What is Drawing Power?

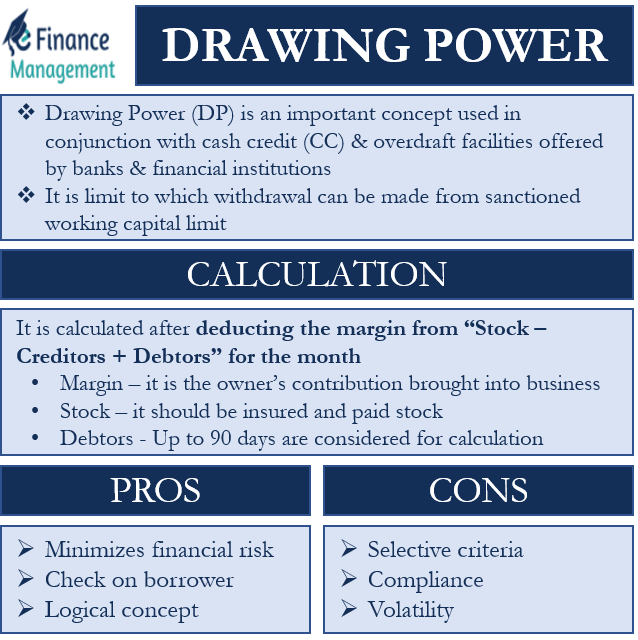

Drawing Power, generally addressed as “DP”, is an important concept used in conjunction with cash credit (CC) and overdraft facilities offered by banks and financial institutions. It is the limit to which the withdrawal can be made from the sanctioned working capital limit. Unlike sanction limit, banks update drawing power periodically, say monthly or quarterly.

How to Calculate Drawing Power?

Drawing Power is calculated after deducting the margin from “Stock – Creditors + Debtors” for the month. To understand this better, we need to have a better understanding of what “margin” is and how to calculate the DP.

Margin

The margin is the owner’s contribution brought into the business. In most cases, a margin on stock and debtors is 25%, while some banks consider a 25% margin for stock and 40% for net debtors. And, this margin may vary from bank to bank. Depending upon the aggression of the bank in lending, the margin is kept. Banks that are more aggressive keep less margin and vice versa. In addition, from industry to industry, the margin will vary depending on the operating/working capital cycle.

Now, that you are clear about what margin is, let us move forward to understand the calculation of stock and debtors. Drawing power considers the total value of the paid stock (paid stock = stock “less” creditors) plus debtors (not more than 90 days old).

Also Read: Drawing Power v/s Sanctioned Limit

Stock

Stock considered for calculating DP should be insured stock. Uninsured stock, if considered for drawing power, does not reflect the true drawing power since the bank runs a huge risk in the case of any mishappening.

Debtors

In most cases, debtors for up to 90 days are considered for calculating DP. But, if the business has a longer credit cycle, more than 90 days of debtors might be considered for DP calculation. This is to be done if it is clearly mentioned as part of the sanction terms.

If the debtors become sticky at any point in time, or if the paid stock shows decreasing trend constantly month on month, it is an alarm bell for the bank.

The table below explains the calculation of drawing power:

| Particulars | Amt. ($) | Amt. ($) |

|---|---|---|

| Insured Stock | XXX | |

| Less: Creditors | (XXX) | |

| Paid Stock | XXX | |

| Less: Margin @ X% of Paid Stock | (XX) | XXX (A) |

| Debotrs | XXX | |

| Less: Debtors > 90 Days | (XX) | |

| Net Debtors | XXX | |

| Less: Margin @ X% of Net Debtors | (XX) | XXX (B) |

| Drawing Power (A + B) | XXX |

Example of Drawing Power Calculation

Consider the following details given as below:

