Working Capital Financing

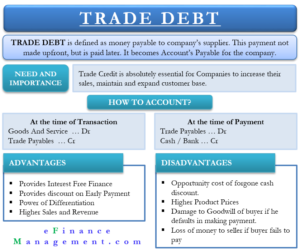

Working capital financing refers to the activity of obtaining funds in order to finance the working capital. There are various sources to finance working capital that include trade credit, cash credit/bank overdraft, working capital loan, discounting of bills, bank guarantee, factoring, commercial paper, inter-corporate deposits, etc.

In this article, we will learn about why businesses need working capital, how to estimate the amount & strategies to finance it.

Need to Finance Working Capital

The arrangement of working capital financing forms a major part of the day-to-day activities of a finance manager. It is a very crucial activity and requires continuous attention because working capital is the money that keeps the day-to-day business operations smooth. A business may get into trouble without appropriate and sufficient working capital. Insufficient working capital may result in:

- Non-payment of certain dues on time (this sometimes may lead to bankruptcy).

- The inevitable interest cost (this directly hits the profits of the business).

Determining Working Capital Requirement

Since working capital is required by a business to fund its daily operations, there are various factors that play a major role in determining working capital requirements. These include the nature of the business, its future plans, credit policy, etc. For example, a business allowing 90 days of credit to its customers would require more working capital as compared to one that allows a credit period of 45 days only. In the former case, it takes longer to convert cash back into cash. While the operating cycle in the latter case is shorter.

There are three methods available to determine the working capital requirement:

- Percentage of revenue or sales

- Regression analysis

- Operating cycle method

Working Capital Financing Strategies

After assessing the amount of working capital required, it becomes important to decide how a business should raise these funds. Whether it should opt for long-term sources or short-term sources? Here comes the role of working capital financing strategies.

Working capital financing strategies deal with the cost of capital factor. The question is – How the costs of capital are optimized? A business can choose between short-term vs. long-term sources of capital. Normally, short-term funds are cheaper than long-term but risky. Short-term funds are risky in terms of the risk of refinancing and the risk of rising interest rates. Once they mature, they may not be refinanced by the same financial institution, and there is a possibility of revision in interest rates every time they are renewed.

Let’s divide a business’s capital investment into two, i.e., investment in fixed assets and investment in working capital. Let us safely assume that long-term funds finance fixed assets. Now remaining is working capital. Let us further divide working capital into two parts, i.e., permanent and temporary working capital. The nature of permanent working capital is similar to fixed assets, i.e., this level of investment in working capital is always present, and the remaining part keeps fluctuating. The working capital management strategies define how these two types of working capital are financed.

Three working capital financing strategies are:

- Hedging Strategy: It follows the principle of finance, i.e., long-term funds to finance long-term assets and vice versa. In this strategy, the maturities of current assets are matched with the maturity of its financing instrument. It does not have any cushion or flexibility in case of any delay in the realization of current assets.

- Conservative Strategy: It is a safer strategy where apart from financing the whole of the permanent working capital, it finances a part of temporary working capital also.

- Aggressive Strategy: It is a high-risk strategy where apart from financing the whole of the temporary working capital, it finances a part of permanent working capital also.

Working Capital Policies

Working capital management is nothing but managing the levels of current assets to maximize a business’s long-run profits. There are three types of working capital policies that businesses can follow for managing their current assets:

- Relaxed Policy: Under this, the level of current assets is kept at a very high level. The benefit of this policy is that it maintains a very smooth operating cycle.

- Restricted Policy: Here, the level of current assets is kept at the minimum possible level. The benefit of this policy is that it maintains very high asset turnover ratios and achieves higher ROI as well.

- Moderate Policy: This policy balances between the relaxed and restricted policy. It is neither too relaxed nor too lean and means. For this policy, liquidity and working capital will be more, return on asset, and risk of insolvency will be less in comparison to aggressive policy and vice-versa for conservative policy.