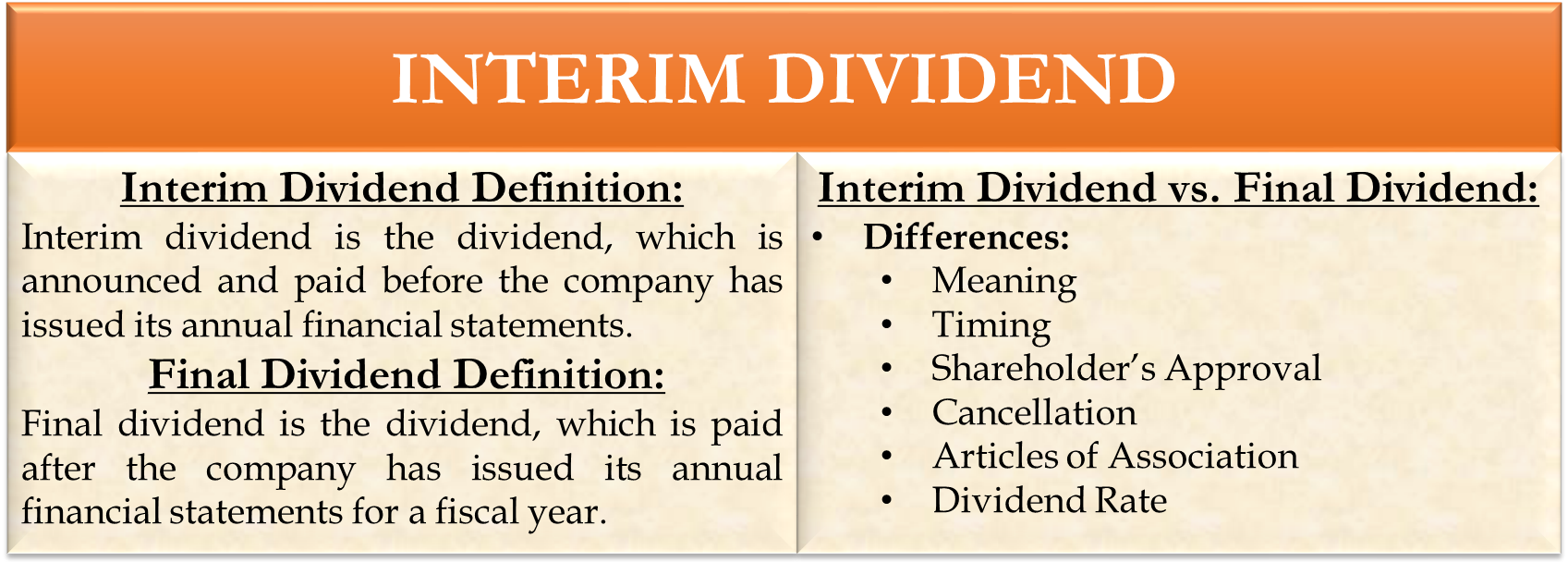

Interim Dividend: Meaning

The interim dividend is the type of dividend that the company announces and pays before issuing annual financial statements. The board of directors declares it. The company might have a policy to pay dividends more than once a year. So the announcement of such dividends occurs between the two consecutive annual general meetings.

As the name suggests, an interim dividend relates to the business activities of less than a year. Such distribution generally takes place semi-annually or quarterly. Along with this, the company issues interim statements. The board of directors generally announces such dividends when the company has enough retained earnings and it is observing higher than expected earnings.

Final Dividend: Meaning

The final dividend is the type of dividend that the company pays after issuing annual financial statements for a fiscal year.

It relates to the business activities of a whole fiscal year. The board of directors proposes it on the basis of the earnings results available.

Shareholders vote on it and approve it at the annual general meeting (AGM).

The interim dividend rate is mostly lower than the final dividend rate. The board of directors should be conservative in announcing interim dividends, so that company’s ability to pay the final dividend is not impaired by less than expected earnings at the end of the year. Factors like growth prospects of the company, sales orders in hand, seasonal factors, and economic outlook will affect the company’s future profitability. Directors should consider all of these factors to make decisions regarding the interim and the final dividend.

Interim Dividend vs. Final Dividend

| Points | Interim Dividend | Final Dividend |

|---|---|---|

Meaning |

It is the dividend that the company declares and pays before issuing annual financial statements. | It is the dividend that the company pays after issuing annual financial statements. |

Timing |

Payment takes place semiannually or quarterly. | Payment takes place annually after the end of the fiscal year |

Shareholder’s Approval |

The board of directors declares it. Some jurisdictions also require shareholders’ approval, while some don’t. | The board of directors proposes it. It compulsorily requires shareholders’ approval at the AGM. |

Cancellation |

Generally, it can’t be canceled once declared. While in some jurisdictions, it can be canceled through shareholders’ vote. | It can’t be canceled once declared. It becomes a liability for the company. |

Articles of Association |

It can only be declared if articles of association allow it. | Does not require any specific mention in the articles of association for declaration. |

Dividend Rate |

Lower than the final dividend rate. | Higher than the interim dividend rate. |