What are Credit Derivatives?

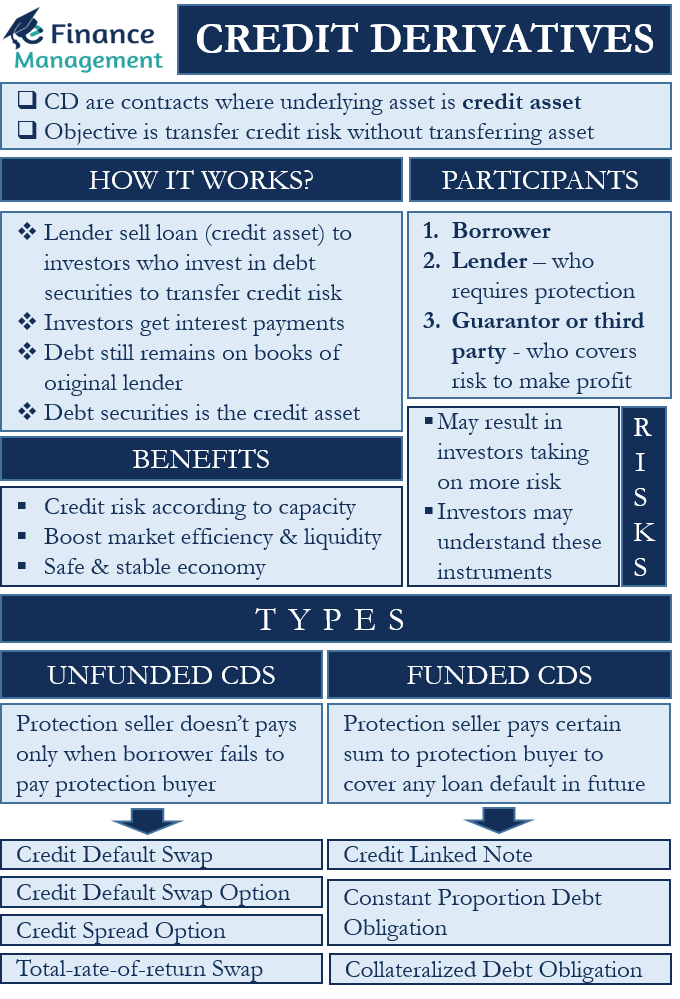

Credit Derivatives (or CDs) are contracts where the underlying asset is a credit asset. The objective of such a contract is to assist holders in transferring the credit risk without transferring the asset. The credit risk is the risk of the borrower defaulting on the loan.

We can say that such a contract works as an insurance policy enabling the holder to transfer the risk on the credit asset. These instruments trade OTC (over the counter). Further, the price of these instruments hinges on the credit ratings of the borrower.

Commercial banks mainly use CDs to hedge their credit risk exposure and boost their credit portfolio. Moreover, insurance firms also use these financial instruments to better return on their asset portfolio.

Credit Derivatives: How it Works?

For transferring the credit risk, the lender will sell the loan (or the credit asset) to investors. To those investors who want to put money in the debt securities. The investors get interest payments. The risk is transferred when the investor buys the debt security. However, the debt still remains on the books of the original lender. There is no change in the status of the debt. The only change is in the credit risk ownership which is transferred from the lender to the new investors. These debt securities are what we refer to as credit derivatives.

There are three types of participants in a CD transaction. These are:

- A borrower who requires the credit and who will pay the loan amount.

- A lender who requires insurance or protection.

- Guarantor or third party who covers the risk to make a profit.

Example

Suppose Company A wants a loan of $1 million to expand its business, but it does not have a healthy credit rating. Bank B, however, issues a loan to Company A, but at a higher interest rate due to the unhealthy credit rating. Bank B enters into a contract with a third party to cover the credit risk. This contract we call a credit derivative.

In this case, Bank B is the protection buyer, and assume the seller of the protection is Seller C. Bank B will have to pay some fee to Seller C for covering the credit risk. The CD will allow Bank B to transfer the loan default risk to Seller C.

