Meaning

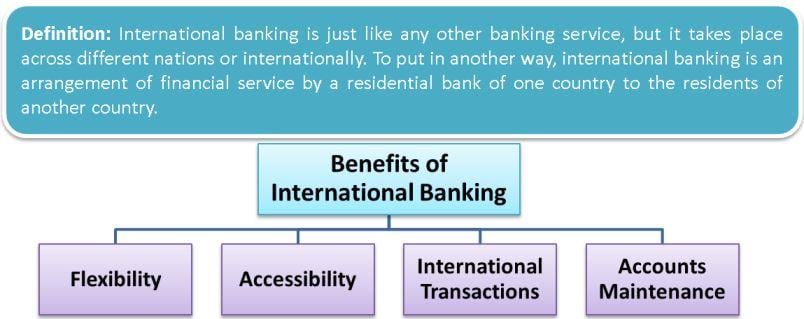

International banking is like any other banking service, but it takes place across different nations or internationally. To put it another way, it is an arrangement of financial services by a residential bank of one country to the residents of another country. Most multinational companies and individuals use this banking facility for transacting. International banking forms a major part of the international financial market.

Let us take an example to understand it in a better way.

Example

Suppose Microsoft, an American company, is functioning in London. It is in need of funds to meet its working capital requirements. In such a scenario, Microsoft can avail of the banking services in the form of loans, overdrafts, or any other financial service through banks in London. Here, the residential bank of London shall be giving its services to an American company. Therefore, the transaction between them is said to be a part of an international banking facility.

Let us have a look at the features and benefits.

Features and Benefits

Flexibility

This banking facility provides flexibility to multinational companies to deal in multiple currencies. The major currencies that multinational companies or individuals can deal with include the euro, dollar, pounds, sterling, and rupee. The companies with headquarters in other countries can manage their bank accounts and avail of financial services in other countries through this banking without any hassle.

Accessibility

International banking provides accessibility and ease of doing business to companies from different countries. An individual or MNC can use their money anywhere around the world. This gives them the freedom to transact and use their money to meet any funds requirement in any part of the world.

International Bank Transfers/Transaction

International banking allows the business to make international bill payments. The currency conversion facility allows the companies to pay and receive money easily. Also, benefits like overdraft facilities, loans, deposits, etc., are available every time for overseas transactions. Correspondent banking is very useful in such transactions.

Accounts Maintenance

A multinational company can maintain the records of global accounts in a fair manner with the help of international banking. All the company’s transactions are recorded in the books of banks across the globe. By compiling the data and figures, the company’s accounts can be maintained.

Conclusion

Globalization and growing economies around the world have led to the development of international banking facilities. The world is now a marketplace, and each business wants to exploit it. Geographical boundaries are no more a concern. With access to technology, banking facilities have grown vastly. One prime example of it is international banking. In the years to come, such banks would see higher growth and higher profitability. Big business houses are expanding themselves at a rapid pace. To maintain their growth, these businesses will need the financial services of international banking. Therefore, the demand for its facilities will increase.

Continue reading – Bank for International Settlement BIS

Quiz on International Banking

Let’s take a quick test on the topic you have read here.

Educative and easy to learn

THANK YOU SO MUCH I HAVE LEARNT A LOT AND UPGRADED MY KNOWLEDGE ACCORDINGLY

Do you need googleplay cards to do a transfer ?

This is a good source to know about any topic, and it is easy to understand. Because this one gives a deep knowledge of meaning and explanation…

Thanks for sharing your experience

Happy Reading!!