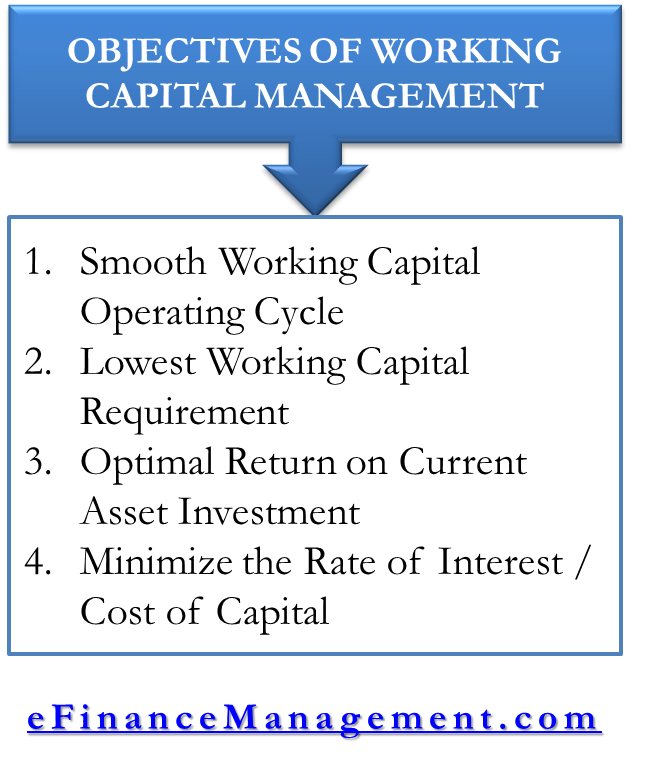

The primary objective of working capital management is to ensure a smooth operating cycle of the business. The secondary objectives are to optimize the level of working capital and minimize the cost of such funds.

Objectives of Working Capital Management

Let us see in detail the objectives of working capital management.

Smooth Working Capital Cycle

The key objective of working capital management is to ensure a smooth working capital cycle (i.e., the cycle starting from the acquisition of raw material to its conversion to cash). Managing the working capital cycle is not an easy task; it is as good as juggling several balls. It could be best achieved if the business is able to manage all the components of its working capital in the best possible manner. In the following points, let’s learn how to manage these components.

- Raw material should be available when required, and it should not hinder production.

- All other requirements of production should be in place before time.

- The finished goods should be sold as early as possible once they are produced and inventoried.

- The accounts receivable should be collected on time.

- Pay accounts payable as and when they become due without any delay.

- Cash should be available whenever required, along with some cushion.

It means the working capital cycle should never stop for the lack of liquidity, whether for buying raw materials, salaries, tax payments, etc.

Working Capital Cycle may vary from industry to industry. Take any industry, but the objective would always be to keep this cash conversion cycle as smooth as possible. The bottleneck in any of the activities would break the business supply chain and increase the cycle.

Optimum Level of Working Capital

It should be optimum because higher working capital means higher interest cost, and lower working capital means a risk of disturbance in the operating cycle.

The investment in working capital starts from the activity of buying raw materials, and the funds become free only after the customer makes the payment. The money you have borrowed for the smooth running of the operating cycle carries interest costs, or you may have your own funds, then it has an opportunity cost. Any delay in any activities would be costly to the business and directly attack the profit margins. There is great potential for optimizing each activity in the operating cycle and consequently optimizing the investment in working capital. There are various techniques available to find the optimal level of working capital.

Minimize Rate of Interest or Cost of Capital

It is important to understand that the interest cost or cost of capital is one of the major costs in any business. To achieve higher profitability, the cost of funds utilized in working capital should be minimum. The management should negotiate well with the financial institutions, select the right mode of finance and maintain optimal capital structure.

The cost reduction is possible if utilizing long-term funds in a proper mix. One should always keep the fundamental principle of financial management in mind when deciding the mix of working capital. That is, fixed assets and permanent assets should be financed by long-term sources of finance of approximately the same maturity. Similarly, short-term or temporary assets should be financed by short-term sources of finance.

There are many ways of financing the WC needs. It may be through long-term financing options like equities, long-term debt, etc. One can take the help of short-term financing options like WC loans, factoring, cash credit, etc. The third is to have a combination of both long and short-term finance. The objective of Working Capital Management also includes balancing the carrying cost of working capital.

Also Read: Working Capital Management

Optimal Return on Current Asset Investment

The return on the investment made in current assets should be more than the weighted average cost of capital to ensure wealth maximization for the owners. In other words, the rate of return earned due to investment in current assets should be more than the rate of interest or cost of capital used for financing the current assets.

In many businesses, you have a liquidity crunch at one point in time and excess liquidity at another. This happens mostly with seasonal industries. At the time of excess liquidity, the management should have good short-term investment avenues to take benefit of the idle funds. These investments should be liquid enough to realize when the business needs them.

Quiz on Objectives of Working Capital Management

RELATED POSTS

- Advantages and Disadvantages of Working Capital Management

- Importance of Working Capital Management

- Working Capital Estimation – Operating Cycle Method

- Factors Determining Working Capital Requirement

- Permanent or Fixed Working Capital

- Types of Working Capital – Gross and Net, Temporary and Permanent