What does Operating Cycle Method do?

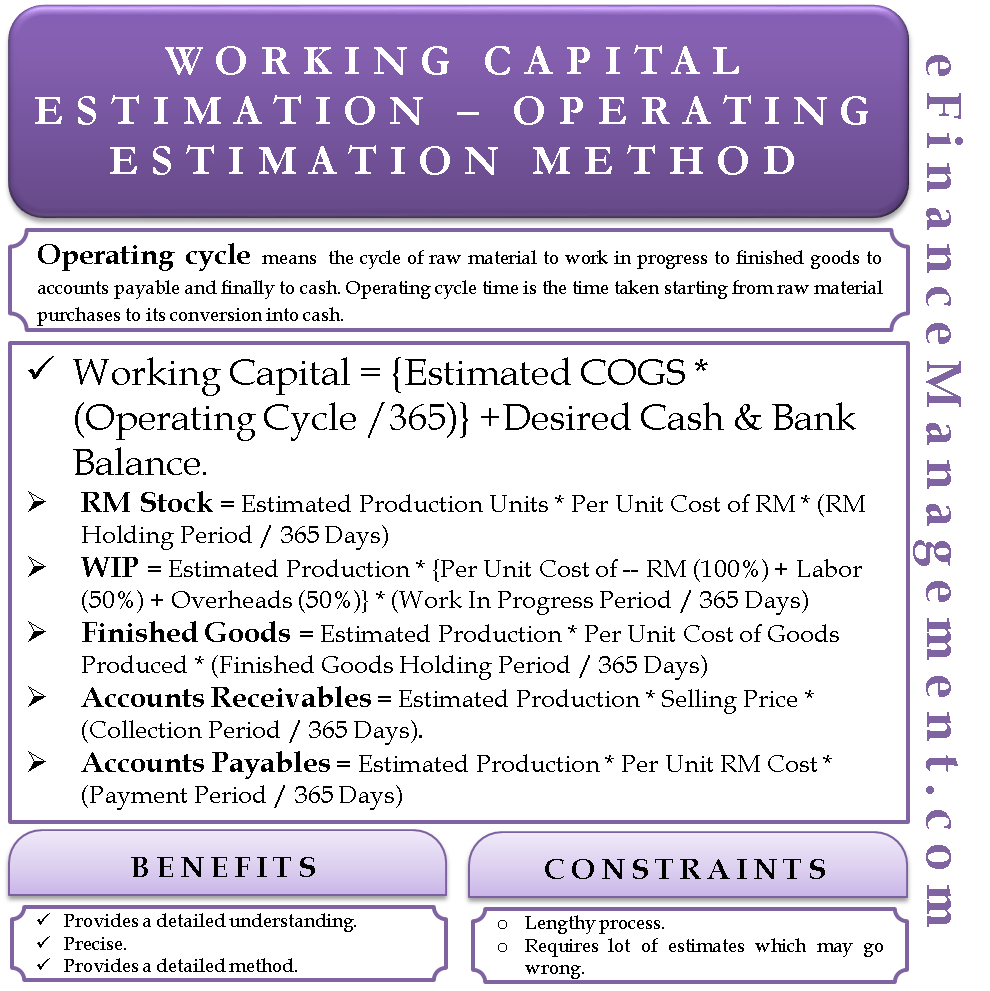

Operating cycle method for estimating working capital is based on the duration of the operating cycle. The longer the cycle period, the bigger the working capital requirements will be. Operating cycle means the cycle of raw material to work in progress to finished goods to accounts payable, and finally to cash. Operating cycle time is the time taken starting from raw material purchases to their conversion into cash.

How to Calculate or Estimate Working Capital Requirement using Operating Cycle Method?

Formula

Working Capital = {Estimated Cost of Goods Sold * (Operating Cycle/ 365)} +Desired Cash and Bank Balance

Calculating the total working capital will not suffice the purpose. How this working capital form is also important. It means each component of working capital will have to be known. For that, we would first need to review the activity level of the company. Let us see how to calculate each item of working capital below:

Raw Material (RM) Stock

The formula for determining the RM stock is as under. RM and many other calculations are based on estimated production units, and, therefore, they should be calculated with utmost accuracy.

Estimated Production Units * Per Unit Cost of RM * (RM Holding Period / 365 Days)

Work In Progress (WIP)

In calculating the WIP, one should especially take care of the percentage of labor and overheads. These may vary depending on the stage of the product and the completion percentage. We have taken the percentage as an example.

Estimated Production * {Per Unit Cost of — RM (100%) + Labor (50%) + Overheads (50%)} * (Work In Progress Period / 365 Days)

Finished Goods Stock

In Finished Goods workings, we have to know the cost of production with the help of the previous year’s cost sheets or budgeted cost sheets of the company’s products.

Estimated Production * Per Unit Cost of Goods Produced * (Finished Goods Holding Period / 365 Days)

Accounts Receivables

This calculation is simple, and we need to put the estimates and average collection period right.

Estimated Production * Selling Price * (Collection Period / 365 Days)

Accounts Payables

The calculation of accounts payable is similar, but the major difference is in the cost of raw materials. We take finished goods selling price in accounts receivable calculation whereas raw material cost in case of accounts payable.

Estimated Production * Per Unit RM Cost * (Payment Period / 365 Days)

Advantages and Disadvantages of Operating Cycle Method of Working Capital Calculations / Estimations

The advantage is that it is a detailed method based on the actual economic conditions prevailing in the market. It gives a detailed understanding of the business and is precise in comparison to other methods. The disadvantage is that it is a lengthy process to arrive at a component-wise calculation of working capital. It needs a lot of estimates like estimated production, holding period of inventory, collection and payment period, etc. So, it is a risky matter. There are probable chances of going wrong in estimating these data, which may hurt the whole process. Keeping a cushion while estimating things on the darker side is advisable.

Other Methods for Estimating the Working Capital Requirements

There are other methods of estimating the requirements of working capital also. You may refer to the other ones mentioned below and select the one that suits your requirements.

Quiz on Working Capital Estimation – Operating Cycle Method