C Corporation – Definition

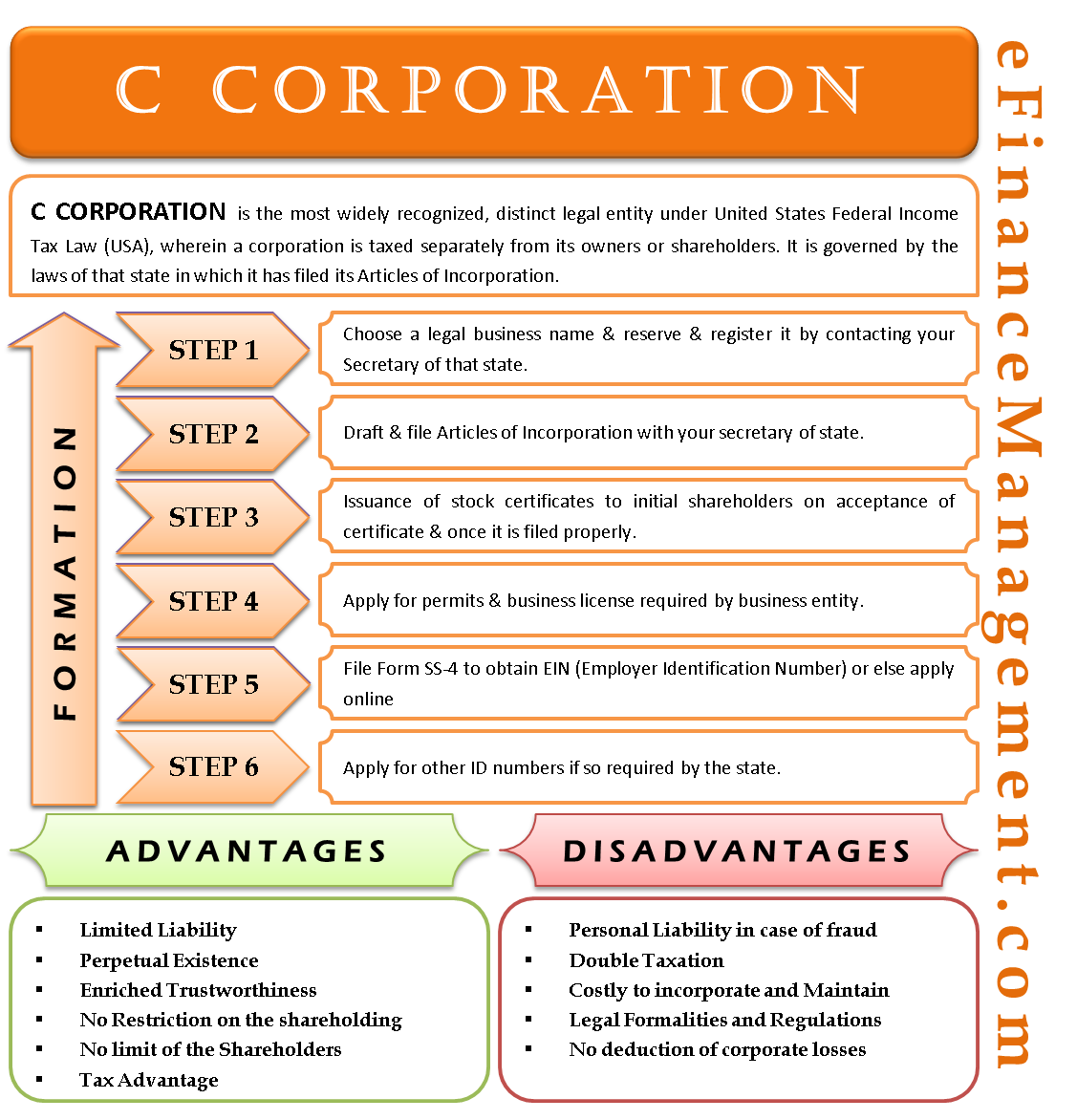

C Corporation is the most widely recognized, distinct legal entity under United States Federal Income Tax Law (USA), wherein a corporation is taxed separately from its owners or shareholders. It is governed by the laws of that state in which it has filed its Articles of Incorporation. It offers unlimited growth potential, which means one can attract many wealthy investors. The shareholders get protection from their personal liability arising out of business. Corporations pay taxes on corporate earnings before distributing them to the shareholders. Then the shareholders have to pay taxes on the dividends received by them. The owners are taxed twice here.

Formation of C Corporation

The following are the one-by-one steps to be followed to form the C Corp.

