Financial Analysis

Financial analysis is the ‘most talked about’ term in the financial world. The reason behind its popularity lies in the objectives that it serves. A business organization, be it for profit or not for profit, carry out financial analysis. The purpose could be forecasting, planning, establishing control, making investments, etc. And the data for such analysis is collected from the financial statements. Therefore, we can also say that financial analysis is as good as financial statement analysis (FSA). It aims at examining the financial data of an entity to determine its profitability, growth, solvency, stability, and effectiveness of its management.

Before diving deep into its objectives, let us look at what financial analysis exactly means.

What is Financial Analysis?

Financial analysis refers to interlinking the components of different financial statements with the purpose of getting insights for better decision making, controlling, etc. Financial statements of a business include the profit and loss account, balance sheet, and cash flow statement. The profit and loss statement shows the result of operations. The balance sheet reflects the financial position of the business. And the cash flow statement depicts the liquidity position of the business. And notes to financial statements provide the breakup of the figures mentioned in financial statements.

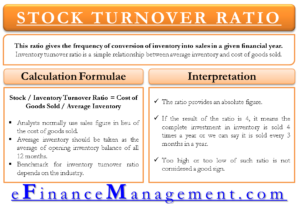

Let’s check how FSA helps establishing relations between different components of different financial statements of a business. In order to calculate the inventory turnover ratio, we need the amount of inventory and net sales of the business. We get the amount of inventory from the balance sheet, while net sales can be obtained from the profit and loss account. This will help in determining how rapidly the inventory gets sold. Any single financial statement will not help management arrive at any such numbers. This is where the need for financial analysis arises.

As already stated above, the essence of financial analysis can be understood only by learning its uses or the objectives behind conducting analysis. Let’s dig in.

Objectives of Financial Analysis

A business has different stakeholders (internal and external), and every one of them analyzes financials as per their needs. Say, for instance, the company’s top management will calculate efficiency ratios to check if all the processes, functions, and operations are in line with the targets that the business wants to achieve. And what corrective measures it requires to undertake in case of any deviations. But, a financial institution will make its comment on the business by calculating liquidity ratios. Let us learn how significant FSA is to different stakeholders.

Management

The job of a good management team is to maximize profits and their shareholder’s wealth in the long term. FSA helps them in finding inefficiencies in the operations and correcting them. This leads to improved and sustainable profitability.

For example, a company encounters a situation where net margins are declining. Using FSA, they come to know that the inventory turnover ratio is lower compared to previous years. Here, FSA pinpoints the area where the problem lies. With further investigation, they can take corrective actions and restore their profitability.

The objectives of FSA include

- Reviewing past data to forecast future growth.

- Budget preparation.

- Verifying optimal utilization of resources.

- Decision-making, planning, and controlling operations.

- Analyzing the creditworthiness of the business.

- Non-financial performance analysis.

Creditors or Lenders

These are the company’s external stakeholders and hence are more concerned about whether the business will repay their money. Objectives of lenders behind FSA include:

- Assessing the short-term and long-term liquidity of the company. In simple words, it is the ability to generate cash.

- Liquidity is ultimately affected by the company’s profitability, and hence, they also look for the company’s profitability.

- Deciding upon terms and conditions of lending money. For example, debt repayment structure.

Investors

- Investors are more interested in assessing the profitability of the business.

- The trend of paying returns.

- Valuation of the company’s shares.

- Payout and retention policies.

- Expected growth.

Analysts

Financial analysts also use various methods of performing financial analysis for the purpose of conducting equity research.

There could be various other objectives for conducting FSA, but the question here is how this analysis will take place. What are the tools available to the stakeholders to evaluate financial statements in order to answer their queries?

Let’s have a look…

Methods for Performing Financial Analysis

Following are some of the primary methods used for financial statement analysis.

