Synergy is a term that one would come across when talking about mergers and acquisitions. It basically refers to the additional value that an M&A transaction leads to. We can safely assume and say that the companies pursue all M&As in the hope of creating synergies only. Companies aim to achieve three types of synergies: revenue synergy, cost synergy, and financial synergy. We will discuss Cost Synergy in this article.

What is Cost Synergy?

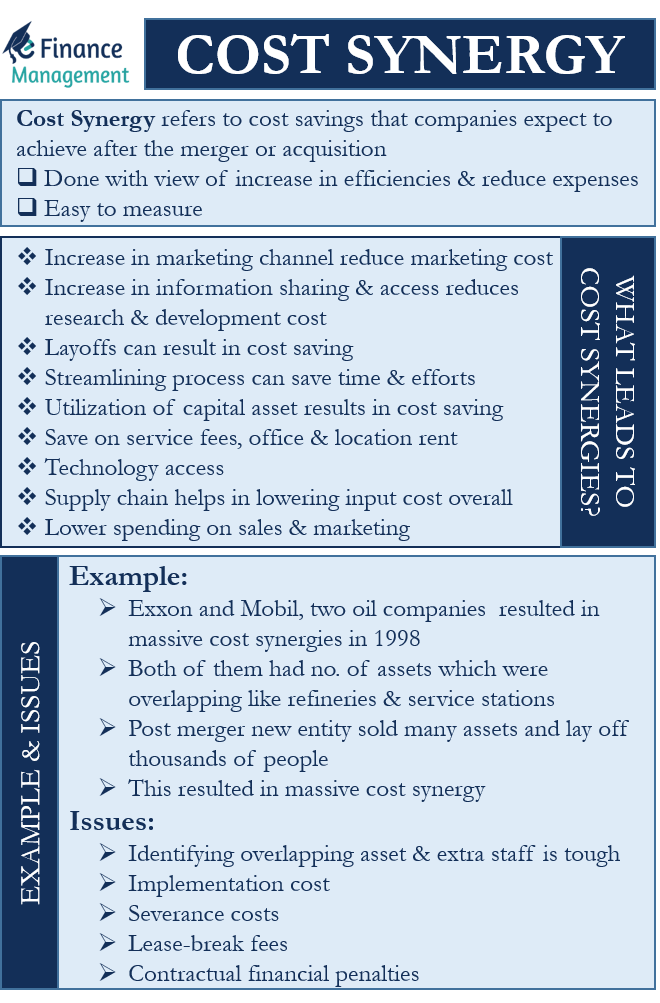

It basically refers to the cost savings that companies expect to achieve after the merger or acquisition. Generally, a company achieves cost synergies because of an increase in efficiencies due to the M&A or a drop in expenses.

Following an M&A deal, companies could witness a reduction in costs on many fronts, such as insurance, equipment, distribution expenses, and more. For instance, after the deal, both companies can use the same distribution network, which would result in substantial savings. Or, if both companies have an accounting department, then it is possible that post-merger, the management may not feel the need to maintain two separate teams. This could result in layoffs and, in turn, cost savings. Companies can also witness cost savings because of economies of scale and volume buying after two separate companies come together.

Cost synergies are easy to measure as well. Companies can look at comparable transactions or the individual expenses of each company to measure whether or not the acquisition has resulted in cost synergies. Also, one can use a bottom-up analysis when assessing each company to know how the total assets will lead to cost savings.

What Leads to Cost Synergies?

Post-merger or acquisition, entities can create cost synergies in the following ways:

- A merger or acquisition can result in an increase in marketing channels and resources. The direct impact of this would be the reduction in marketing costs, thus achieving a cost-saving.

- There are good chances that M&A increases information sharing and access to new research and development. This could result in improvement in production and, in turn, yield cost savings.

- The new management could go for layoffs because, after a merger or acquisition, it is possible that the new entity has more employees than they need. So, the layoffs could result in cost savings for the company.

- The production processes of the two units could be streamlined. And that could lead to time and cost savings.

- An increase in the utilization of capital assets can also result in capital synergy and thus cost savings.

- Companies can also save on service fees, as well as on office and location rent.

- Suppose any of these two companies possess any proprietary technology, technology that could make the other company’s processes more efficient. Then it would obviously result in cost savings.

- Cost savings will be there if the supply chain relationship of one company helps in lowering the input cost overall. Also, the new entity will be much bigger and, thus, will be in a better position to negotiate with the suppliers.

- Cost savings could also come in the form of lower spending on sales and marketing than what the two companies would spend separately. Also, the new entities will be able to get better rates from the advertisers.

Cost Synergy: Example and Issues

In 1998, the merger of Exxon and Mobil resulted in massive cost synergies. The merger’s objective, beyond doubt, was to create the world’s largest oil company.

The two oil companies had a number of assets, and many of them were overlapping, including refineries and service stations. So post-merger, the new entity was able to sell extra assets as well as lay off thousands of people, resulting in massive cost synergies.

On paper, deriving cost synergies look simple. However, identifying the overlapping assets and extra staff is a painful task. The management needs to assess all possible impacts these actions could have. Additionally, the management needs to be very sure that the savings from such actions will far outweigh their cost.

Moreover, it could take time for the entity to realize the cost synergies. It may take a few years for the company to transition to new suppliers, buildings, and employees.

There is also an implementation cost that the company needs to bear in order to realize the synergies. Implementing new systems and processes within the IT framework could cost the company a reasonable amount of money. The company would also have to bear the employee severance costs, lease-break fees, contractual financial penalties, etc.

Final Words

Cost synergy is the primary motivating force in most M&A deals. Though these synergies look obvious on paper when a company goes for a merger or acquisition, they are very hard to achieve. The management has to take into account all possible impacts (both short and long term) of their cost savings actions to ensure the merger or acquisition produces the desired results.