The primary difference between dividend yield and dividend payout is that the former is a percentage of dividend earned on the current price of stock whereas the latter talks about the percentage of total earnings, the company has decided to distribute as a dividend. In this article, we will learn about the difference between dividend yield vs payout.

The dividend is the distribution of profits of the company among the shareholders. Companies generally declare it at regular intervals, which may be monthly, quarterly, or annually. Dividends are expressed as a percentage of the nominal value of the stock. For example, Roman Inc share’s nominal value is $10 and it currently trades at $50 on the NYSE. The company declared a dividend of 50%. This means the dollar value of the dividend declared is ($10*50%) $5. The company will pay $5 to each shareholder.

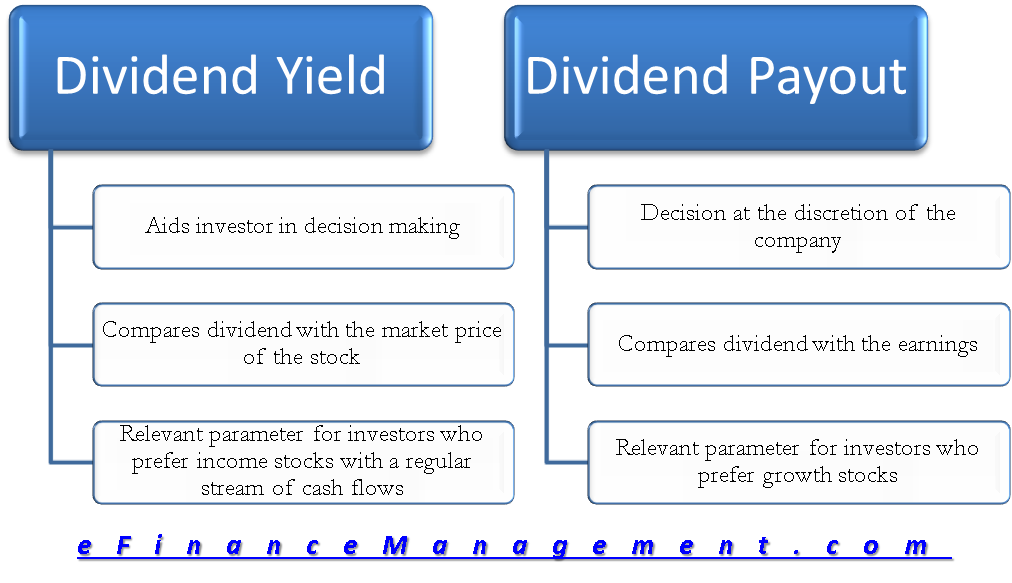

Difference between Dividend Yield and Dividend Payout

The two terms may sound closely related at a glance. However, they are not even remotely so. Let’s learn about the differences between dividend yield vs payout.

Meaning

The dividend yield is a percentage of cash dividends received against the market price of the stock. At the same time, the dividend payout ratio represents that portion of the earnings which the company distributes as a dividend.

Also Read: Dividend Payout Ratio

Formula

The formula for calculating dividend yield is as follows:

| Dividend Yield = (Dividend Per Share/Market Price Per Share)*100% |

Borrowing from the previous example, the dividend yield for a stockholder of Roman Inc will be 10%, i.e., ($5/$50)*100%.

The formula to calculate dividend payout is as follows:

| Dividend Payout Ratio = (Dividend Per Share /Earnings Per Share)*100% |

Extending from the previous example, Roman Inc has a share capital comprising 100,000 shares. And it reports total earnings after tax of $2,000,000. Therefore its EPS equals ($2,000,000/100,000) $20 per share. The dividend per share is $5. Thus the dividend payout ratio is 0.25 or 25%, i.e., ($5/$20)*100%.

Interpretation

The dividend yield is a measure of the return on investment that investors can expect to receive from a company’s dividend payments. Dividend payout, on the other hand, is a measure of how much cash a company is distributing to its shareholders and how much it is retaining for growth opportunities.

Use

The dividend yield is highly relevant from the investor’s perspective. It is used to measure the income generated by a stock and therefore aids the investor in decision-making. While the payout ratio is used to measure the cash payout to shareholders. It replicates the growth opportunities available to the company.

Impact of Stock Price

The dividend yield is affected by changes in the stock price, whereas dividend payout has no direct relationship with stock price movements.

Investor Preference

Dividend yield may be preferred by investors who are seeking a steady stream of income or looking for income stocks. While dividend payout may be preferred by investors who are seeking growth opportunities and reinvestment of earnings and are looking for growth stocks or long-term investment opportunities.

Summary

The following is the table of differences between the two:

| Basis | Dividend Yield | Dividend Payout |

|---|---|---|

| Meaning / Comparison | Compares dividend with the market price of the stock | Compares dividend with the earnings of the company |

| Formula | Dividend Per Share/Market Price Per Share | Dividend Per Share/Earnings Per Share |

| Interpretation | Defines ROI for investors | Defines growth opportunities available with the company |

| Use | Aids investors in decision-making | Measure the cash payout to shareholders |

| Impact of Changes in Stock Prices | Affected by changes in the stock price | No direct relationship with stock price |

| Investor Preference | Preferred by investors seeking a steady stream of income | Preferred by investors seeking growth opportunities |

Quiz on Dividend Yield Vs. Payout

Let’s take a quick test on the topic you have read here.