Ratio Analysis

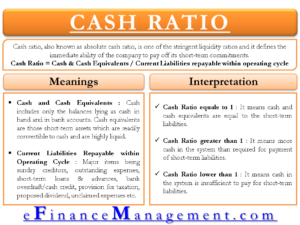

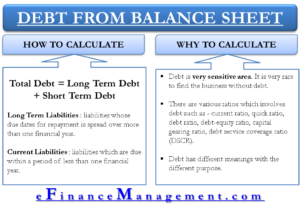

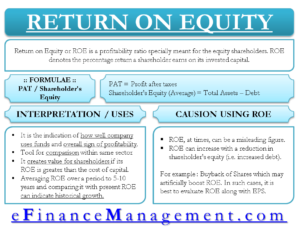

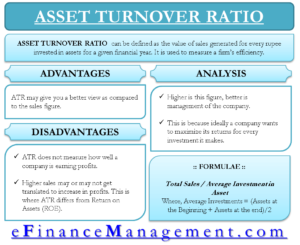

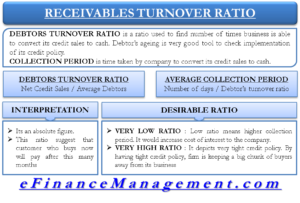

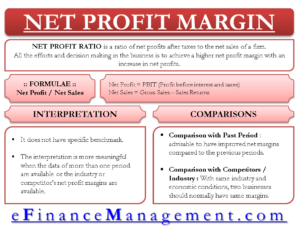

Ratio analysis, the most widely utilized tool, involves calculating ratios from the financial statements to draw significant insight into the growth, liquidity, profitability, solvency, and efficiency of a business. In simple terms, ratios can be defined as the relationship between two or more elements of financial statements. They play a very significant role in finance. These ratios provide an in-depth understanding of the business that one cannot understand by merely looking at the standalone financial statements.

For example, a net profit ratio to sales indicates the net profit margin. When this ratio is compared with the industry standards, we can form an opinion about the company’s performance. In the other instance, if we compare it with the previous year’s margins, we can assess whether the company is improving, stable, or downgraded. This is how financial analysis augments the worth of preparing financial statements.

Though ratio analysis is the most prominent tool for analyzing financial statements, there are some more tools that assist in conducting the financial analysis for a business organization. These are as follows:

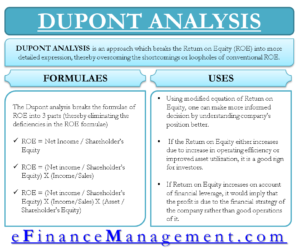

DuPont Analysis

DuPont analysis was introduced by F. Donaldson Brown, an employee of a US company, DuPont Corporation. He has pioneered the method of calculating ROE (Return on Equity). Rather than introducing a new method, he came up with an inter-relationship between some formulas to understand the cause and effect of a ratio to others. DuPont analysis is a 3-step method that helps identify the factors responsible for changes in ROE. For example, DuPont analysis defines return on assets as the product of net profit margin and total asset turnover ratio.

Vertical Analysis

Vertical analysis or common size financials are nothing but expressing all the figures of profit and loss account as a percentage of sales and in the balance sheet as a percentage of total assets. It helps compare two companies because their financial statements are in the same format, and an item to item comparison is easily possible.

Horizontal Analysis

Under the horizontal analysis method, managers compare the business performance of one period with another. It aims to determine the improvement or decrement in the company’s operations and performance.

Other Techniques

Various other techniques for financial analysis include:

- Performance analysis

- Trend analysis

- CVP analysis

- Cash flow analysis

Keep reading: Methods of Financial Statement Analysis

Limitations of Financial Analysis

There are many challenges faced by managers while analyzing financial statements. Some of them are:

Interpretation

The first and foremost problem with the financial analysis is the interpretation of results. One has to interpret the result very minutely, which requires analytical skills. Wrong interpretation ruins the purpose of analysis.

Reliable

Reliability on the financial statements is another major issue. Sometimes, management adopts malicious techniques like window dressing which prevents financial statements to represent the true picture.

Difference in Accounting Policies

Different businesses have different accounting policies. This makes the comparison between the two a complex task.

Uncertain Data

The analysis is done on the basis of past data for establishing targets for the future. But the fact is that we cannot predict the future, which makes it less reliable.

Nature of Business

The basis of comparison varies from industry to industry. Even the difference in business size in the same industry also matters.

Others

This analysis does not consider the effect of inflation. Also, sometimes, the process gets rigid.

Conclusion

Financial analysis refers to the activity of assessing financial statements to judge the financial performance of a company. It helps in assessing profitability, solvency, liquidity, and stability. FSA has three broad tools – ratio analysis, DuPont analysis, and common-size financials. Out of all, ratio analysis is the most prominent. Financial analysis is useful in assessing, comparing, and valuing a company.