What is the Cash Market?

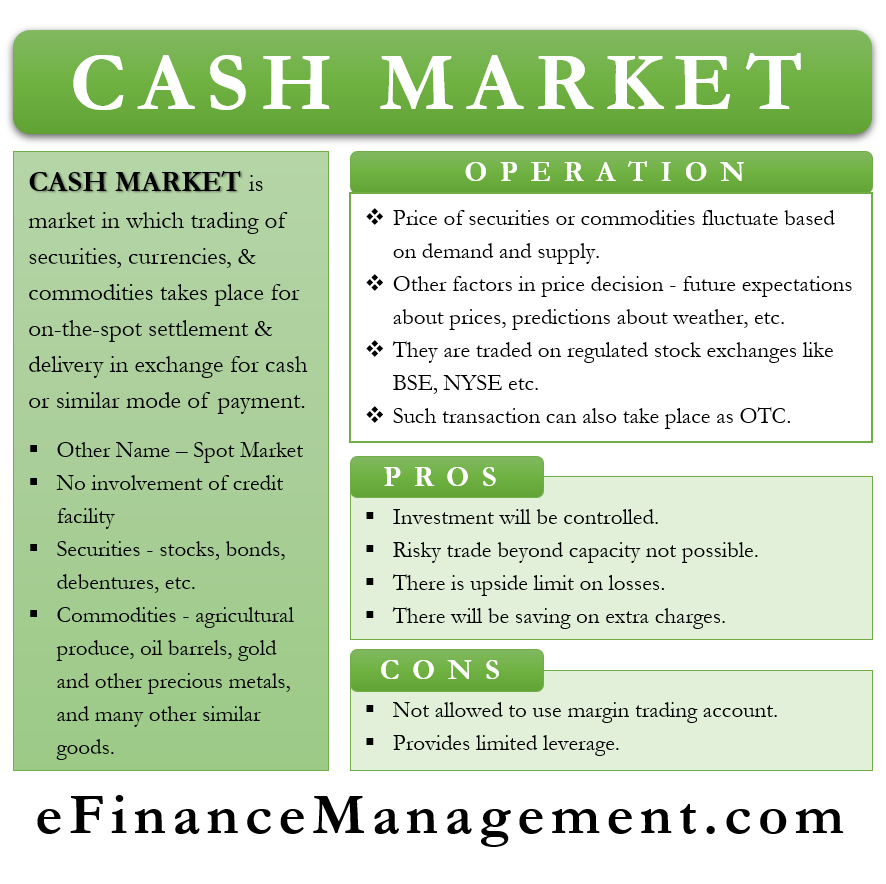

A Cash Market is a financial market in which trading of securities, currencies, and commodities takes place for on-the-spot settlement and delivery in exchange for cash or a similar mode of payment. There is no involvement of a credit facility in such markets. The securities can be in the form of stocks, bonds, debentures, etc. Commodities can consist of agricultural produce, oil barrels, gold and other precious metals, and many other similar goods. Other than securities and commodities, trading of currencies can also be done likewise. The other name for a Cash market is “Spot market.” It is so because transactions and their settlement occur on the spot.

“Immediate delivery” in a cash market does not take place in a literal sense. The delivery can happen in a couple of days or even within a month as per the terms and conditions of the sale. The rate at which the transaction will take place will be the one the parties agree to at the time of the final sale and transfer of money. There are instances in which a buyer and a seller may verbally agree to trade at a certain price. Later, suppose the price of the commodity goes up. The seller can ask for a higher price since no exchange of money or payment took place. Hence, trades in a cash market generally fructify only after an exchange of payment or money.

How does a Cash Market operate?

In general market conditions, prices of securities or commodities tend to fluctuate solely on the amount of their demand and supply in such a market. If the demand is high, the price of the item tends to go up. On the other hand, if the demand is low or nil, the price of the item crashes or falls. Similarly, prices of items tend to go up in case of short supply and vice-versa. Future expectations about prices, predictions about weather, and other related costs such as storage play a little role in deciding prices in such markets. It is so because the agreement takes place on the spot and is based on the present market situation.

A Cash market can be a regulated exchange such as the NYSE (New York Stock Exchange), BSE (Bombay Stock Exchange), etc. Such exchanges have a set rules and regulations framework within which they operate and hence are safe and systematic.

Also Read: Futures Market

Such transactions can also take place as OTC or Over-the-Counter transactions. OTC markets are unsystematic and do not have a very rigid regulatory framework to operate within. There is usually no central exchange or a broker, and the trade takes place directly between the buyer and the seller. Contracts are generally customized according to the requirements of both parties. Also, the rate agreed upon in the agreement is unknown to other market players. Hence, such markets do have the advantage of maintaining secrecy. But there is always counterparty risk in OTC markets due to the lack of strict rules and regulations. The seller or the buyer can retract and not agree to complete the transaction anytime as per his will and choice. Hence, this leads to unreliability and mistrust in such markets.

Making a choice

An investor needs to carefully choose between the regulated exchanges and the over-the-counter markets while making a transaction. Factors such as risk tolerance, return expectations, goals of the investment, etc., are the guiding factors when choosing between the two options.

What are the advantages and limitations of a Cash Market?

The main and foremost advantage of a Cash Market is that investors can trade only up to the limit of their cash holdings. Trades have to be settled on the settlement date, and hence they cannot enter into deals beyond what their pockets permit. Hence, investments will always be controlled, and risky trades beyond the capacity of the investor will not happen. The maximum amount that the investor can lose in such markets is the original amount of his investment, which will most likely not occur. Thus, there is an upside limit to one’s losses. Also, they will save on any extra charges such as interest costs.

Cash markets have their own limitations too. An investor cannot use a margin trading account for Cash market transactions since deals are closed on the spot. Such markets provide limited leverage, and an investor has to have liquid money in his accounts on the settlement date. Thus, the upside potential in such investments is limited to the amount of liquid money an investor actually has. Also, investors may miss out on lucrative trades and profit-making opportunities due to liquidity constraints.