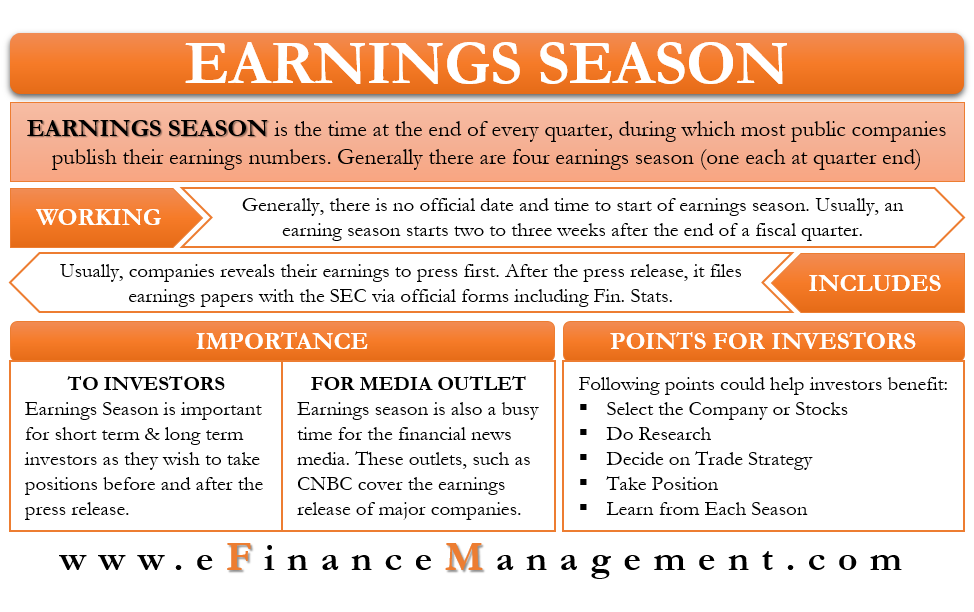

Earnings season is the time at the end of every quarter, during which most public companies publish their earnings numbers. Or, we can say these are the days of the year when most companies come up with their quarterly/yearly earnings number. Generally, there are four earnings seasons in a year, i.e., one each for each quarter.

Earnings Season: How it Works?

Virtually some or the other company report their earnings every day. But, since most companies use a calendar year to define their fiscal year, they release their earnings around the same time. We call this period as earnings season.

A point to note is that there are no official dates for an earning season. Usually, an earning season starts two to three weeks after the end of a fiscal quarter. And, it stretches to about a month after the end of the quarter.

For example, the earning season for Jan to Mar quarter will start in April. Similarly, the other three earnings seasons are in July, October, and January. The gap is due to the time the companies take to prepare their earnings report and release it to the public.

Though there is no official date for the start and end of earning season, we do have an unofficial time. Many believe the earnings season starts after the issue of earnings by Alcoa, which is an aluminum producer. It is among the first major company to issue its earnings reports after the end of a quarter. The unofficial ending date is when all major companies have reported their earnings report card, or about six weeks after the start of the season.

What does it include?

During this period, several companies reveal their earnings through press releases and SEC (Securities and Exchange Commission) filings. Generally, the company issues a press release first, giving key but minimal information.

After the press release, it files earnings papers with the SEC via official forms, such as Form 10-Q or 10-K. These filings include the company’s financial statements and other documents.

Several prominent companies do hold earnings calls also while publishing their results. In this, the company’s management shares and discusses the earnings results. During the earnings call, management answers why their numbers are such, plans and projections, management changes, and other relevant matters. Several firms put a recording or presentation of their earnings calls on their website.

Also Read: What is Accounting Period?

Earnings Season – Importance

This season is very crucial for investors and media outlets:

For Investors

Share of public companies generally sees more volatility and high trading volume during the earnings season. It is because investors take positions in the stock before and after the release of the earnings report. The positions that investors take are based on what they expect a company to report and what it reports.

Often, the short-term traders become extra active during an earning season. Yet, this period is crucial for both short and long-term traders. Long-term traders use this period to adjust and update their portfolios.

For Media Outlets

Earnings season is also a busy time for the financial news media. These outlets, such as CNBC and The Wall Street Journal, cover the earnings release of major companies. They also come out with a general commentary on the companies that met, beat, or miss the analysts’ earnings expectations.

How can Investors Benefit?

Following are points that could help investors benefit during an earning season:

Select Companies or Stocks

It is almost impossible to track every company that releases its earnings report during an earning season. Thus, an investor should focus on a few companies. These companies could be those that are already in your portfolio or new ones that you plan to take a position with. Once you finalize the companies, you should find the dates when these companies will report their earnings. You can know this by seeing an earnings calendar. The details are also available on the stock exchange, where the company trades.

Do Research

After you have a list of companies to focus on, you need to check the analysts’ estimates for the company. You should also try to develop your expectations for the company’s earnings. For this, look at the historical numbers, read research reports, follow the announcement from the company, and more.

Decide on Trading Strategy

Use your analysis to decide on a trading strategy for that stock. Your trading strategy should be in line with your profit expectations, risk level, entry, and exit points, as well as a plan B if the earnings results are not as per your expectations.

Take Position

Depending on your trading strategy, you should take an appropriate position in the market. After choosing a position, you must regularly track the market to look for information that can impact your payout.

Learn from Each Season

After the end of an earning season and once you have closed your positions, you must evaluate your performance. You should take note of the mistakes you made and the learnings from each season. It would make sure that you perform even better in the next season. Remember, it takes time to come up with a successful trading strategy.

Byproducts of Earnings Season

Following concepts you will find in an earnings season:

Earnings Surprises

We expect some companies to do well in an earnings season and some to report disappointing results. But, in almost all earnings seasons, there will be a few companies that perform unexpectedly. It means they give earnings surprises. The surprise can be good or bad, depending on what the expectations were from that company.

Bellwethers

We call some companies or industries bellwethers. These bellwethers usually describe the trend of an earning season for that particular industry or the full season. It means that if this bellwether came up with disappointing numbers, then we can expect others to report disappointing numbers as well.

Overall Results vs. Overall Expectations

Before the start of the season, analysts come up with their estimates for the earnings season. If the actual overall earnings are in-line or exceed the analysts’ expectations, then we can say that the stock market and global business environment are improving.

Final Words

Earnings season is crucial for the public companies and the investors as well. There is a significant amount of stock movement during this time frame. So, every investor must be extra attentive during this period.