| Particulars | ($) |

|---|---|

| Stock | 50 |

| Creditors | 12 |

| Total Debtors | 70 |

| Debtors > 90 Days | 10 |

| Stock covered under Insurance | 44 |

| Margin on Stock | 0.25 |

| Margin on Debtors | 0.4 |

| Sanctioned Working Capital Limit | 70 |

Solution

| Particulars | ($) |

|---|---|

| Stock (Insured Stock) | 44 |

| Less: Creditors | 12 |

| Paid Stock | 32 |

| Less: 25% Margin | 8 |

| Stock allowed for DP calculation (A) | 24 |

| Debtors | 70 |

| Less: Debtors > 90 Days | 10 |

| Net Debtors | 60 |

| Less: 40% Margin | 24 |

| Debtors allowed for DP Calculation (B) | 36 |

| Drawing Power (A + B) | 60 |

Working Capital limit works out before sanction. Working capital limits are primarily secured against the stock and debtors of the firm or company. It is to be noted that even if the drawing power for some months works out to be more than the sanctioned limit, the maximum withdrawal limit is the “Sanctioned Amount”. That means a customer can utilize the maximum amount as the limit sanctioned, even if the drawing power arrived is more for a particular month’s closing. If the sanctioned limit were $50 in the above example, then DP would be restricted to $50 only.

Also Read: Cash Credit

Yes, the sanction limit and drawing power are not the same. Drawing power is the limit up to which actual withdrawal can be made maximum up to the sanctioned limit. Unlike sanction limits, banks update drawing power periodically, say monthly or quarterly. Read Drawing Power v/s Sanctioned Limit to learn about the differences between the two.

Advantages of Drawing Power

The following are the advantages of drawing power:

Minimizes Financial Risk

The best feature of drawing power is that the bank regularly updates it. It helps them to minimize the financial risks associated with the advance. Drawing power is basically a credit monitoring tool adopted by banks. It helps them monitor the company’s performance and analyze whether the company would be able to repay its loans on the basis of its performance. A decline in the company’s performance would alert the bank in advance, and they can then curtail themselves by capping the maximum utilization of the loan.

Keeping a Check on Borrower

Financial institutions keep a tab on the borrower’s business through monitoring of drawing power. Banks have a separate credit monitoring department that sees into the financial performances of the borrowers. As banks run the financial risk, they have to be very sure of the borrower and his products. Banks demand various reports from the borrower to analyze the product’s profitability, marketability, cost, and various other parameters.

Banks grant the loan on the basis of CMA data (Credit Monitoring and Analysis data) which shows past performances of the borrower and future projections. It might be possible that the borrower has misrepresented the projections and obtained the loan. Hence, banks need a check to regularly assess the borrower and his business based on actual figures. They need to ensure that the loan is properly backed up by sufficient assets.

Logical Concept

The concept of drawing power is very rational and logical in the practical world. It limits actual withdrawal by the borrower without affecting the actual sanction limit of the loan. Lenders calculate drawing power by adding inventory and account receivables and subtracting accounts payables for the past month. Then banks reduce a certain margin from the above-mentioned amount. The margin is generally 25% on inventory and 40% on netbook debts (trade receivables minus trade payables). The margin is lesser on the stock because inventory is a less liquid form of current assets.

Disadvantages of Drawing Power

The following are the disadvantages of drawing power:

Selective Criteria

Banks follow selective criteria for the calculation of drawing power. The criteria and formula are very stringent. Banks run the financial risk, so they take only the insured inventory into account, while the calculation of drawing power as the uninsured stock would be of no value to them in case of default by the borrower. Similarly, accounts receivables not exceeding 90 months are only taken in its calculation as older book debts would suggest that it’s difficult to realize funds from the debtors on short notice. However, these criteria are subject to changes depending on the individual bank policies.

Compliance

The borrower has to submit a monthly/quarterly report to the bank according to the bank’s policies. Such reports contain information about inventory, trade receivables, and trade creditors and are furnished for the previous month. This frequent preparation and submission of reports cause hindrances in the primary operation of the business and are time-consuming too. Because of increased compliances like these, the business adds up an administrative burden on the staff. It might be a post-sanction credit monitoring tool employed by the bank, but it does not go well with the borrowers.

Volatility

Due to the stringent compliances of the lending institution, there is a need for the monthly furnishing of statements and new reports by the borrower. On the basis of these monthly reports and new statements, banks calculate new drawing power each month. The drawing power of the business increases when the reports show a good amount of inventory and receivables. But when the reports are of an unfavorable nature (showing less stock and receivables), the bank subsequently lowers the drawing power. This might limit the availability of funds to the borrower who needs a higher amount of funds.

Frequently Asked Questions (FAQs)

To calculate drawing power, we need to take “paid stock”. For the amount of creditors outstanding, the stock is unpaid to that extent. So, deduction of creditors is done as the bank shall not be funding for something that is not being spent.

