You are here to understand Qualified Dividend and so we assume you have a fair idea about the concept of dividends in corporations. It is nothing but the distribution of a part of the profit to the shareholders. For more understanding of the concept, you may go through – Dividend Decisions.

What is a Qualified Dividend?

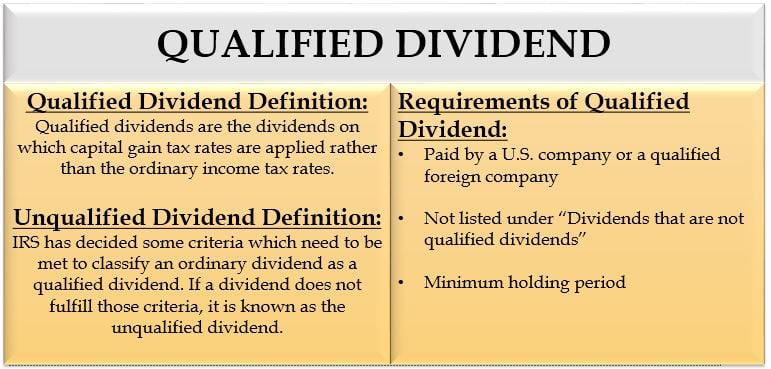

The term qualified dividend took birth from tax laws applicable to the dividends. Qualified dividends are those special kinds of dividends whose tax rates are different from ordinary dividends. Ordinary dividends are subject to regular tax rates. Qualified dividends are taxed at the same rate as long-term capital gains whose maximum tax bracket is 20%.

Advantages

- Qualified dividends are a type of dividend that can provide tax benefits to investors. This can lead to significant tax savings for high-yield dividend investors, making them a popular choice for income-seeking investors.

- Tax saving further encourages the investor to invest and therefore contributes to economic growth.

- It also encourages the companies to pay dividends as dividend-paying companies attract more tax-savvy investors.

Disadvantage

To be eligible for a lower tax rate, dividends must meet certain requirements set by the IRS. Meeting these requirements is a bit tricky. Let’s understand what these requirements are.

Qualified Dividend Requirements

IRS has specified some requirements to classify a dividend as a qualified dividend. These prerequisites include:

To be a qualified foreign corporation, a foreign corporation has to meet any of the following conditions to classify its dividend as qualified:

a) The company has incorporated in a U.S. possession.

b) It is entitled to the benefits of an income tax treaty with the United States.

c) The company’s stock is traded on any of the established stock markets in the United States.

Refer to the link to Publication 550 on the IRS website for a detailed explanation of qualified foreign corporations – Qualified Foreign Corporation.

The following do not qualify as qualified dividends or simply say are dividends that are not qualified dividends, not even if they are shown in box 1b of Form 1099-DIV.

a) Capital gain distributions.

b) Dividends from tax-exempt corporations.

c) Dividends on shares held through an option or a future contract.

d) Dividends paid on stock borrowed in a short sale.

e) Dividends on employee securities under the employee stock option plan (ESOP).

f) Dividends paid by credit unions or other mutual savings institutions.

g) Dividends paid on deposits with mutual savings banks, cooperative banks, credit unions, U.S. building and loan associations, or similar institutions.

This detailed exhaustive list is available in the Publication 550 of the IRS website – Dividends that are not Qualified Dividends.

To classify a dividend as a qualified dividend, holding period criteria must be met. The requirement is that the stock must be held for more than 60 days during the specified 121-day period. The specified 121-day period begins 60 days before the ex-dividend date. For the purpose of calculating the number of days, the day you sold the share is included, but the day you purchased is not included in the calculation. And if it is a preferred stock, it must be held for 90 days during the specified period of 180 days beginning from 90 days before the ex-dividend date. This condition is applicable if the dividends are due in periods more than 366 days. Otherwise, the condition of 60 days and 121 days will prevail.

Example

Consider the following data to understand the minimum holding period criteria with clarity. Assume that a company declared its dividend on 2nd February and set a record date of 13th February. The ex-dividend date, as declared by the stock exchange is 12th February.

| Dividend Declaration Date | Ex-dividend Date | Record Date |

|---|---|---|

| 2nd February | 12th February | 13th February |

| Beginning date of 121 days period (60 days prior to the ex-dividend date) | 14th December | |

| Ending date of 121 days period for qualifying for qualified dividends | 14th April | |

Therefore, the investor should hold shares for more than 60 days from 14th December to 14th April. Look at the table below mentioning the different dates on which shares were purchased and sold, and their holding period.

| Purchase Date | Sale Date | Total Holding Period (in days) | No. of days shares were held during 121 days period |

|---|---|---|---|

| 14th Dec | 14th Feb | 62 | 62 |

| 3rd Dec | 14th Feb | 73 | 63* |

| 23rd Dec | 22nd Feb | 61 | 61 |

| 11th Feb | 14th Apr | 62 | 62 |

| 3rd Dec | 10th Feb | 69 | 59 |

* Counting of the number of days shares held during 121 days period will begin from 14th Dec (60 days before the ex-dividend date).

In the above table, the benefit of qualified dividends will be eligible in the first four cases. But in the last case, the benefit of a lower tax rate will not be applicable even though the total holding period is more than 60 days. This is because the investor has held the shares for 58 days only during the 121 days period.

Ordinary Dividend Definition

IRS has decided on some criteria which need to be met to classify an ordinary dividend as a qualified dividend. If a dividend does not fulfill those criteria, it is an unqualified or non-qualified, or ordinary dividend. Investors will have to pay an ordinary income tax rate (applicable to their tax bracket) on the unqualified dividend received. These tax rates will be higher in comparison to tax rates paid on the qualified dividend.

Tax Rates on Qualified and Unqualified Dividends

| Ordinary Income Tax Bracket | Tax Rate for Unqualified Dividend | Tax Rate for Qualified Dividend |

| 10% | 10% | 0% |

| 15% | 15% | |

| 25% | 25% | 15% |

| 28% | 28% | |

| 33% | 33% | |

| 35% | 35% | |

| 39.6% | 39.6% | 20% |

Let’s say you are holding 10,000 shares in a company. It declares a dividend of $2 per share. So, the dividend income will be $ 20,000. Now, assume two situations:

- Situation 1: The dividends are unqualified or ordinary dividends.

- Situation 2: The dividends are qualified dividends.

To find out the dividend tax rate, you need to know which tax bracket you fall into for ordinary income. If you fall into the 25% tax bracket, you will have to pay the same rate of 25% on the dividend income in situation 1. So, the tax expense would be $5000 ($20,000 * 0.25). And, if it is the second situation you would have paid a lower tax rate of 15%. The dividend expense, in that case, would be $3000 ($20,000 * 0.15). Hence, you will be saving $2,000 on the tax (i.e., $5,000 – $3,000).