Capital rationing is the strategy of picking up the most profitable projects to invest the available funds. Hard capital rationing and soft capital rationing are two different types of capital rationing practices applied during capital restrictions a company faces in its capital budgeting process. In efficient capital markets, a company aims to maximize the shareholder’s wealth and its value by investing in all profitable projects. However, a company may realize that the internal and external funds available for new investments may be limited in real life.

Definition of Hard and Soft Capital Rationing

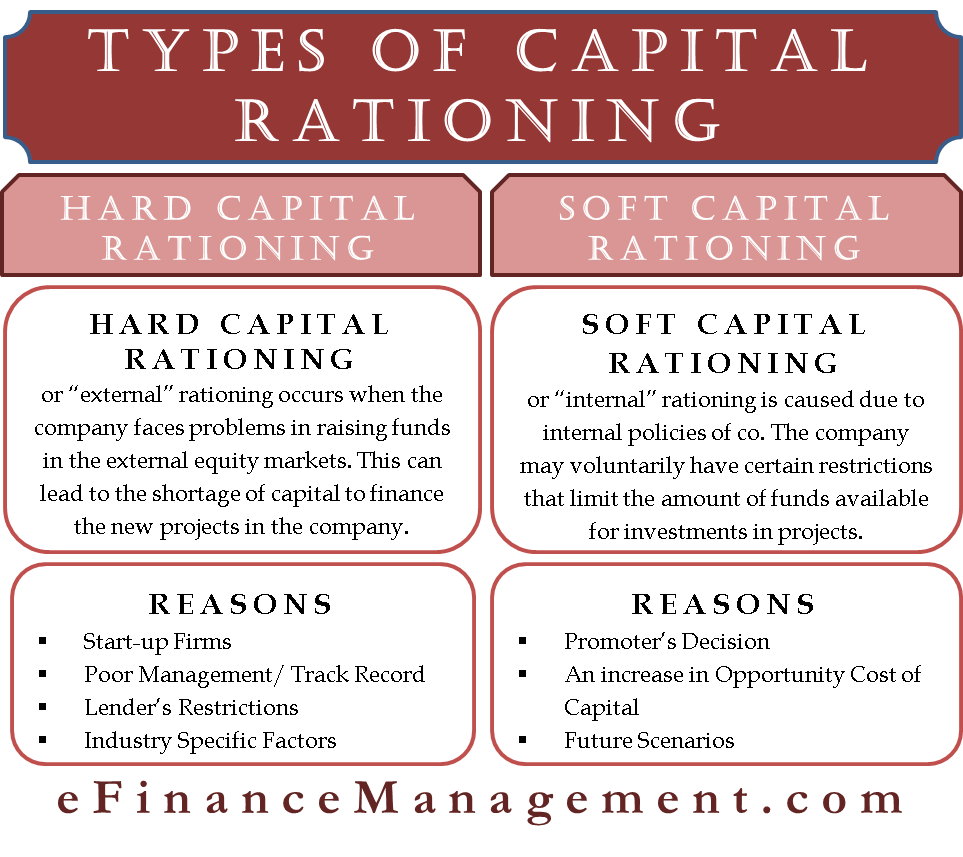

There are two situations that may lead to capital rationing, namely hard and soft capital rationing. Hard capital rationing or “external” rationing occurs when the company faces problems in raising funds in the external equity markets. This can lead to a shortage of capital to finance the new projects in the company.

On the other hand, soft capital rationing or “internal” rationing is caused due to the internal policies of the company. The company may voluntarily have certain restrictions that limit the number of funds available for investments in projects. However, there can be a modification to these restrictions future; hence, the term ‘soft’ is used.

Reasons for Hard Capital Rationing

Hard capital rationing is an external form of capital rationing. The company finds itself in a position where it is not able to generate external funds to finance its investments.

There could be several reasons for this scenario:

Start-up Firms

Generally, young start-up firms are not able to raise funds from equity markets. This may happen despite the high projected returns or the lucrative future of the company.

Poor Management/Track Record

A bad track record or poor management team of a company can also affect the external funds. The lenders can consider such companies as a risky assets and may shy away from investing in projects of these companies.

Lender’s Restrictions

Often, medium-sized and large companies rely on institutional investors and banks for most of their debt requirements. There may be restrictions and debt covenants placed by these lenders which affect the company’s fund-raising strategy.

Industry-Specific Factors

There could be a general downfall in the entire industry affecting the fundraising abilities of a company.

Reasons for Soft Capital Rationing

Soft capital rationing, on the other hand, is a company-led capital restriction due to the following reasons:

Promoters’ Decision

The company’s promoters may decide to limit raising more capital too soon for fear of losing control of the company’s operations. They may prefer to raise funds slowly and over a longer period to ensure their control of the company. Moreover, this could also help get a better valuation while raising capital in the future.

Also Read: Capital Rationing

An increase in Opportunity Cost of Capital

Too much leverage in the capital structure makes the company a riskier investment. This leads to an increase in the opportunity cost of capital. The companies aim to keep their solvency and liquidity ratios under control by limiting the amount of debt raised.

Future Scenarios

The companies follow soft rationing to be ready for the opportunities available in the future, such as a project with a better rate of return or a decline in the cost of capital. There is prudence in conserving some capital for such future scenarios.

Single Period and Multi-Period Capital Rationing

Capital rationing can be distinguished on the basis of the period of rationing. Single period rationing is when there is a capital shortage for one period only. The profitability index (PI) is the most popular method used in this scenario. Multi-period rationing occurs when the shortage is for more than one period. The use of the linear programming technique is to rank projects in multi-period rationing.

Conclusion

Though capital rationing seems to contradict maximizing shareholder wealth, it is a very important process in a company’s budgeting process. Depending on the type of capital rationing, the company can decide on the techniques for analyzing the investments.

Continue reading – Capital Rationing – Its Assumptions, Advantages, and Disadvantages.

Hi Mr. Sanjay. I just recently read your work about “Types of Capital Rationing”. After reading your work i was still confused about why is linear programming a more suitable method than profitability index when it comes to investments with a multi-period capital rationing. What are the reasons?

PI takes only relative profitability into consideration for ranking projects. This works in simple, one period situation. However, it does not take into account absolute cash flows, which can change the budget in subsequent years. Once the budget increases or decreases, several other projects can be included or discarded irrespective of the PI ranking.’

Thank you for the great job its interesting and easy to understand them very quickly but explain for me the techniques of incorporating risks in capital budgeting decision because am not understanding them

This is a wonderful platform to understand the nature of capital, capital markets, and its divergent approach to functioning.

General Secretary to IQRA FOUNDATION FOR EDUCATIONAL AND ECONOMIC EMPOWERMENT (IFEEE)

what is the Linear programming technique for project selection?