A stock dividend calendar is basically a tool that offers all information an investor may require related to a dividend. Using the calendar, you can get the information regarding the dividend for a specific company or a list of companies based on the selected criteria. Broker houses or website creates such calendar in the form of a tool that provides all the detail and is accessible to everyone free of cost.

Stock Dividend Calendar – What it Tells?

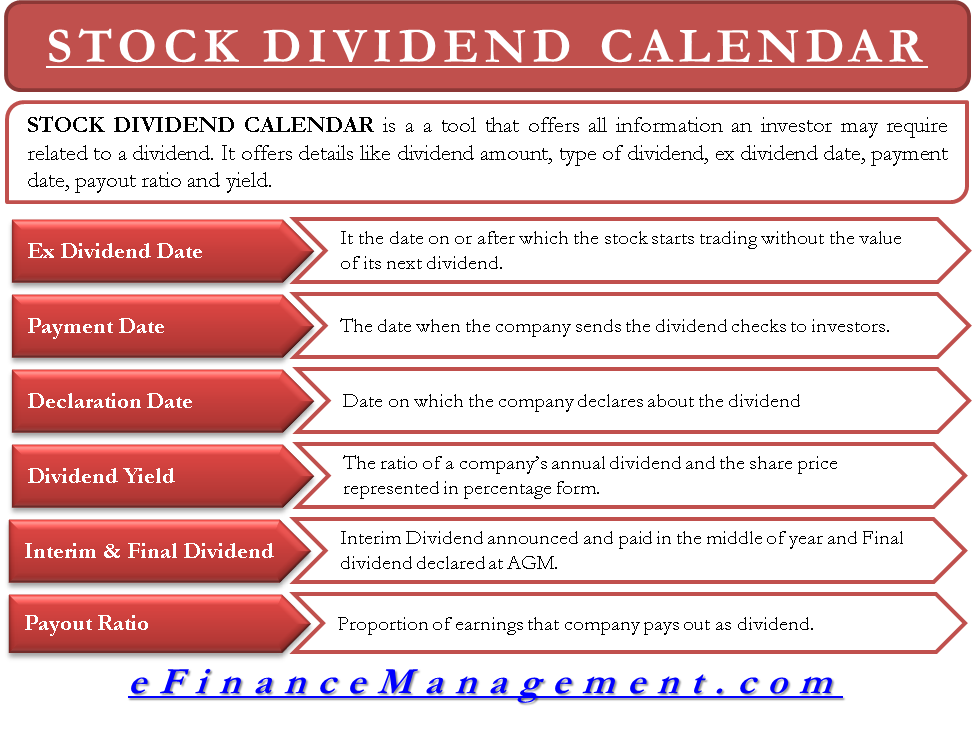

The stock dividend calendar usually offers details like dividend amount, type of dividend, ex-dividend date, payment date, payout ratio, and yield. Knowing these terms in detail will give us a clear understanding of the importance of the stock dividend calendar.

Ex-Dividend Date

The ex-dividend date is the date on or after which the stock starts trading without the value of its next dividend. The primary use of such a date is to distinguish between the investors entitled to a dividend and those who are not. Those who buy the stock on or after the announcement of the ex-dividend date by that company are not entitled to a dividend.

When the management decides to declare a dividend, they set a record date. This is the cut-off date for investors to be on the company’s record to be eligible for the dividend. After the record date, the ex-dividend date is set on the basis of rules set by the stock exchange where that particular stock trades.

Also Read: Ex-Dividend Date

Usually, the ex-dividend date is one business day before the record date. For instance, if the record date is Monday, February 4th, the ex-dividend date would fall on Friday, February 1st.

Knowing the ex-dividend date is very important for an income investor. An investor must buy a dividend-paying stock at least two days before the record date, as it takes two days to settle a trade. So, if you are aware of the ex-date, it will help you plan your trade and maximize the return. You can easily know the ex-date for any stock using the stock dividend calendar.

Payment Date

It is another important date available in the stock dividend calendar. This is the date when the company sends dividend checks to the investors. The payment date has no impact on the share price as investors know this date in advance. Nevertheless, it still helps investors know when to expect some income.

Declaration Date

The date on which the company declares the dividend is the declaration date. Some stock calendars also include this date.

Dividend Yield

It is another important piece of information provided in the stock dividend calendar. The dividend yield is the ratio of a company’s annual dividend and the share price. It is in the form of a percentage. Stocks with high dividend yields may be attractive because the company gives more dividends.

Also Read: Record Date – Meaning, Example and More

But, this is not always the case. A company may see a high dividend yield even when its stock prices fall. Also, a high dividend yield mostly comes at the cost of growth. If a company is paying a dividend, it is not reinvesting that amount in the business.

Interim and Final Dividend

Some calendars also tell if the dividend given is interim or final. The interim dividend is announced and paid in the middle of the accounting year. In contrast, the final dividend is declared at the company’s Annual General Meeting (AGM). And after the end of the financial year, the interim dividend is usually paid from retained earnings. At the same time, the final or annual dividend is paid from the profits made during the year.

Payout Ratio

It is the proportion of earnings that the company pays out as a dividend. The payout ratio is expressed as a percentage, and one can calculate it by dividing total dividends paid by net income. For instance, if a company has a payout ratio of 20%, it means the company pays 20% of its income as a dividend.

Overall, one can say that a stock dividend calendar is an important tool for an investor and trader. It helps them make an informed decision and gives all dividend-related information on one screen.

I’d need to test with you here. Which isn’t something I usually do! I enjoy studying a publish that will make people think. Also, thanks for allowing me to comment!