So, if Company A fails to pay the loan, Seller C will have to make good the losses depending on the agreement. This means Seller C will have to pay the balance interest and/or principal to Bank B. And, if Company A pays the full loan, Seller C will profit by the amount of the fees for providing protection.

So, we can say that the one CD serves the following benefits:

- Enables Company A to get the loan.

- It helps Bank B to cover the credit risk with the loan.

- Allow the third party to make a profit in the form of fees (if there is no default)

Types of Credit Derivatives

There are two main categories of CDs:

Unfunded CDs

In this type of CD, the protection seller does not make any upfront payment to the protection buyer. Instead, the protection seller pays the protection buyer only when the borrower fails to pay the protection buyer (lender). Thus, in the case of unfunded CDs, the lender gets exposed to the default risk from the counterparty. There are different types of unfunded CDs, and these are Credit default swaps (CDS), Credit default swap options, Credit spread options, and the Total-rate-of-return swap.

Funded CDs

These CDs don’t expose the lenders or the protection buyer to the credit risk from the protection seller or counterparty. In this, the protection seller pays a certain sum to the protection buyer to cover any loan default in the future. There are three types of funded CDs, and these are Credit linked notes (CLN), Constant Proportion Debt Obligation (CPDO), and Collateralized debt obligation (CDO).

Now, let’s look at each type of CD in detail.

Unfunded CDs

Following are the types of unfunded CDs:

Credit Default Swap (CDS)

In credit default swap, both the protection seller and the protection buyer agree on a deal. Under the deal, the buyer of the protection makes regular payments to the protection seller over the period of the deal. The buyer of the protection makes the regular payment from the loan installments or EMIs that it gets from the original borrower. These regular payments are in the form of swap spread or premium. The main advantage to the buyer of the protection is that it enables them to cut out risky entities from their balance sheet without selling them. And the benefit to the seller is that they are able to earn a higher return by investing in markets that are difficult to get into.

Credit Default Swap Option

This contract gives the buyer the right (with no obligation) to enter into a CDS deal at a specific strike price and at a certain future date. We can say that it is primarily an option on a CDS.

Credit Spread Option

Here two transactions- buying and selling options both take place simultaneously. Both buy and sell options must have the same underlying asset and same expiry date, but with the varying strike price. This difference in the strike price is what results in a profit.

Total-rate-of-return Swap

The total return swap involves transferring credit as well as interest rate risks with an underlying financial asset to a third party. In such a swap also, the transfer of risk only takes place without any transfer of the ownership of the underlying asset.

Funded Credit Derivatives

Following are the types of funded CDs:

Credit Linked Note (CLN)

Such security has a CDS embedded in it. This CD enables the buyer of the protection to transfer a certain set of credit risks to a third party. In case of no default from the borrower till maturity, the note is entitled to be redeemed at par. But if there is a default, the note is redeemed at an amount below the par value.

Constant Proportion Debt Obligation (CPDO)

This CD enables exposure to credit risk using a note with a credit rating embedded in it. Such a CD uses the dynamic leveraging of trades and gives high yields with low credit risk. ABN Amro was the first to use it in 2006. It pays a high-interest rate same as a risky junk bond.

Collateralized Debt Obligation (CDO)

In collateralized debt obligation CD, the bank or a lender bundles all their loans, and these bundles function as separate debt instruments. Such debt instruments are backed by collateral. Moreover, these instruments are then sold in small tranches to the investors. The interest and payment could be different for different tranches. These tranches are based on the basis of their credit risk. Usually, the most senior tranche pays the lowest rate. Only institutional investors can invest in CDOs.

Benefits and Risks of Credit Derivatives

Following are the benefits of CDs:

- It allows lenders to take on the credit risk in accordance with their capacity.

- It boosts efficiency and liquidity in the market.

- CDs can also work as shock absorbers to keep the economy safe and stable.

Following are the risks associated with CDs:

- It may result in investors taking on more risk.

- Average investors may not be able to understand these instruments.

Final Words

Credit Derivatives are popular financial instruments for reducing credit risk. However, parties using such instruments (buyer and seller) must have a very good understanding of these instruments to benefit the most from them.