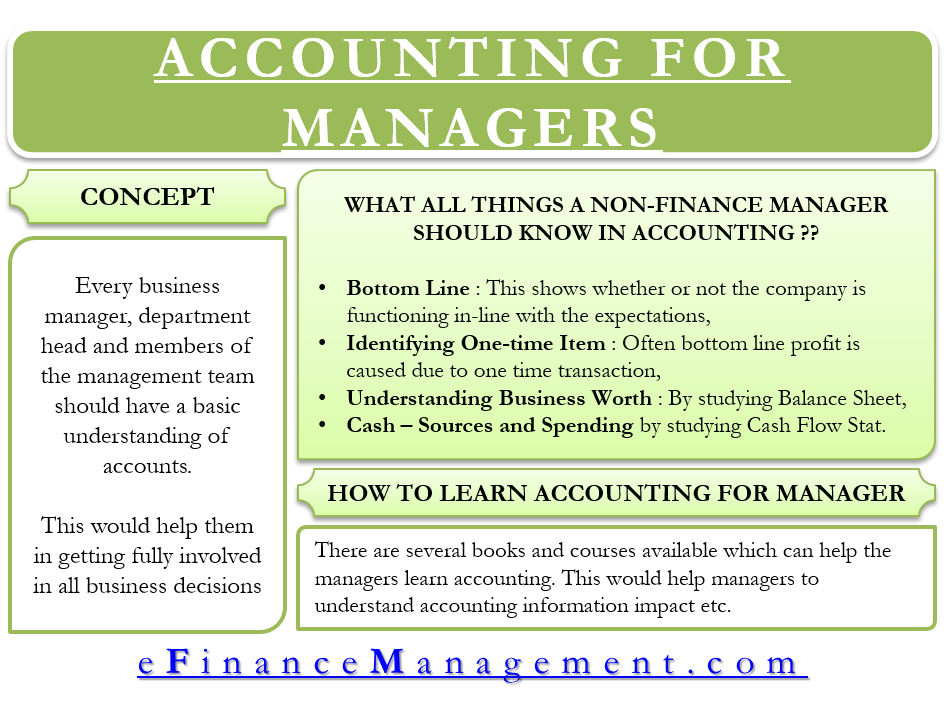

Every business manager, department head, and member of the management team should have a basic understanding of accounts. This basic accounting information ensures that managers get fully involved in all business decisions and are capable of understanding accounting matters as well. If managers don’t have accounting knowledge, there are several courses and books to help them know what is accounting for managers.

Why Must Managers Know Accounting?

We have often seen companies provide training in leadership and strategy. However, in the past decade or so, it has been seen that understanding the intricacies of financial statements can have a bigger impact on business health.

Non-finance managers must have adequate knowledge of accounting to interpret financial statements and make key decisions. Moreover, knowing accounts has become a necessity for non-financial managers owing to the rising importance of corporate governance following the debacles such as Enron, Equitable Life, Worldcom, and Marconi. It has become extremely important for managers to ensure there are no issues or errors with the accounts.

Sound financial control is the prerequisite for business success. Managers with poor accounting knowledge may not be able to contribute when their company faces a financial issue. Additionally, financial knowledge helps a manager to answer common business questions – What are the company’s financial priorities? Is the project viable? How to improve cash flow? What’s happening to profit margins?

Also Read: Top 10 Essential Accounting Functions

Must-Know Accounting Concepts

Accounting is a pretty vast subject, and managers should try to know as much as they can. In case they don’t have a finance or accounting background, there are a few very important concepts that every manager must know.

Bottom Line

The bottom line number in the earnings statement tells whether or not the company is functioning in line with expectations. If it is a positive number, we can say the company is profitable. Then the company is fundamentally sound as it is earning more than it spends. In case the number is negative, then it will mean that it is time to take corrective action.

Identifying One-time Item

Often there may be cases when the bottom line shows a profit due to a one-time transaction. Managers must be able to identify them to understand the true position of the company. For instance, a company that normally makes a profit reports a loss in one quarter due to one-time marketing expenses. If a manager identifies this, they will know that there is nothing to worry about as the benefit of the marketing campaign will be available in the future.

Understanding Business Worth

A manager can get this information by studying the balance sheet. To understand the business’s worth, a manager must know how the profit or loss is translating into assets and liabilities. Moreover, the manager must know the condition of the assets, i.e., whether they are liquid or tied to productive investment. Such information will play a crucial role in making key business decisions. For example, if a manager wants to expand, studying the balance sheet will help him know how much funds they have. And how much debt they can afford.

Cash – Sources and Spending

A manager must study the cash flow statement to know where it is coming from and where it is going. Studying cash flow helps in figuring out how to pay daily expenses and how to plan for long-term budget items, such as loan EMI. Moreover, it will also help determine any expected shortfall and how this shortfall can be met.

Identifying fraud and financial irregularities

Having accounting knowledge enables managers to detect discrepancies or potential financial misconduct within the organization. By understanding financial records and spotting unusual patterns, they can take appropriate action to mitigate risks.

Financial decision-making

Managers need to make informed decisions about resource allocation, investments, and budgeting. Understanding accounting principles allows them to interpret financial data and use it to evaluate the financial health of the organization. It helps them identify opportunities and risks, make strategic choices, and plan for the future.

How to Learn Accounting for Managers?

As we said earlier, there are several courses and books to help anyone know what is accounting for managers. These courses and books detail how to compile accounting transactions. Also, it helps the managers to know how to extract information from the financial statements. Moreover, these also help the manager understand how accounting information impacts decision-making in areas such as human resources, acquisitions, sales, and marketing.

Apart from the courses and books, several educational institutions also offer crash courses to help managers with accounts. There are also MBA courses, where students are taught basic accounting skills. Often the company in which the manager is working sponsors the fees for such courses.

Read What is Accounting for more details.