When creditors are more than the stock, it means that the stock have been fully funded by creditors and therefore bank finance is not needed. Therefore, stock will not qualify for bank finance.

Under normal circumstances, creditors will not exceed stock. If it happens, it should be examined in more detail, before even considering working capital finance.

Why we deduct creditor from stock to calculate drawing power?

Hi,

To calculate drawing power, we need to take “paid stock”. For the amount of creditors outstanding, the stock is unpaid to that extent. So, deduction of creditors is done. Bank shall not be funding for something that is not being spent, so creditors are to be deducted.

DP formula used by Banks are Stock -Margin and Book Debts – Creditors -Margin.But DP formula is Stock – Creditors- Margin and Debtors – Margin.Please elaborate the same ,

Hi Atul,

Not all banks follow the same formula for DP. It differs from bank to bank.

Some banks follow a more conservative approach, while some follow a lenient approach for credit monitoring.

what is the treatment if creditores are more then stock?????

I also want to know , how we will show the calculation if creditors are more than stock amount.

When creditors are more than the stock, it means that the stock have been fully funded by creditors and therefore bank finance is not needed. Stock will not qualify for bank finance.

While calculating DP, the excess of creditors over stock should be treated as finance of debts to that extent by creditors., Only the balance will qualify for bank finance [Debits – excess creditors)]-margin]

Under normal circumstances, creditors will not exceed stock. If it happens, it should be examined in more detail, before even considering working capital finance.

When creditors are more than stock, it means that the stock has been fully funded by creditors or firm/company is getting cheaper finance from creditors in comparison to lending institutions, therefore bank finance is not needed.

How To Calculate if we have LC and CC limit both

If creditors are more, you won’t be granted the LC and BG limits. If you already have LC and BG limits, same will be deducted from the calculated limits.

My Query is Treatment of Group Creditors while Calculating DP, Should we deduct it also from the Paid Stock..??

As we have not been taking Group Debtors so this should not be deducted…???

Reply

My query is regarding the Creditors. If a company receives easy credit for stocks provided by its Parent / group company and total creditors which includes parent co also exceeds stock, can we consider Parent company credit for less than say 3-4 months only.

Why Bank not consider available balance of last month in DP calculation system.

if I have limit of 30 cr.

i.e if our stock is 20 cr after margin = 17 cr in dp

debtors 10 cr after margin = 7.5 cr in dp

total = 24.5 cr in dp

less

creditors 1 cr = 1.0 cr

total dp as per calculation is = 23.5 cr

But in may case available balance was Rs. 8 cr. in C.C. limit but bank not consider the same & deduct our DP by 6.5 cr.

Dp must be greater than sanction limit.If it has low then you can not use your balance and it was automatically show in overdue.

put your question correctly, your question seems confusing

If a borrower has availed cc limits, letter of credit – both usance and Sight, margin for cc limits is 25% and for LC is 10%. how to calculate DP? What is the impact of usance LC with respect to DP. Kindly explain with examples please

Whether CENVAT credit is included while calculating the drawing power?

CENVAT Credit eventually is the part of DP because it is paid to Suppliers for the stock and is the part of stock although we treat the same separately in the books of accounts.

how to calculate total stock required for a credit limit of 12 lakhs , creditors is 6 lakhs

how to calculate total stock required for a credit limit of rs 12 lakhs , creditors 6 lakhs and margin 25%

INR 22 lakhs stock is required. [22-6(creditors)] x 0.75%]

INR 22 lakhs stock will be required [22-creditors-0.25% margin on the balance]

Shall we deduct margin on paid stock if same i negative figure I.e paid stock will be in negative

Can we withdraw an amount in cash from a cash credit limit.

NO Cash withdrawal transactions is allowed under CC Account.

Hy. Thanks for providing us so many information regarding calculation of DP.But still i have a query regarding calculation of net paid stock that whether combustible and non combustible stock should be reduced from stock or not???

Whether Advance to customers considered for calculation of Drawing power

how to calculate working capital limit in a cash credit account

kindly guide me

How to set stock insurance limit if working capital sanction Rs 25 crores , stock shown in stock statement Rs 8 crores and debtors Rs 26 crores then what is the limit of stock insurance of the firm please suggest.

