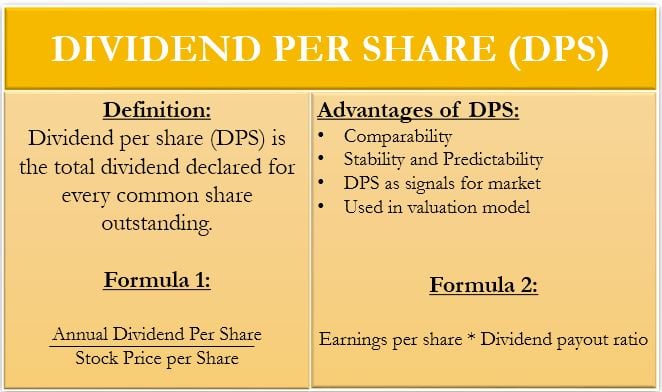

Dividend Per Share: Definition

Dividend per share (DPS) is the total dividend declared by the company divided by the total number of common outstanding shares. It tells how much dividend a shareholder has earned on each share held by him. But do you know why investors always want to know their DPS and do they calculate it, this all will be answered in detail in this article.

Dividend Per Share (DPS) Formula

The formula to calculate DPS varies on the basis of the data available.

Formula 1

| Dividend Per Share = Dividends / Number of Common Shares Outstanding |

- Dividends: Along with the annual dividend, it also includes interim dividends distributed to common shareholders for a specific fiscal year. Preference and special dividends are not included here. The reason why preference dividend is not considered is that the dividend on preference share capital is usually fixed and known in advance. And the special dividend is excluded from the calculation because a company declares such a dividend in rare circumstances only.

- The number of common shares outstanding: It includes the number of common shares outstanding as of a particular date. The Company makes the list of shareholders entitled to receive dividends on the record date. The number of outstanding shares as of that date is the denominator.

Formula 2

| Dividend Per Share = Dividends / Weighted Average Number of Common Shares Outstanding |

- The weighted average number of common shares outstanding: Changes in the number of shares outstanding during the year are ignored in the first formula. In the second formula, the number of common shares outstanding is taken, and weights are given to them based on the time they have remained outstanding during the fiscal year. Then, the weighted average is found to consider the changes in shares outstanding during the year.

To simplify, let’s take a hypothetical example for weighted average shares:

| Date | Description | Increase | Decrease | Shares outstanding (A) | Time Weights (B) | (A)*(B) |

| 1/1/2016 | Beginning No. of shares outstanding | 1,000,000 | 3/12 months | 250,000 | ||

| 1/4/2016 | Convertible debt converted into shares | 200,000 | 1,200,000 | 7/12 months | 700,000 | |

| 1/11/2016 | Shares Repurchased | 600,000 | 600,000 | 2/12 months | 100,000 | |

| Weighted average no. of common shares outstanding | 1,050,000 | |||||

We noticed that the difference between the two formulas is due to the no. of outstanding shares, i.e., the numerator.

The first formula is intended for the investors to know how much total dividend they will receive depending on the holding of the investor. Therefore, here the outstanding no. of common shares is the no. of shares outstanding as on the record date.

The second formula is useful for analysts to know the effective dividend per share.

Formula 3

| Dividend Per Share = Earnings Per Share * Dividend Payout Ratio |

This formula is used when the user is provided with the income statement of the company.

Dividend Per Share Calculation with Example

| Description | Company X | Company Y |

|---|---|---|

| Profit attributable to common shareholders (A) | $ 2,000,000 | $ 500,000 |

| Dividends declared (B) | $ 1,000,000 | $ 250,000 |

| No of shares outstanding (C) | 500,000 | 100,000 |

| Earnings per share (D) = (A/C) | $ 4/ Share | $ 5/ Share |

| Dividend per share (E) = (B/C) | $ 2/ Share | $ 2.5/ Share |

You can also use the Dividend Per Share Calculator.

Analysis/Interpretation of Dividend Per Share

In the example above, both companies have the same payout ratio, i.e., 50%. But company Y has returned more to its shareholders even after having lower profits compared to company X. Therefore, Company Y is considered better as it has a DPS of $2.5 as compared to $2 company X. It should be noted that this kind of comparison should be done between similar companies. Companies of different natures require more detailed analysis and research.

If the number of outstanding shares is lesser, the return on each share will be more, and the scenario will be exactly the opposite if the number of shares is more. Or there could be a scenario that the profit of the company is lower, but it is declaring higher DPS in comparison to its industry.

Also Read: Dividend Per Share Calculator

Advantages of Using Dividend Per Share Ratio

Now, that we know what exactly a dividend per share is, let’s know about the reason why investors calculate DPS. When a company announces that it is distributing X% of its profit as dividends, it sounds great to its shareholders. But how much does an individual investor earn from each share he owns in a company? Investors are always interested in the business that provides them with maximum return. So calculating DPS helps them to evaluate their investment decision. The following are the advantages of using DPS.

Comparability

DPS provides better comparability between the two companies as it is on a per-share basis. You should not compare the absolute amount of dividends as it might lead to an unreliable conclusion due to differences in the size of companies.

DPS Trends as Signals for Markets

Increasing the level of DPS is considered to be a positive signal as it shows that the company has more confidence in its future earnings. Similarly, reducing that level would send a negative signal. In this scenario, you should always go through a dividend policy before concluding anything.

Simplicity and Predictability of DPS

DPS is a very simple ratio to understand. Also, if a company tries to maintain a stable level of DPS, then it will result in fewer fluctuations in DPS statistics. Due to this, predicting the future dividend income through DPS becomes easy. An increasing trend in DPS is a symbol of the company’s growth. While a decrease in DPS returns a bad signal regarding the company’s profitability.

Also Read: How to Determine Dividend?

Used in the Valuation Model

Many valuation models consider DPS (e.g., dividend discount model) due to its predictability. It is one of the most useful ratios in valuing and analyzing the company’s stock.

Conclusion

Using DPS as a metric provides more comparability and reliable interpretation rather than the absolute dividend. Please note that you should cross-check the method with which it calculates DPS. Using any DPS statistics blindly might lead to faulty analysis.

DPS is considered a positive sign for the financial strength of a company. However, DPS is affected by many factors like the dividend policy, reinvestment opportunities available, size, industry, life cycle stage, etc. Hence, it should be used with caution and other metrics to conclude the company’s financial strength.