What is Direct Material

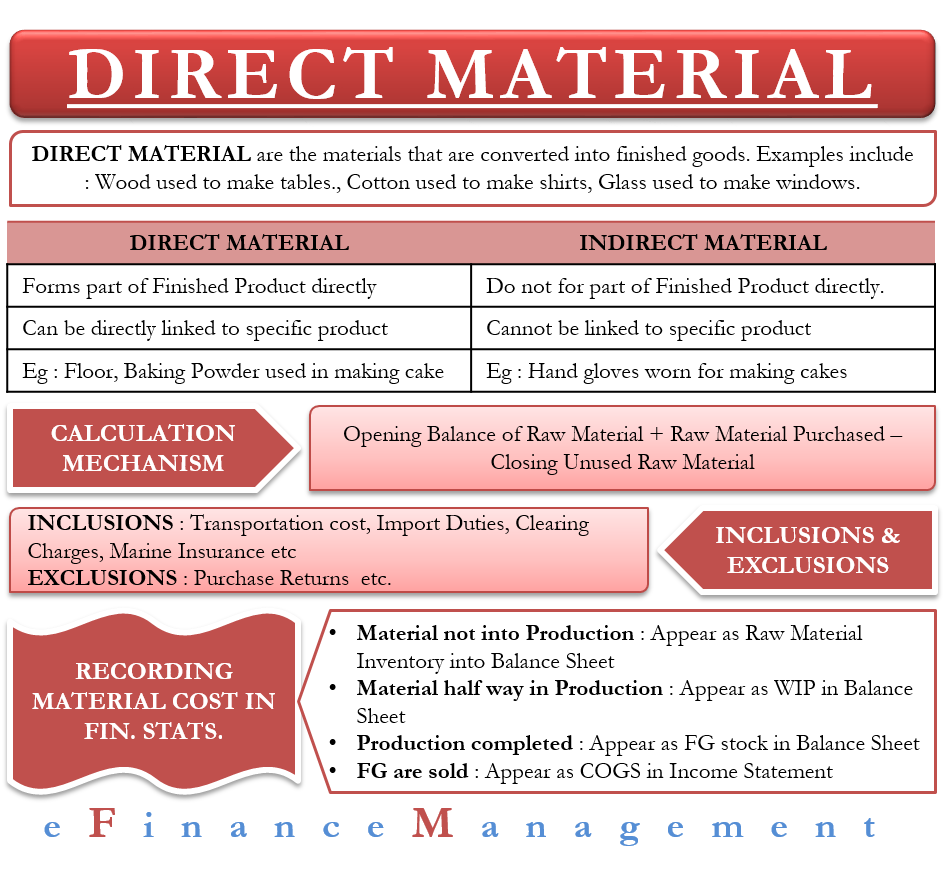

Think about the list of items you need to prepare a chocolate cake. Your list will include items like flour, cocoa powder, sugar, eggs, milk, baking powder, etc. These items are none other than what companies and manufacturing organizations call ‘direct material’ for preparing a cake. Hence, direct materials are raw materials that are converted into finished goods. These are not materials that we ‘use’ in the production process. Instead, direct materials are those raw materials that physically become finished goods at the end of the manufacturing process. In other words, they are components of a finished product.

Examples of Direct Material

- The wood is used to make tables.

- A cloth used to make shirts.

- The glass is used to make windows.

Difference between Direct Materials vs. Indirect Materials

While raw materials themselves become finished goods, indirect materials are those materials that do not form a part of the finished goods. E.g., Chefs in a bakery typically use hand gloves while preparing cakes and other bakery items. The bakery will also use various cleaning agents (dishwashers, floor cleaners, etc.) to keep the kitchen area clean. Both these items are an example of indirect costs since they do not form a part of the finished goods. Their job is to make the production process more efficient or easier.

One more differentiating characteristic of indirect materials is that we can’t link their costs to a specific product. E.g. while you can say how much sugar you have used to prepare cakes and how much to produce muffins, you can not say how much part of the hand gloves cost is attributable to cakes and how much to muffins. You cannot also say how much floor cleaner was used to facilitate the production of muffins and how much for the production of pastries.

Read more about direct and indirect costs.

What Constitutes Direct Materials Cost

Obviously, direct material cost will be the cost of the ingredients you buy to manufacture your product. But things are not as simple as they look. In our own example of preparing a chocolate cake, you don’t go and buy all the ingredients from the market and in exact quantities. Some of the items, like sugar, milk, and eggs, are already with you, so you use them. Some portion of the items which you purchased from the market, say, cocoa powder, baking soda, etc., are left unused. So, is it easy for you to tell what is the cost of the chocolate cake which you just prepared?

For a firm, although we calculate direct materials cost on a monthly/quarterly/semi-annually/yearly basis and then derive the per-unit cost, the situation is quite similar. Out of all the raw materials a manufacturing organization needs to manufacture a product, it will purchase some direct material from its suppliers, some of them it already has in its storage, and some of them it did not use at the end of the month/quarter/half-year/year. And this is where confusion regarding the calculation of direct material cost for the relevant time period starts hitting.

How to Calculate Direct Material Cost

So, to simplify the calculation process, we follow a three-step process:

- Add the value of the opening balance of raw materials.

- Add the total purchases made during the year.

- Deduct the value of the closing stock (unused stock) at the end of the year.

Also, a firm must include transportation charges incurred for getting raw materials to their factory/plant into direct materials cost. The firm can include such cost into direct materials cost, either by adding it to the price of the raw materials or by showing such costs under the head of freight charges in the income statement. Also, if the firm returns any purchased item to the suppliers, the firm must deduct such purchase returns from the cost of direct materials.

Sometimes, firms import raw materials from another country. This import attracts expenses such as import duty, clearing charges, marine insurance, etc. Firms must include these import-related costs into direct material costs in the same manner as transportation costs.

Where and How to Record Direct Material in the Financial Statements

The cost of direct materials may appear in the Income Statement or in the Balance Sheet according to its location/position at the time when the firm was preparing its Financial Statements.

- When the raw materials are not yet in the production process. They appear on the Balance Sheet as ‘raw materials’ or ‘raw materials inventory.’

- When the raw materials are halfway into the production process, this means that the raw materials are now a part of the production process, but the process is yet to complete. We will report them as work-in-process inventory on the Balance Sheet.

- If the production process is complete, which means that the raw materials have been converted into finished goods, but they are yet not sold to the customers. We will report them as ‘finished goods inventory’ or ‘inventory’ on the balance sheet.

- When the production process is complete, and the finished goods are sold to the customers. We will report them as Cost of Goods Sold under Income Statement.

Good day , really i read all topic and it was very useful to me , although i have more question regarding to transportation cost and import duties and how to charged theri cost directly to direct material ?

also if you support your article with examples it will be very useful to all students

thanks