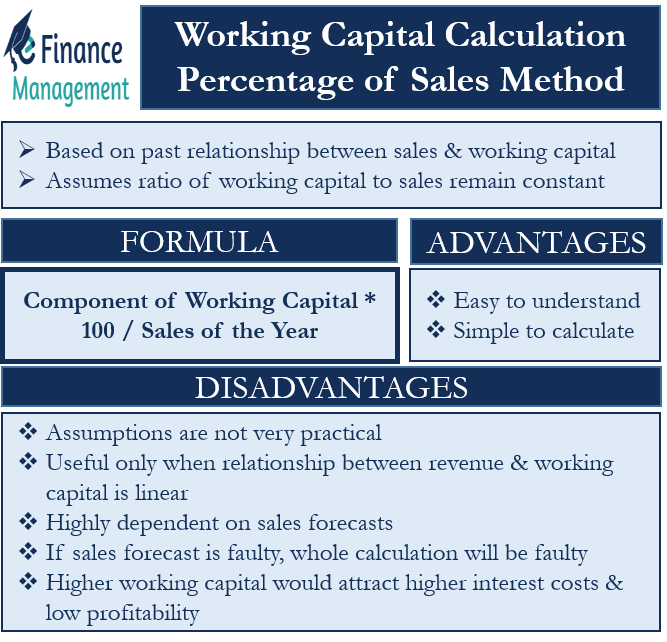

The percentage of sales method is a working capital forecasting method based on the past relationship between sales and working capital. Like technical analysis in the stock market, it assumes that history will repeat itself, and thus the ratio of working capital to sales will remain constant. In other words, it assumes that the whole business will move in tandem with sales.

How to Calculate Working Capital Using Percentage of Sales Method?

The percentage of sales method is the simplest and easiest way of finding future working capital. First, each component of working capital as a percentage of sales is calculated. For accounts payable are 20 million, and sales are 100 million, accounts payable as a percentage of sales would be 20%. Secondly, the coming year’s sales forecast is taken as a base, and the component is calculated per the percentage. In our instant example, if forecasted sales are 150 million, accounts payable should be 30 million. This is as simple as that. Let us see a practical example with formula and example.

Percentage of Sales Method Formula = Component of Working Capital * 100 / Sales of the Year.

Percentage of Sales Method Example

Consider the following balance sheet for the year 2014 as an example. The sales for 2014 are $400. The forecasted sales figure for the year 2015 is $600.

| Assets | Amt. ($) | Liabilities | Amt. ($) |

| Owner’s Capital | 200 | Fixed Assets | 170 |

| Debentures | 110 | Inventories | 40 |

| Accounts Payable | 40 | Accounts Receivables | 110 |

| Cash and Bank | 20 | ||

| 350 | 290 |

The percentage of sales method will calculate the working capital and its components as illustrated in the below table. We can see that in the last column, estimates for 2015 are calculated, and the working capital requirement for 2015 comes out to be $195 for the forecasted sales figure of $600.

| Particulars | Actual Figures of 2014 | % of Sales | Estimate for 2015 | |

| Sales | (x) | 400 | 100 | 600 |

| Current Assets | 170 | 42.5 | 255 | |

| Inventories | 40 | 10 | 60 | |

| Accounts Receivables | 110 | 27.5 | 165 | |

| Cash and Bank | 20 | 5 | 20 | |

| Current Liabilities | (y) | 40 | 10 | 60 |

| Accounts Payable | 40 | 10 | 60 | |

| Working Capital | (x-y) | 130 | 32.5 | 195 |

Advantages and Disadvantages of Percentage of Sales Method

The advantages of this method are that it is easy to understand and simple to calculate. There is no rocket science in calculating the working capital based on this method.

The most significant disadvantage is its assumption which is not very practical in all situations. This method is useful only where the relationship between the revenue and working capital is linear. Elsewhere this method is not suggested. Another drawback is that it is highly dependent on sales forecasts. If the sales forecast is faulty, a whole calculation will be faulty. Higher working capital would attract higher interest costs and low profitability, and lower working capital would pose a problem to the smoothness of the operating cycle.

I needed to compose you that very small note just to give thanks over again with the remarkable strategies you’ve contributed at this time.