What is Credit Default Swap?

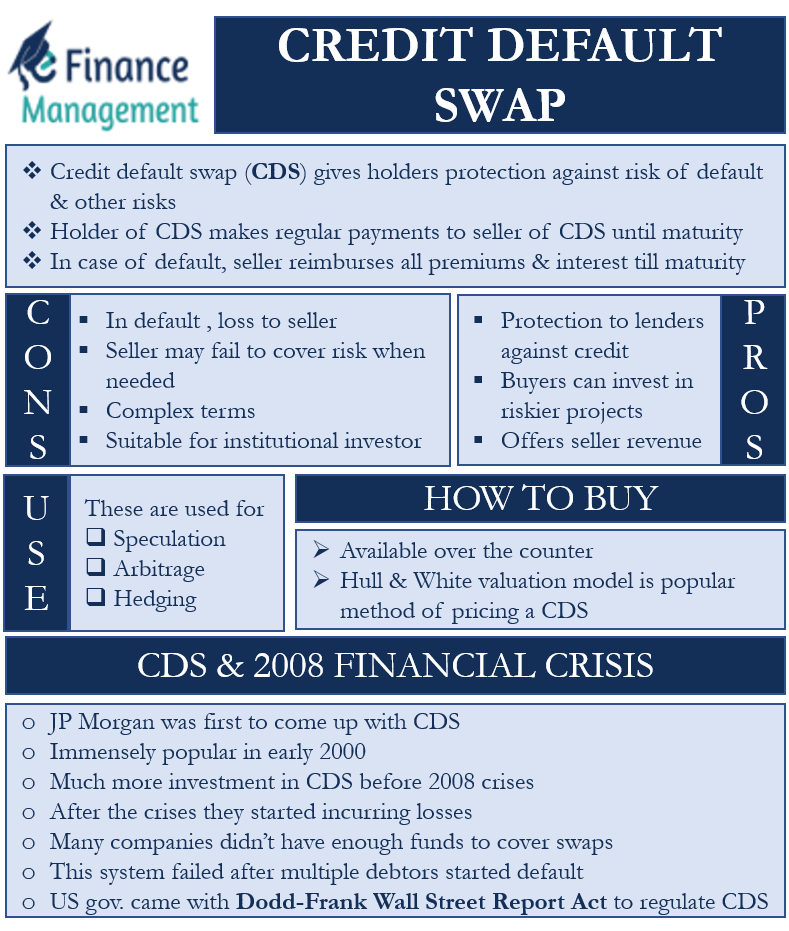

A Credit Default Swap or CDS is a derivative instrument that gives holders protection against the risk of default and other risks. The holder or the buyer of the CDS needs to make regular payments to the seller of the CDS until the maturity date of the underlying credit. In case of a default by the issuer, the seller of the CDS will have to reimburse all the premiums and interest due until maturity.

Most swaps nowadays are used to protect against the default of high-risk municipal bonds. Also, lenders use swaps for protection against sovereign and corporate debt, CDOs (collateralized debt obligations), MBS (mortgage-backed securities), and junk bonds.

Credit Default Swap: How They Work?

CDS works like an insurance policy, allowing the holder to get protection against an unlikely future event.

For example, a company issues bonds, and several investors buy these bonds. For the investors, there is a risk that what if the issuer of the bonds fails to pay the due money. Thus, to protect against such a risk, they buy a CDS from a third party, who will pay the due amount if the borrower defaults. Usually, the third party is an insurance company, hedge fund, or a bank.

If there is no default, the seller will make a profit from the periodic fees that the buyer of the CDS pays. Note that a CDS does not eliminate the risk; instead, it shifts the risk from the original lender to the CDS seller.

Also Read: Credit Derivatives

Uses of Credit Default Swaps

Investors can use the CDS for:

Speculation

Investors can trade CDS to make a profit if they believe its price is too high or low. Also, they can use the CDS to speculate if an entity is likely to default. This is because an increase in the CDS spread suggests a drop in the entity’s creditworthiness and vice-versa.

It is also possible for the CDS buyer to sell the protection if they believe the creditworthiness of the borrower is improving. For such reason, many argue that a CDS helps to give an idea of the creditworthiness of the borrower.