General norms, Stock insurance is to be taken for the highest estimated/expected stock level. And if actual the stock is higher than the insured amount at any point of time then limit of insurance should be increased immediately.

you have to take insurance on stock randomly 1050.00 lakh…….. (including RM, finish good & wip)

If creditors is more the stock then how to calculate dp. for example stock 40 lac creditors 60 lac debtors 75 lac.

Re: Drawing power for Export Finance: A while ago it was explained to us that DP did not include creditors for Running PCFC A/c in Foreign currency. As:

1. Export Finance was order driven & would only be disbursed to a maximum of 90% of the order.

2. Further Margin of 10%(in our case) would be deducted from the stock,which was secondary.

As under Running account PCFC -since export orders often required advances for bulk raw material or pre purchase of inputs, the prime driver of DP calculation for a running account would be the export order.

Branch auditors insist that this is wrong & there is no difference between the norms for regular CC & Running PCFC accounts & DP is only to be calculated by way of traditional Stock- creditors= DP.

How True is this?

NICE INFORMATION. THANKS

Is it mandatory to allocate DP to the multiple banks if DP is less than the sanctioned limit, also is there any RBI guidelines regarding the DP allocation

Is the below declaration sufficient instead of given bank wise DP allocation:

“The working capital utilization from the entire banking system (all banks including your bank) will not exceed Drawing power as per Drawing Power Statement submitted to you”

Hi Sachin,

Yes, apparently the declaration is enough in terms of multiple banking arrangements (i.e. “The working capital utilization from the entire banking system (all banks including your bank) will not exceed Drawing power as per Drawing Power Statement submitted to you”). However, it depends on the bank whether they ask you to submit any additional document along with the DP statements. Some stringent/conservative banks try to follow some additional checks to ensure the correctness of this declaration.

can we consider next month sales as wip for d.p ??

Hi All,

If Company made provision for slow moving non-moving stock and doubtful debtors also, can above provision reduced from Total Stock and Total Debtors while working drawing power calculation.

If Yes, is it mandatory or provided in any guidelines issued by RBI/Banks.

Whether Security Deposits from Debtors to be included in debtors or not while calculating Drawing Power.

Hi,

i have availed a cash credit facility.

I have a modest 15% margin(my own investment)

My purchases are in cash whereas my sales are credit sales.This results in me having given more credit than my CC limits. I normally keep very less stock due to the nature of my business.

What should i do to use my CC limits completely every month?

If i have more debtors than stock while submitting the statements, will my withdrawal limit be reduced(even though my debtors owe much more than the limit)?

kindly explain.

hi our od limit 350000/-

debtors amt rs.19253631/-

creditors amt rs. 5143921/-

plz some one help for calculation

Quality content is the secret to interest the users to pay a visit the site, that’s what this web page is providing.

I’ve discovered It absolutely useful and it has helped me out loads. I am hoping to contribute to other customers as it has helped me. Great job.

I like the helpful information you provide in your articles. I’ll bookmark your blog and check again here frequently. I’m quite sure I’ll learn plenty of new stuff right here! Best of luck for the next!

How to value stock for calculating Drawing power,

Cost or Market value?

HOW TO CALCULATE DRAWING POWER IN LC FACILITY

Our c/c limit document given by bank. Jisme mention hai ke margin= 25% of stock+debtor(less than 90 days)-creditor. Iska kya matlab hai pls clear???

Is the amount of stock of stores and spares of a manufacturing co will be taken at the time of DP calculation?

Whether CC , DEPOSITS RELATED TO OFFICE PREMISES AND COST RELATED TO CONTRACT ACQUISITION ARE CONSIDERED AS PART OF DP CALCULATION

Hi,

Please let me inform what is the bank provisions? if i will submit two months (March & April) stock statement at once in May and the DP as per March is less than the DP of April. And the March DP is also less than my Feb DP, which is being utilised.

Is there any Penal provision by bank or RBI?

Is Advance to suppliers considered for Dp calculation?

My query is what bank needs to do if drawing power after deducting margin is less than sanctioned limit?

Bank’s has two options:

1. Ask for temporary additional security in terms of goods or instruments, etc. till the drawing power comes back to the disbursed limit if the entire sanctioned limit is released.

2. In case the entire sanctioned limit is not released then they will release only up to the available drawing power, irrespective of the quantum of the sanctioned limit.