Step 1

Choose a legal business name and reserve it by contacting the Secretary of that state where you want to commence the business. Register the business name with that Secretary of the state if he offers such a service. Most secretaries charge a fee and give a time period of generally 30 days to reserve that business name, and in that meanwhile, you need to prepare the Articles of Incorporation. If the Articles are not filed within such a time period, the name is released back to the public so that any other corporate can register that name.

Step 2

Draft and file the Articles of Incorporation with your secretary of the state. One can also draft it on his own, but it is preferable to do it through an attorney or an online service. In most states, there is also a requirement to list out the names and addresses of the initial directors and officers in the Articles of Incorporation.

Step 3

Here, there is an issuance of the stock certificates to the initial shareholders once the notice of the acceptance and filing of the Articles of Incorporation is received.

Also Read: Corporation

Step 4

Apply for the permits and business licenses required by the business entity. In some states, there is also a requirement for the Federal License before the commencement of the business operations. So, make sure that you acquire them; otherwise, you may face heavy penalties.

Step 5

File Form SS-4 to obtain EIN (Employer Identification Number) or else apply online. The online application generates the EIN very faster. The EIN number is the Tax ID Number of your corporation. Also, there will be a requirement to open a bank account to file annual taxes. Even though the employer doesn’t hire an employee, he must obtain this EIN number.

Step 6

Apply for other ID numbers if there is a requirement of it by the state. Jurisdiction differs from state to state. So, the compliances and the legal formalities are also different in different states. Therefore, their fulfillment is also mandatory. Else, heavy penalties may occur. If one wants to start a corporation and is not familiar with the state rules and regulations, he must seek legal advice.

Advantages of C Corporation

Limited Liability

Shareholders, officers, employees, and others are shielded from personal liability for the business’s legal obligations. This means individuals aren’t personally responsible for the company’s legal issues.

Also Read: S Corporation

Perpetual Existence

The corporation can have as many shareholders as it wants, and there’s no maximum number. However, if the total value of the things the corporation owns becomes more than $10 million and there are 500 shareholders, then the corporation has to follow certain rules and register with the SEC Act (Securities Exchange Act) from 1934.

Enriched Trustworthiness

When the corporation is well-known and respected in the market, it naturally earns trust and respect. This can lead to good things like suppliers being happy to provide materials, banks being ready to give loans, and the public starting to recognize and notice the corporation.

No Restriction on the shareholding

Unless the rules of the corporation’s official papers say otherwise, anyone can own stocks without any limitations.

No limit of the Shareholders

There is no limit to the number of arrival of the shareholders in the corporation. But, once the value of the assets crosses $10 million and the shareholders are 500, the corporation needs to register with the SEC Act (Securities Exchange Act), 1934.

Tax Advantage

Some expenses are deductible at the time of the payment of taxes as per IRS (Internal Revenue Service). The tax advantages are especially in the field of employee fringe benefits. Medical reimbursement expenses, a premium paid in respect to the medical benefits, etc., are non-taxable business expenditures unless otherwise stated.

Disadvantages of C Corporation

Personal Liability in case of fraud

If the owners misuse any of the corporation’s funds or have swindled money from others, they are personally liable to pay the obligations and debts. In this case, they cannot escape from their personal debts or liabilities caused due to them.

Double Taxation

The biggest downside of C Corporation is double taxation. This problem arises when the corporation wants to distribute its profits to the shareholders at the end of the year. The corporation has to pay the tax on its income tax returns. Since the shareholders carry a separate entity from the corporation, they will also pay their own taxes. So, once the profits are distributed to the shareholders in the form of the dividend, the shareholders have to show that dividends as income received by them. They are to pay tax again at their personal rates on their income which is inclusive of the dividend.

Costly to incorporate and Maintain

There is a lump sum payment (fee) when it comes to the filing of the Articles of Incorporation. It is supposed to be paid in the state in which the corporation is operated. Also, the complex formalities, double taxation, and sheer legal obligations make this corporation quite expensive for the shareholders.

Legal Formalities and Regulations

C Corporation faces more government supervision due to its complex tax rules, compliances, legal formalities, and higher protection for the owners. Many states require a lot of legal proceedings and formal meetings as to how the corporation will manage its internal affairs? What are the strategies? What will their next plan be? etc

No deduction of corporate losses

There is no deduction available for corporate losses. The shareholders cannot write off those losses on their personal return.

Read C Corporation Vs S Corporation to learn about the differences between the two types of corporations.