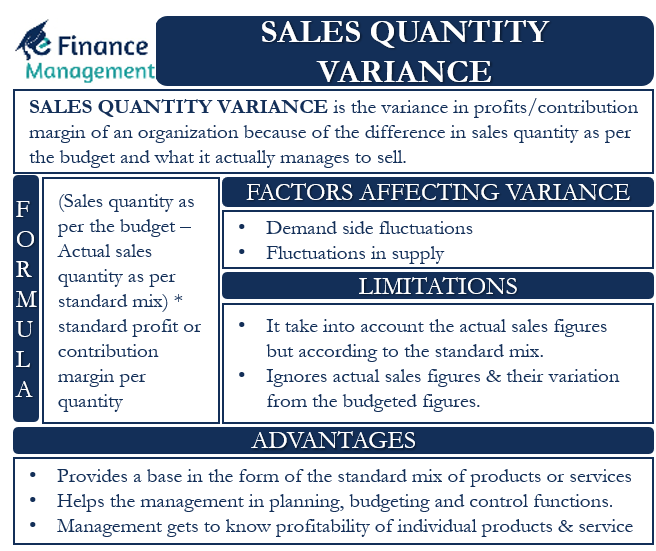

Sales quantity variance is the variance in profits or contribution margins of an organization because of the difference in sales quantity as per the budget and what it actually manages to sell. We calculate the SQV for a fixed period of time and on the basis of the standard mix of products and services. It is an important budgeting metric that helps in the planning and control functions of the management.

A favorable SQV means that the profits of the company have risen because of an actual increase in the sales quantity of products or services that it offers. The increase in profits is because of an increase in the quantity of goods for sale, and not due to a rise in prices of those goods. On the other hand, SQV will be unfavorable when the company suffers a fall in profits over a period of time. This fall will be due to a shortfall in actual sales quantity from the sales quantity as per the budget.

Sales quantity variance and the Sales Mix Variance put together are the total Sales Volume Variance. Thus, we can say that SQV is a sub-part or sub-variance of the Sales Volume Variance. There is a small difference between SQV and SVV. The sales quantity variance considers the sales numbers (quantity) according to the standard mix of products set before the start of the period. But the sales volume variance considers the overall sales volume of the goods.

What Factors affect the Sales Quantity Variance?

The factors that affect or cause SQV are:

Demand-Side Fluctuations

A change in demand for the product or service of the company will result in SQV. A rise in demand over the period under consideration will lead to higher profits, higher turnover, and a favorable SQV. A rise in demand can happen because of many factors. These factors include a change in income of the consumers, change in tastes and fashion, an increase in the price of competitor’s products, improvement in quality, technology enhancement, etc.

Also Read: Sales Volume Variance

A company can also experience unfavorable SQV because of a fall in demand. Some of the reasons for a fall in demand can be outdated technology, availability of better substitutes, fall in prices of competitor’s products, quality issues, poor marketing, and promotions, etc. This will result in lower profits and a lower turnover for the company.

Fluctuations in Supply

Fluctuations in supply are a major reason for a change in SQV of a company. A higher supply of goods and services than the budget will result in higher sales, profits, and a favorable SQV. We need to note that usually, higher supplies can happen only when there is enough demand available, and demand is not the issue at all. A company can increase its supply of goods by implementing better technology and increasing production or effectively utilizing its spare capacity. Also, it can make a fresh infusion of capital, produce or buy more and then supply more.

A reduction in the supply of goods and services in the market will result in lower profits, lower turnover, and an unfavorable SQV for the company. A company may be unable to supply as per the demand in the market because of resource constraints of labor, machinery, or capital. Also, production may suffer due to the breakdown of machinery, strikes, natural calamities such as earthquakes, floods, etc.

How do we Calculate Sales Quantity Variance?

We calculate SQV with the help of the following formula:

SQV= (Sales quantity as per the budget – Actual sales quantity as per standard mix) x standard profit or contribution margin per quantity

One important point to note in the above formula is that we take the actual sales numbers for calculation purposes, but according to their standard mix or proportion. The change from the standard mix will be part of the Sales Mix Variance. Let us understand this concept with the help of the following example:

Also Read: Sales Mix Variance

Example

XYZ Pvt.Ltd.is a manufacturer of clothes. In the men’s category, it manufactures two varieties of shirts: A and B. The company managed to sell 4000 pcs. of A and 6000 pcs. of B in the last month with a profit margin of $10 and $8 per piece respectively. In the present month, it manages to produce and sell 8000 pcs. of variety A and 7000 pcs. of variety B.

In order to calculate the Sales quantity variance, let us first find out the standard sales mix or ratio.

A= 4000 pcs. / (4000 pcs. + 6000 pcs.)

=4000 /10000 = 40%

B= 6000 pcs. / (4000 pcs. + 6000 pcs.)

= 6000 / 10000 = 60%

Actual total sales in the month=8000 pcs. + 7000 pcs. = 15000 pcs.

Thus, sales as per standard mix=

A= 40% of 15000 pcs = 6000 pcs.

B= 60% of 15000 pcs.= 9000 pcs.

Now we will calculate the difference between the sales units as per budget and actual sales as per the standard mix.

A= 4000 pcs – 6000 pcs= 2000 pcs. favorable

B= 6000 pcs – 9000 pcs = 3000 pcs favorable

As the final step, let us calculate the Sales quantity variance.

A= $10 x 2000 pcs.= $20000 favorable

B= $8 x 3000 pcs. = $24000 favorable

Total Sales Quantity Variance = $20000 + $ 24000= $ 44000.

What are the Advantages and Limitations of Sales Quantity Variance?

Sales quantity variance provides a base in the form of the standard mix of products or services to be sold by a company. It helps the management in their planning, budgeting, and control functions. The metric helps the management understand how far the actual results are from the budgeted standard mix. Also, the management gets to know the profitability of individual products and services and not just the profits from the total sales. Hence, the results help it decide which products are more profitable so that it should focus on them more. It can do away or focus lesser on the products that constantly give unfavorable variance.

As usual, we come across any metric; SQV, too, has certain limitations. The calculations consider the actual sales figures but according to the standard mix or proportion. Therefore, it ignores the actual sales figures and their variation from the budgeted figures. Even though a particular product is doing very well, the management may not understand it on some occasions on the basis of the SQV results because the results are not based on the actual sales mix of the products. Hence, we should always try to use the Sales Quantity variance in tandem with Sales volume variance and Sales mix variance to give more accurate and balanced results.

Visit Sales Volume Variance for more.