What do we mean by Sales Price Variance?

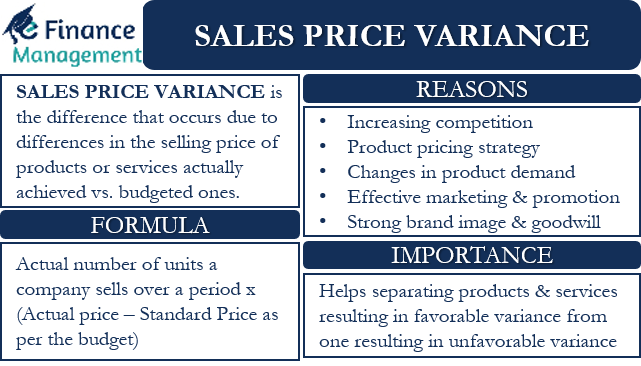

Sales Price Variance is the variance or difference that occurs due to differences in the selling price of products or services actually achieved vs. budgeted ones. Companies prepare a budget or forecast of the amount of revenue they will generate by the sales of their products over a particular period of time. For this, they assume the sales prices of the products and services and the quantity the company will be able to sell over that period. The company may need to increase or decrease the selling price of its products later due to some unavoidable reasons.

All these changes create a gap between the prices considered while budgeting revenue and the actual selling price of the products. We use the metric of Sales Price Variance to measure this gap or difference.

We need to clearly understand that the SPV is always calculated for a specific period. It can be for a month, quarter, year, or as per the management requirements. It can be favorable in case the company is able to charge a higher price for its product or service than the previous estimates. The SPV will be unfavorable in case the sales price as per the budget is higher than the price at which it actually sells its products.

How do we Calculate Sales Price Variance?

The steps to arrive at the SPV are :

- We get the difference between the estimated or budgeted sales price and the actual selling price by deducting one from the other.

- Then we multiply the difference as per point 1 above by the number of units of the products the company is actually able to sell.

- The figure obtained by multiplying is the amount/quantum of SPV.

Thus, the formula to calculate the SPV will be as follows:

SPV= Actual number of units a company sells over a period x (Actual price of the product/service – Standard Price as per the budget)

Also Read: Sales Value Variance

Let us understand the calculation with the help of some examples.

Example 1

ABC Pharmaceuticals Ltd. is a drug manufacturing company that primarily makes the paracetamol drug X. It manages to produce and sell 100000 strips of the drug X in a month at the price of $10 per strip. The demand for its medicine X saw a sudden surge with the advent of a medical catastrophe Covid-19 across the world. The management decides to seize the opportunity of making some extra profits by raising the prices of its medicine X to $12 per strip.

Therefore, the Sales Price Variance of the company for the current month will be calculated as follows:

SPV= 100000 ($12 -$10)

= $200000 favorable per month.

In this case, the company makes extra money because of the price increase. Hence, the SPV is favorable.

Example 2

XYZ Toys Ltd. is a toy manufacturing company and sells a famous toy Z in the markets. On average, it sells 5000 units of toy Z @ $50 per piece in a month. The same medical catastrophe Covid-19 hits the company’s business hard and in a negative manner. In order to maintain the same level of production and sales, it is forced to reduce the price of toy Z to $45 per piece.

We calculate the Sales Price Variance for the company as follows:

SPV= 5000 units x ( $45 – $50)

= $25000 unfavorable per month.

In the above case, the company faces a loss with the price cut. Hence, the SPV is unfavorable.

Why does Sales Price Variance Occur?

There are a number of reasons that force a company to change the prices of its offerings, resulting in Sales Price Variance. Let us have a glance over those reasons and circumstances:

Competition

Increasing competition is one of the most important factors that force a company to alter or reduce its prices. In this era of cut-throat competition, all the companies use pricing to improve their sales and/or to keep the competitor away. Thus, companies often give discounts to their customers, permanently reduce the prices of their products, or increase the quantum by keeping the price the same to fight the competition. This results in an unfavorable SPV.

Also Read: Sales Volume Variance

Similarly, there are companies that are monopolies or close to monopolies. And such companies, due to their market domination, never worries about the competition. Therefore, such companies use every available opportunity to increase the price of their products. This pricing power results in a favorable SPV. Although an unjustified price increase can result in a fall in the quantity demanded. And that will eventually result in a reduction in turnover as well as profits for the company.

This leads to an inference that despite commanding pricing power, any unjust increase may adversely affect the sales volume. And may force consumers to explore other suppliers. Or may play spoilsport with the goodwill and brand of the company.

Pricing Strategy

A company’s product pricing strategy also results in SPV. It may make use of a skimming strategy while launching a new product. The prices initially will be higher, and gradually they will change or go down. This will result in an SPV.

Similarly, it may use market penetration pricing by initially selling its offerings at a price lower than the competition. Or they can sell the goods at the initial launch stage at a discount to the standard price. Gradually it will increase its prices once it develops a loyal customer base. This will again cause a Sales price variance. Likewise, an SPV will occur whenever the company changes the pricing strategy of its products in between the budget period.

Changes in Product Demand

Consumer tastes and preferences are uncertain and keep changing with time. They may reduce the consumption of some products due to a change in taste or due to some unforeseen natural calamity such as a flood or an earthquake. The sudden drop in demand for the products may force the companies to reduce their prices in order to sell more. Or to liquidate the available stock, so production momentum continues. This will result in an unfavorable SPV.

Sometimes, the opposite may happen with a sudden surge in demand for some products. For example, the sale of pharmaceutical products and health foods surges in times of a medical catastrophe. The companies may suddenly raise the prices of their products to make extra profits. And that can lead to a favorable SPV.

Other Reasons

Apart from these key reasons, there can be a number of other reasons leading to a sales price variance. Effective marketing and promotion, new launches and products with improved features, strong brand image, goodwill, etc., can all help a company to achieve a favorable SPV.

On the other hand, factors like the imposition of new restrictive government rules and regulations, outdated technology resulting in poor quality goods, etc., can cause an unfavorable SPV.

Refer to Sales Value Variance for learning about other types of sales variances.

What is the Importance of Sales Price Variance?

Sales Price Variance is an important statistical metric, especially in the present fiercely competitive business environment. It helps the companies to separate those products and services that result in a favorable variance from those that result in unfavorable variance over a period of time. The company can continue to focus more on the first set of products. It can focus lesser or eliminate the product or service altogether, which results in continuous unfavorable sales price variance over multiple periods of time.

Also, sales price variance encourages the company to improve its pricing strategy and prepare a sales budget accordingly. Budgets based on historical data may have become redundant and obsolete. Thus, it helps in the improvement of management planning and control.

A favorable variance will help the company to charge a higher price for its products in the market, resulting in higher sales volume and profits. But the company should also be careful while doing so. Otherwise, it might end up losing customers to competitors or reduction in consumption in the long run. Both the cases will lead to loss of sales and profits.