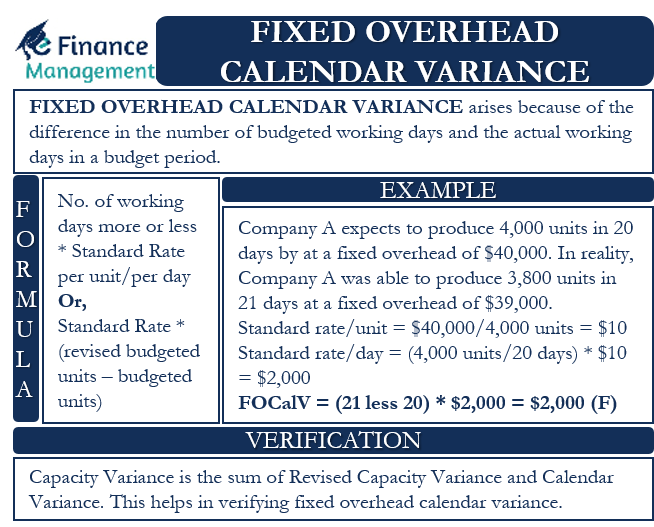

Fixed Overhead Calendar Variance (FOCalV) is one of the efficiency variances. This variance arises because of the difference in the number of budgeted working days and the actual working days in a budget period. Or, we can say it arises because the actual time consumed is different from the expected or estimated time. The time consumed could be in terms of days or hours.

Such a variance could occur because of any extra holidays, such as celebrating the anniversary of a company, or an off because of a lockdown, curfew, death of a national leader, or any other reason. Note that this variance occurs only in rare circumstances because the management considers the usual holidays when deciding the standard days.

FOCalV is usually unfavorable, but if there are more number of working days, this variance could be favorable. And, if there is no change in the number of working days, then there is no need for this variance.

This variance represents the gain or loss in the number of days (from the standard days) a company carries its operation in a budget period. So, those who manage operations or authorize the working period are responsible for this variance.

Fixed Overhead Calendar Variance – Formula

We can easily calculate this variance by multiplying the standard rate of recovery of fixed overhead by the difference between the standard and the actual number of days.

So, FOCalV = No. of working days more or less * Standard Rate per unit/per day

Or, Standard Rate * (Revised budgeted units less Budgeted units)

Or, Standard Rate (per hour) * (Revised Budgeted Hours less Budgeted Hours)

Or, Increase or decrease in production because of more or less working days at the rate of budgeted capacity * Standard rate per unit.

FOCalV can be favorable or unfavorable (adverse). This variance will be favorable if the actual working days are higher than the standard days. And, if the standard days are more than the actual days, then the variance is adverse or unfavorable.

Examples

Let’s take a simple example to understand the calculation for the FOCalV.

Company A expects to produce 4,000 units in 20 days by spending a fixed overhead of $40,000. In reality, however, Company A was able to produce 3,800 units in 21 days at a fixed overhead of $39,000.

To calculate Fixed Overhead Calendar Variance, the first thing that we need is the Standard Rate.

For this, we need a standard rate per unit and a standard rate per day.

Standard rate per unit = $40,000 / 4,000 units = $10

Standard rate per day = (4,000 units / 20 days) * $10 = $2,000

Now, let us put these values in the formula for the calculation of FOCalV:

FOCalV = (21 less 20) * $2,000 = $2,000 Favorable

This variance is favorable because the actual number of days was more than the budgeted days.

Let’s consider another example, and calculate the FOCalV with another formula.

Company X expects to produce 15,000 units and the number of working days it has is 25. The standard fixed overhead is $30,000. However, Company X was able to produce 16,000 units, and the number of working days was 27 units. The actual fixed overhead was $30,500.

The formula that we will use this time is:

= Increase or decrease in production due to more or less working days at the rate of budgeted capacity * Standard Rate per unit.

First, we need the Standard Rate. It will be $2 ($30,000 / 15,000 units).

Since the actual days were more, an increase in production will be = (27 days less 25 days) * (15,000/25)= 1,200 units.

So, FOCalV will be = 1,200 units x $2 = $2,400

This variance is favorable because the actual number of days is more than the budget days.

Verifying Answer for Fixed Overhead Calendar Variance

We can also verify the answer for Fixed Overhead Calendar Variance. This is because the Capacity Variance is the sum of Revised Capacity Variance and Calendar Variance. Let’s take an example to understand this.

Company Y makes the following budget about its capacity: 22,000 units, fixed overheads of 44,000, man-hours 25,000 and 25 days. However, the actual numbers were: 24,000 units, designated overheads of 49,000, man-hours 27,000, and 26 days.

In this case, we will use the following formula to calculate the Fixed Overhead Calendar Variance:

Standard Rate * (Revised budgeted units less Budgeted units)

First, we need to calculate revised budgeted units. It will be (22,000/25) * 26 = 22,880

Now, we need the standard rate. It will be 2 (44,000/22,000).

Calendar Variance = 2 * (22,880 less 22,000] = 1,760

Now, we need to calculate Fixed Overhead Capacity Variance.

The formula for Fixed Overhead Capacity Variance is:

Standard Rate * (Standard Quantity less Budgeted Quantity)

For this, we need budgeted quantity, which is in reference to the man hours. It will be (22,000 units/25,000 units) * 27,000 hours = 23,760

Fixed Overhead Capacity Variance = 2 * (23, 760 less 22, 000] = 3,520

Now, we need to calculate the Fixed Overhead Revised Capacity Variance.

The formula for Fixed Overhead Revised Capacity Variance is:

Standard Rate * (Standard Quantity less Revised Budgeted Quantity)

= 2 * (23,760 less 22,880] = 1760

Now, verify the answers by putting the values in the following formula:

Capacity Variance = Revised Capacity Variance plus Calendar Variance

3, 520 = 1760 + 1760

Since LHS equals to RHS, this means our answers are correct

Read more at Fixed Overhead Volume Variance

RELATED POSTS

- Fixed Overhead Capacity Variance – Meaning, Formula and Example

- Variable Overhead Efficiency Variance – Meaning, Formula, and Example

- Variable Overhead Cost Variance – Meaning, Formula, and Example

- Fixed Overhead Volume Variance

- Variance Analysis Formula with Example

- Production Volume Variance: Meaning, Formula, Limitations, and More

Hi,

Great work. I read your content and loved it.