Reverse Factoring Definition

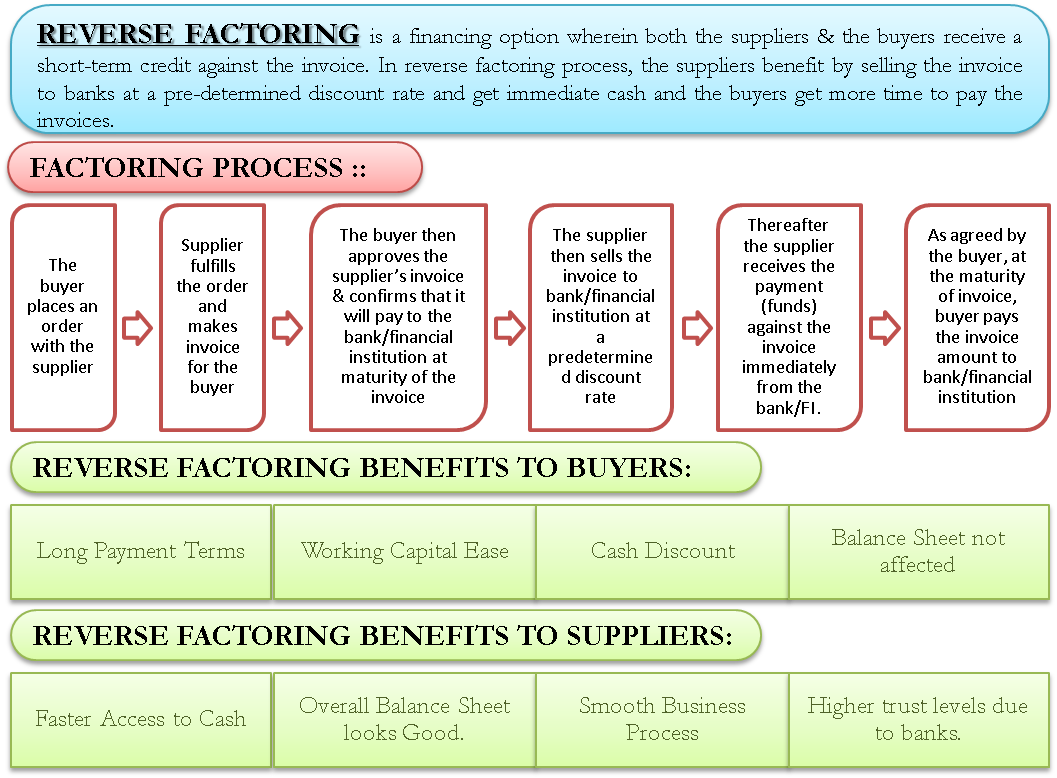

Reverse factoring is a traditional approach of factoring in modern-day supply chain finance. It is a buyer-led financing option wherein both the suppliers & the buyers receive a short-term credit against the invoice. Under reverse factoring, the suppliers sell invoices to banks or financial institutions at a pre-determined discount rate. The supplier gets immediate access to cash by selling invoices, whereas buyers get more time to pay the invoices. We can say that reverse factoring is a three-way financing process wherein supplier, buyer & financial institution all three are involved in the transaction.

This helps optimize working capital for both parties & provides liquidity to the business. The catch here is that the discount rate at which the invoice is settled by the bank/financial institution is lower than the buyer’s own sources of operating funds. Therefore, we can say that reverse factoring is a cheaper short-term finance option for buyers.

Reverse Factoring Process

A corporate buyer and some or all of its suppliers will be on board with a Reverse Factoring program. In most circumstances, buyers will only offer reverse factoring to a group of its most creditworthy suppliers. Following is the stepwise process:

- The buyer places an order with the supplier

- Supplier fulfills the order and makes invoice for the buyer

- The buyer then approves the supplier’s invoice and confirms that it will pay the bank/financial institution at the maturity of the invoice.

- The supplier then sells the invoice to a bank/financial institution at a predetermined discount rate.

- After that, the supplier receives the payment (funds) against the invoice immediately from the bank/financial institution.

- As agreed by the buyer, at the maturity of the invoice, the buyer pays the invoice amount to the bank/financial institution.

Benefits of Reverse Factoring

There are various benefits for both buyers and suppliers; some of them are as follows:

Benefits to the Buyers

- The buyer can have longer payment terms with the suppliers without having to negotiate any other factors such as prices.

- The trade payables increase so the buyer experiences efficiency in daily operations. This further results in working capital optimization for the buyer.

- The buyers can take benefits of cash discount while still paying for the invoice at the invoice maturity date.

- As this is an off-balance sheet finance option, the overall balance sheet of the buyer also looks good with better ratios of trade payables turnover, days payables outstanding, working capital turnover, etc. This helps in raising other sources of finance at better rates.

Benefits to the Suppliers

- The suppliers can get faster access to cash at advantageous rates. This also results in a faster cash conversion cycle from delivery to cash.

- Similar to the buyer’s advantage, the overall balance sheet of the suppliers also looks good, and they can get future finance at better rates.

Benefits to Both Buyers and Suppliers

There are some combined benefits to buyer & supplier as follows:

- Both the buyer & supplier experience smoother processes as they have to deal with banks/financial institutions for payments. This further translates to the strong cooperation between buyers and suppliers, which creates a competitive advantage

Limitations of Reverse Factoring

Distrust between supplier & buyer – If there is a lack of trust between the supplier and buyer, they will not be able to avail of reverse factoring. Reverse factoring is a combined financing option where both supplier and buyer commit to fulfilling the terms of the bank/financial institution. If, for example, the supplier sells the invoice & the buyer doesn’t pay, then the obligation will be on the supplier. This clearly won’t work.

Also Read: Factoring

Reverse Factoring – As a Business Solution

Technology has played a major role in the rise of reverse factoring. In the early 1990s, reverse factoring was only offered to large corporate buyers. Also, only a handful of banks offered this. With the rise in technology, there was a rise in financial technology firms. Both banks and financial technology firms started offering reverse factoring as a means of finance and as a business solution.

The finance providers started making online platforms to automate the reverse factoring process & provide more efficient business solutions. These platforms made the whole process more transparent, where multi-party transactions were visible to all the involved parties. The process is structured in such a manner that each department, be it procurement, treasury, IT, or legal, is in sync with the transaction. This inclusiveness, automation, simplicity & transparency provided perfect business solutions to buyers & sellers. Now all the major banks & such Fintech companies provide reverse factoring, and it is provided not only to large buyers but also to SME buyers. According to a report by McKinsey, reverse factoring/supply chain finance has increased by 20% per annum from 2010 to 2014, and the growth is expected to rise in the future. Reverse factoring has evolved through the years, and service providers are now looking toward blockchain technology to enhance the service further.

Read more about various other Types of Factoring.

Quiz on Reverse Factoring

Let’s take a quick test on the topic you have read here.

Thanks for sharing this article. I am new to reverse factoring. I believe that this is very informative and will definitely help me to be more knowledgeable about reverse factoring.