Synergy is a term that we would generally come across when there is a discussion about M&A (mergers and acquisitions). It basically refers to the additional value that an M&A transaction leads to. We can safely assume and say that all M&As are pursued by the companies in the hope of creating synergies only. There are primarily three types of synergies that companies aim to achieve – revenue synergy, cost synergy, and financial synergy. We will discuss Revenue Synergy in this article.

What is Revenue Synergy?

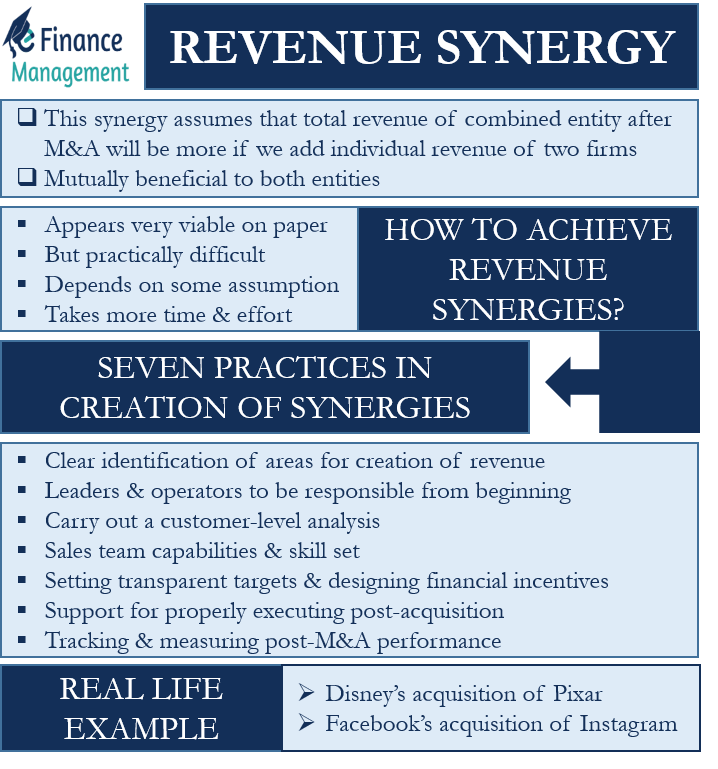

Such a synergy assumes that the total revenue of the combined entity after a merger or acquisition will be more if we add the individual revenue of the two firms. Or, the combined entity is able to generate more revenue than the two entities, if operating separately. In other words, sum total of revenues of the two will be more when both are together.

Such a synergy is mutually beneficial to both entities. The target company can ask for a hefty premium from the acquiring company on the grounds that it would add to the revenue of the acquiring company. Similarly, a savvy acquiring company can bargain, saying the increase in sales post transaction will easily offset the less acquisition price.

A simple example of this synergy is Company A has revenue of $10 million and Company B has $5 million. After a merger or acquisition, the total revenue of both, say Company AB is $19 million. We can say that the revenue synergy, in this case, is $4 million.

Also Read: Cost Synergy – Meaning, Example, and Issues

Examples of Revenue Synergy

Acquisition by Disney

Disney’s acquisition of Pixar in 2006 is a very good example of such a synergy. This deal was very logical, and thus, was beneficial to both the companies. For instance, Disney’s revenue was almost $34 billion in 2006. But in 2011, the revenue for the company was almost $41 billion. The deal was also beneficial for Disney’s stock price. On the other hand, the S&P 500 dropped during the same period.

There were several reasons why the deal resulted in revenue synergies:

- Disney’s size allowed Pixar to come up with popular motion pictures, and on a regular basis.

- Disney’s massive distribution network was very helpful for Pixar.

- Disney stores globally provided a massive platform for selling merchandise featuring Pixar’s characters.

- Disney’s theme parks provided exposure, as well as promotion to Pixar’s characters.

Acquisition by Facebook

Another good and successful example of such a synergy is the acquisition of Instagram by Facebook. At the time of the acquisition, Instagram’s revenue was reportedly zero.

Nonetheless, Facebook’s management had confidence that the acquisition and combination of these two social sites would result in remarkable revenue prospects or synergies. Integrating some of Instagram’s features into Facebook resulted in an increase in user engagement. And, this made Facebook more attractive to advertisers and this effectively increased its revenues.

How to Achieve Revenue Synergies?

Such a type of synergy appears very viable on paper. However, the entities face a lot of practical difficulties while implementing and achieving the revenue synergies in the real world, it is very difficult to achieve revenue synergies. This is because this synergy generally depends on uncertain assumptions, such as cross-selling, introducing new products, proper integration, market expansion, etc.

Many experts are of the view that achieving revenue synergies generally takes more time and effort than achieving cost synergies. Companies face a number of challenges in achieving revenue synergy, such as designing accurate targets, implementing and coordinating new workflow and strategies across the combined entity, and more.

Seven Practices that help in Creation of Synergies

Mckinsey carried out thorough research and in-depth interviews with the executives’ to list seven practices that help companies to create revenue synergies in M&A. These practices are:

- Companies must have a clear understanding of the sources of revenue synergies. In other words, the companies should have a clear identification of areas for the creation of revenue synergies beforehand.

- It is very important for the leaders and operators of the companies to take responsibility from the very beginning.

- Companies need to carry out a customer-level analysis to quantify opportunities. The analysis can include asking customers about products they need, how much trust they have in the brand, etc. A company can carry such an analysis either before or after the deal, or both.

- The strategy to achieve synergies must keep in mind the capabilities and skill set of the sales team. Or, the management should take into account how quickly the sales team can add new skill sets to sell the new products or services.

- Setting transparent targets, as well as designing financial incentives is also an important practice that drives such a synergy.

- Providing the needed support for properly executing a post-acquisition entity is also critical in achieving such a synergy. For instance, a company can pull executives from both companies to form a single team/task force. This team could make it very easy to communicate and coordinate with the stakeholders of each company.

- Tracking and measuring the post-M&A performance also plays a crucial role in ensuring revenue synergies. It is recommended that companies measure and keep track of the “leading” and “lagging” metrics. Leading metrics focus on the inputs and the lagging metrics focus on the output that those inputs generate. Moreover, companies must include these metrics in their daily operations.

Final Words

The rising importance of M&A in the corporate world magnifies the importance of generating revenue synergies. This is because attaining revenue synergies play a crucial role in delivering value to shareholders. However, attaining revenue synergies is not that easy. It requires a great deal of planning and execution on the part of both companies to achieve revenue synergies.