Consignee – Meaning

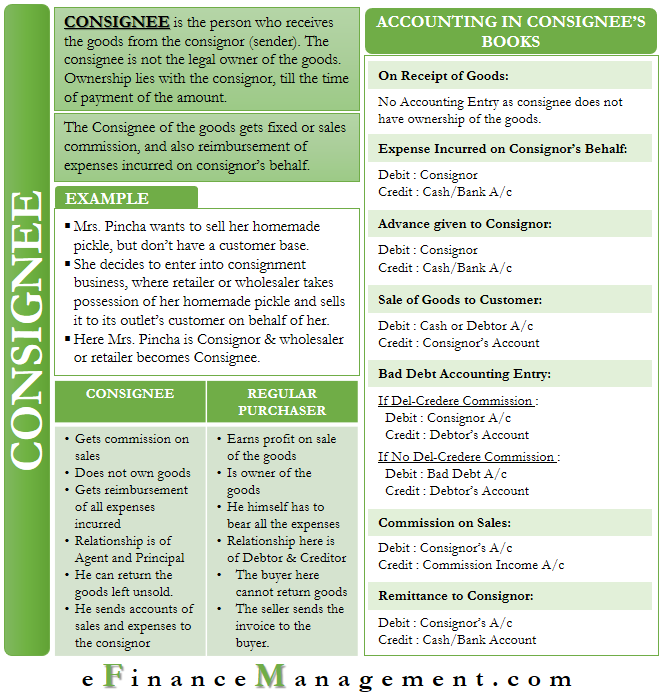

The Consignee and the Consignor are two terms used in the consignment business where a manufacturer or wholesale dealer sends a shipment of goods to a seller or an agent to sell them. The consignee is the person who receives the goods, whereas the consignor is the person who sends the goods on consignment.

A consignee is a party (buyer) to whom the consignor (seller) names as the recipient of the shipment of goods on the transportation documents on arriving at the port of destination. Though a consignee clears all the customs formalities, duties, and taxes on arrival, he is not the legal owner of the goods. The ownership of the goods remains with the consignor. However, the consignee gets the legal entitlement of the goods only after the payment of the amount.

A consignee, in most cases, is the receiver of the goods. But, in some cases, there is an intermediate consignee who receives the shipment on behalf of the ultimate consignee.

Consignee Role – an Example

Mrs. Pincha (Consignor) wants to sell her homemade pickle but doesn’t have a customer base. She decides to enter into the consignment business, where the retailer or wholesaler (Consignee) takes possession of her homemade pickle and sells it to its outlet’s customer on behalf of her. Mrs. Pincha may receive some advance against the consigned goods or receive the full amount by the retail outlet on sale after deducting its commission.

Also Read: Consignment

It is a win-win situation for both Mrs. Pincha and the retailer. The consignor – Mrs. Pincha, gets access to a new market for her homemade products, and the consignee- the retailer, earns a commission in return for the sales.

Briefing a few points about the consignee (Retailers) from the above example:

- The retail store is not the owner of the consignment of the homemade pickle.

- However, the possession of the goods remains in the hands of the retailer.

- The retail outlet will not disclose homemade pickles as inventory on the asset side of its balance sheet. Instead, it will show the consignment account on the liability side of its books.

Consignee Compensation

A consignee sells goods received on consignment on behalf of the consignor. In return, he gets a pre-defined commission on sales. The consignee is also getting the reimbursement for all the expenses, for example, the delivery expenses, transport cost for taking delivery, etc., incurred on behalf of the consignor.

Difference between Consignee and Regular Purchaser

| Consignee | Purchaser | |

| Purpose | Commission on Sale | Personal Consumption or Resale to earn a profit. |

| Ownership | He is usually termed as a buyer who has no formal ownership but holds goods to sell. | The purchaser becomes the owner of the goods immediately on the purchase of the products. |

| Expenses | He gets reimbursement for all the expenses incurred on behalf of the consignor. | The purchaser has to bear all the costs incurred after the sale. |

| Relationship | The relationship between the consignor and consignee is that of a principal and agent. | The relationship between a Purchaser and seller is that of a debtor and creditor. |

| Returns | He can return the goods left unsold. | A buyer cannot return goods usually unless so specified in the agreement and within the given time. |

| Bill document | He sends accounts of sales and expenses to the consignor | The seller sends the invoice to the buyer. |

Accounting Entries in the Books of Consignee:

Below are the necessary journal entries passed in the books of Consignee:

1. Receipt of the Goods

No journal entry

The owner of the goods is a consignor, so he cannot record it as a purchase. Hence no entry is recorded in the books; instead, the entry of the receipt is recorded on the inward consignment book. The inward consignment book is not a financial book. It is just a memorandum book.

2. Expenses incurred on behalf of the Consignor

| Consignor’s CA/c | Dr. | 500 | |

| To Cash A/c | 500 |

(Being expenses incurred on goods received on the consignment on behalf of the consignor. )

3. Advance(if any) given to the Consignor

| Consignor’s CA/c | Dr. | 5000 | |

| To Bills Payable or Bank A/c | 5000 |

(Being advance given to the consignor against goods received.)

4. Sales

| Cash or Debtor’s (if Sales on Credit) A/c | Dr. | 25000 | |

| To Consignor’s A/c | 25000 |

(Being sale of goods received on consignment.)

Note: The consignor is the owner of the goods; his account gets credit for all the sales made of the consigned goods.

5. Bad Debt Entry

There are two types of entry for bad debt:

- When the consignee does not receive the del credere commission.

- When the consignee receives the del credere commission

First case:

| Consignor’s A/c | Dr. | 500 | |

| To Debtor’s A/c | 500 |

(Being bad debt on account of credit sales of goods received on consignment is debited to consignor’s account )

Second Case

| Bad Debts A/c | Dr. | 500 | |

| To Debtor’s A/c | 500 |

(Being bad debt on account of credit sales of goods received on consignment is treated ad the person loss of the consignee because he is getting del credere commission )

Note: Del credere commission is a commission paid to the consignee by the consignor for bearing additional risk arising from bad debt on account of credit sales effected on behalf of the consignor.

6. Commission on Sales

| Consignor’s A/c | Dr. | 5000 | |

| To Commission A/c | 5000 |

(Being commission earned on the sales of goods of the consignment. )

7. Remittance to the Consignor for the final settlement of his Account.

| Consignor’s A/c | Dr. | 14000 | |

| To Bills Payable / Bank A/c | 14000 |

(Being payment of the balance due to the consignor)

RELATED POSTS

- Free Carrier – Meaning, Obligations, Benefits, Pros and Cons

- Inland Bill of Lading – Meaning, Importance and More

- Sole Proprietorship

- Carriage and Insurance Paid To – Meaning, Obligations, and More

- Merchandise Inventory – Meaning, Accounting and More

- FOB Destination – Meaning, Types, Importance And More

Yeah! It’s understood