Arbitrage

Arbitrage means buying a security in one market and selling it simultaneously in another market to benefit from the temporary price difference. In CDS, there is a negative correlation between the credit default swaps spread and the share price. So, if an outlook of a borrowing entity improves, its share price would go up, but the CDS spread would reduce. And, in case of the outlook fall, the stock price drops, and the CDS spread would increase.

For instance, suppose an entity faces an adverse scenario. This would push its share price down, and thus, an investor can expect a rise in the CDS spread as the chances of default increase. In such a scenario, investors can get an arbitrage opportunity by exploiting the slowness in the market.

Hedging

This is the primary use of the CDS as its core function is to help holders reduce their financial risks. Banks commonly use CDS to hedge the risk of a default by a borrower. In the event of a default, the seller compensates the holder by paying the balance amount.

The other alternative available to a bank is to sell the loan to another bank or financial institution if they do not want to use CDS. Doing this, however, could strain the relationship between the bank and the borrower as it shows that the bank does not have trust in the borrower. Hence, CDS is a preferred and acceptable route to hedge or minimize the risk of credit failure.

Additionally, the CDS also helps banks in managing concentration risk. Such a risk arises when one borrower accounts for a significant part of the bank’s total loan portfolio. If such a borrower defaults, it will result in big losses to the bank.

So, to hedge such losses, banks can buy CDS without straining their relationship with the client. Though the use of CDS is more common among banks, other financial institutions, such as pension funds, insurance companies, and more, can also use CDS to hedge their risk.

Pros and Cons of Credit Default Swap

Following are the benefits of the CDS:

- It gives protection to lenders against credit risk.

- Allow CDS buyers to invest in riskier projects than they otherwise do. This, in turn, helps boost innovation and creativity in the economy.

- Swaps offer a steady stream of revenue to a seller with little downside risk. It is, however, important for the seller of swaps to diversify or sell swaps to different industries. So, even if one or two industry defaults, they still get revenue from other industries.

Following are the risks with CDS:

- The buyer or the holder of the CDS may default, resulting in losses to the seller.

- Similarly, there is always a risk for the buyer that the seller of CDS may fail to cover the risk when the need arises. That means the purpose for which CDS was taken does not meet. A similar situation we have witnessed during the 2008 financial crisis.

- These are complex products that laymen may not understand.

- Since accounting of such swaps requires in-depth market knowledge, these swaps are more suitable for institutional investors rather than retail investors.

CDS and the 2008 Financial Crisis

Blythe Masters from JP Morgan was the first to come up with the credit default swaps in 1994. These derivative instruments became immensely popular in early 2000. Their value stood at $62.2 trillion by 2007, but their value dropped after the 2008 financial crisis. In 2010, their value was $26.3 trillion, and in 2012, the value was $25.5 trillion.

Before the 2008 financial crisis, there was much more investment in the CDS than in any other instrument. Moreover, many major investment banks were dealing in CDS at the time. However, after the start of the crisis, Lehman Brothers incurred the most losses. This is because the bank had $600 billion in debt, of which $400 billion was protected with CDS. But the American Insurance Group, the bank’s insurer, did not have enough funds at the time to clear all the debts. That’s why to bail out Lehman Brothers; the Federal Reserve had to step in.

Financial crises also crushed companies that were trading in the CDS. Since there was not much regulation over the use of these financial products, banks were using them to cover many of their products. At the time, there was no agency to verify if the seller of the swap had enough funds to pay back in case of a default.

In fact, at the time, most sellers of swaps did not have enough funds to cover the value of the swaps. Such a system worked for many years but failed after multiple debtors started to default simultaneously at the time of the 2008 crisis.

In 2009, the U.S. government came up with the Dodd-Frank Wall Street Report Act to regulate the CDS. The regulation did away with the riskiest swaps and laid restrictions on banks on using the customer deposits for investing in CDS and other derivatives. Moreover, the Act also requires setting up a central clearinghouse for trading and pricing of swaps.

How to Buy?

Buying swaps is as easy as buying a stock because they also trade (OTC – over the counter). As for pricing, financial institutions use industry computer programs to value CDS. The Hull and White valuation model is the most popular method of pricing a CDS.

The value of a swap can fluctuate owing to several factors, including chances of default. Moreover, an investor in a swap may exit anytime by selling it to another investor.

Final Words

Even though credit default swaps do not have a very good history, they are still very popular. Financial organizations use them regularly for speculation and portfolio management purposes. Restrictions on swaps after the 2008 financial crisis have made them an important part of the financial industry.