Risk-Free Rate or its other name is the Risk-Free Interest Rate. And the Risk-Free Rate is the rate that one can get without taking any risks. Or, we can say that it is the return on an investment that carries zero risks. However, the concept of zero risks is only theoretical because, in the real-world situation, all sorts of investments do carry some or other risk. But, some investments carry so less risk or the level of risk is so negligible that we classify them to be risk-free.

An example could be such as three-month government Treasury bill. When we normally talk about the risk-free rate, we generally refer to the Nominal Risk-Free rate in common parlance. But sometimes, knowing about the real risk-free rate is also important. Thus, it is important to understand the concept and the difference between the Real vs Nominal Risk-Free Rate.

Real vs Nominal Risk-Free Rate – Meaning

Before we dive deeper into the Real vs Nominal Risk-Free Rate, it is important to understand what the two terms mean.

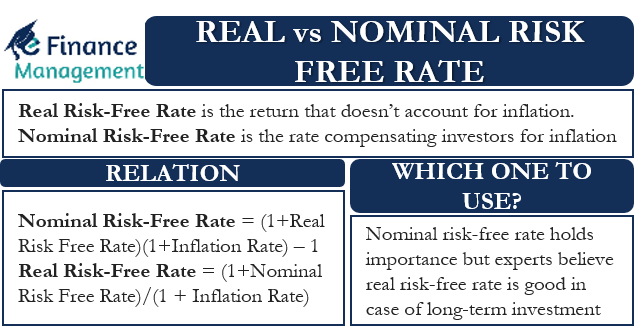

The real risk-free interest rate is the return that does not account for inflation. Since all investors want a return that accounts for inflation, the real risk-free interest rate is largely a theoretical concept. Moreover, there is no solid way to determine this rate. But, many studies suggest that the long-run growth rate of an economy should equal to the real risk-free rate.

On the other hand, Nominal Risk-Free Rate is a general risk-free rate indicated or available on investment. Moreover, it does not take into account any influence of inflation. In other words, it is the usual interest rate indicated on the security, and it has no relation with the rate of inflation. And this is the rate an investor usually sees.

Real vs Nominal Risk-Free Rate – Relation

In a way, there is a strong relation between the real and nominal risk-free rate. For instance, if one goes up, the other will rise too, and vice versa. The key difference between the two is only the impact and adjustment of the inflation.

The following equation aptly defines the relationship between the Real vs Nominal Risk-Free Rate:

Nominal Risk-Free Rate = (1 + Real Risk Free Rate) × (1 + Inflation Rate) – 1

Or (1 + Rf) * (1 + i) -1. Here Rf is the Real Risk-Free Rate, and i is the applicable inflation rate.

We can also rearrange the above equation for the real risk-free interest rate.

Real Risk-Free Rate = (1 + Nominal Risk Free Rate)/(1 + Inflation Rate)

The below example will assist us in getting a better understanding of the calculation:

Suppose the inflation rate is 0.7%, and the rate of return on a three-month government Treasury bill is 2.5%. The three-month government Treasury bill is the nominal risk-free rate. In this case, the real risk-free rate will be:

Real Risk Free Rate = (1 + 2.5%) / (1 + 0.7%) = 1.79%

Several experts also believe that just subtracting the current inflation rate from the nominal risk-free rate will give the real risk-free rate. We can express this relation using the below equation:

Nominal Risk-Free Interest Rate = Real Risk-Free Interest Rate plus Inflation Rate

Another important difference between the two is that the Nominal Risk-Free Rate is readily available and mentioned/indicated with the investing instrument. However, the Real Risk-Free Rate needs to be derived and need inflation rate details too.

Also Read: Real Risk-Free Rate of Interest

Which One to Use?

Usually, it is the nominal risk-free rate that holds importance to the investors. And that is readily available. But, many experts believe that when considering long-term investments, an investor should focus on the real risk-free rate.

Also, the risk-free rate is important when calculating the cost of capital. During the calculation, there is often confusion regarding which rate to use – real or nominal risk-free rate. Generally, we use the nominal risk-free rate for the calculation. But experts say that when the cash flows are real cash flows, then one should use the real risk-free rate. This becomes more important when the inflation rate fluctuates fast as it could wipe off (if inflation rises) or substantially boost (if inflation drops) the real returns to the investors.