Direct Materials Budget: Meaning

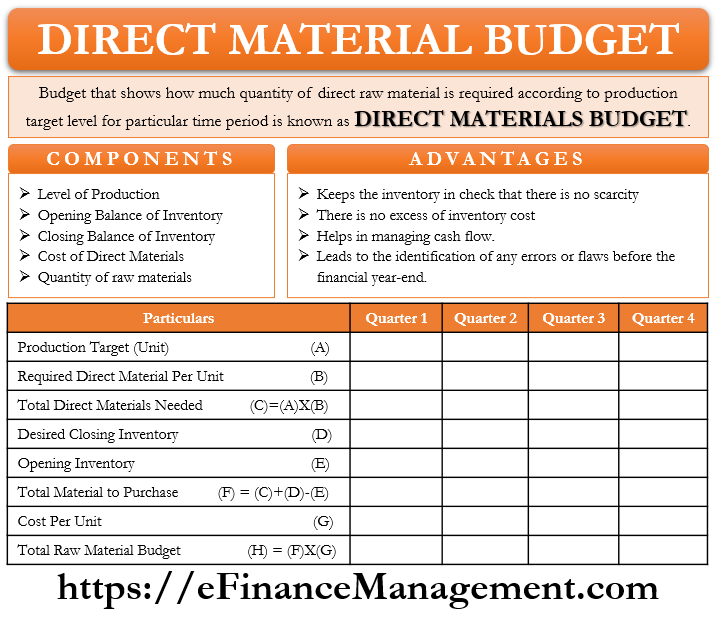

A budget that shows how much quantity of direct raw material is required according to the production target level for a particular time period is known as Direct Materials Budget. The preparation of this Budget can be monthly, quarterly, or yearly. The management determines the time period. Direct Materials Budget calculates the units of raw material according to the closing inventory and production targets for that respective year.

Direct Materials Budget gives an idea of the quantity of direct material required to meet the production needs. It is a part of the company’s Material Requirement Planning (MRP).

What is Material Requirement Planning?

Material Requirement Planning tries to keep correct raw materials in the correct quantity and at the correct time. This saves costs and enhances efficiency. It also helps the company avoid any production disruption and bottlenecks due to materials.

This budget complements the production target. The other name of this budget is the Direct Materials Purchases Budget.

The direct Materials Budget, along with the direct labor budget and overhead budget, is a part of the production budget only. All three collectively form the company’s production budget. At times a small budget calculating the total units to be produced is also known as a production budget, but it is incomplete without the other three budgets.

Also Read: Production Budget

Direct Materials Budget directly or indirectly impacts other budgets like Cash flow Budget, Financial Budget, etc. In the end, all these budgets form part of the Master Budget.

Components of Direct Materials Budget

Production Level

It shows the total production target by considering the production capacity and demand for the company’s products. Target production level acts as a base for Direct Materials Budget, as all purchases have to be in sync with the production volume.

Opening Balance of Inventory (Direct Materials)

Companies always keep a certain amount of inventory in their warehouse for any unforeseen situation in the future. At times, it might happen that there is a sudden increase in demand, which leads to a sudden rise in production. In such a situation, the existing inventory acts as a safety net. The opening inventory of this month/quarter/year is a closing inventory of earlier month/quarter/year. Therefore, while deciding on the purchase plan, it is necessary to know and understand the level of opening inventory already with the company.

Closing Balance of Inventory (Direct Materials)

At the time of planning the production targets and purchases, it also decides the quantum of the closing inventory that the company would like to keep as a safety net. Closing inventory is the inventory that is to be kept in the stock at the end of the month/quarter/ year. Adjustments in the purchase of raw materials and production are made according to the targeted closing inventory.

Cost of Direct Materials

The purchasing price of raw materials is a very important component. There exists a standard price which is a budgeted price. Calculating cost per unit of raw materials and total direct materials cost is of immense importance. That will help fund planning.

The total quantity of raw materials

According to the requirement of raw materials per unit of finished goods, the quantity of raw materials is determined. Let’s say the target production is 100 units, and each unit of the final product requires 3 units of raw materials. The number of raw materials to be ordered would be 300 units.

Format of Direct Materials Budget

The first step is a calculation of targeted production.

Targeted Production = Expected Sales + Desired Closing Inventory of Finished Goods – Opening Balance of Finished Goods

After calculating the total target production, now preparation of the Direct Materials takes place. The format given below is a hypothetical example.

Direct Materials Budget for the year ended on 31st March 2021

| Particulars | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 |

|---|---|---|---|---|

| Production Target (units) | 500 | 600 | 700 | 800 |

| * | 2 | 2 | 2 | 2 |

| Required direct materials per unit of finished goods | ||||

| Total Direct Materials Needed | 1000 | 1200 | 1400 | 1600 |

| Add: Desired Ending Inventory of Direct Materials | 200 | 240 | 280 | 320 |

| Less: Opening Balance of Direct Materials | 160 | 200 | 240 | 280 |

| Total Direct Materials to Purchase | 1040 | 1240 | 1440 | 1640 |

| Cost Per Unit of Direct Materials ($) | 0.5 | 0.5 | 0.55 | 0.55 |

| Total Cost of Raw Materials to be Purchase | 520 | 620 | 792 | 902 |

A Direct Materials Budget is created for the financial year with quarterly splits. Companies can easily prepare this budget with the help of given data.

Preparation of ‘Schedule of Expected Cash Disbursement for Materials,’ along with this budget, takes place sometimes. It complements the budget and gives total cash disbursements for managing the cash flows.

Advantages of Direct Materials Budget

- This budget keeps the inventory always in check. There is no sudden scarcity or abundance of raw materials.

- There is no excess inventory cost.

- This Budget helps in managing cash flows in a better way. This budget notifies the exact amount and timing of the expected cash flow required in the future.

- The preparation of the Direct Materials budget is for every month or quarter. Thus this leads to the identification of any errors or flaws before the financial year-end.

The above advantages are non-exhaustive in nature; there could be other advantages as well.

Understanding Direct Materials Variance Analysis

Let’s understand the direct materials variance. It is even possible that the budgeted quantity/price could be different from the actual quantity/price because budgeting is on the basis of estimation. This variation or difference is the Direct Materials Variance Analysis.

This analysis is a combination of two elements – materials price variance and materials quantity variance. The materials price variance is the difference between the actual cost and the budgeted cost of purchasing raw materials. The material quantity variance is the difference between the actual and budgeted quantity of raw materials used in the business. External or internal factors lead to these variations.

The formula is as follows:-

Materials Price Variance = Actual Quantity of Materials Purchased * (Actual Price – Standard Price)

Materials Quantity Variance = Standard Price * (Actual Quantity of Materials Used in Production – Standard Quantity)

Understanding variance analysis helps the management identify gaps or planning errors in the business operations. And suggest or triggers the areas which need special attention and constant monitoring.

Conclusion

Direct Materials Budget, along with the schedule of expected cash disbursement, direct labor budget, and overheads budget, becomes an important part of the Master Budget. Direct Materials Budget is useful for various departments like the Production department, Warehousing department, Purchasing department, etc. Preparing this budget with full accuracy is very important. Even a minor error could disrupt the inventory, production targets, and cash flows. As budgeting works on estimation, there’s always room for errors in the case of the Direct Materials Budget as well. However, all said and done budgeting is an important and essential task. But it should not be treated as a one-time exercise, rather constant monitoring and updating will give the results. Rather doing variance analysis is a routine at the end of the accounting period or budget period.