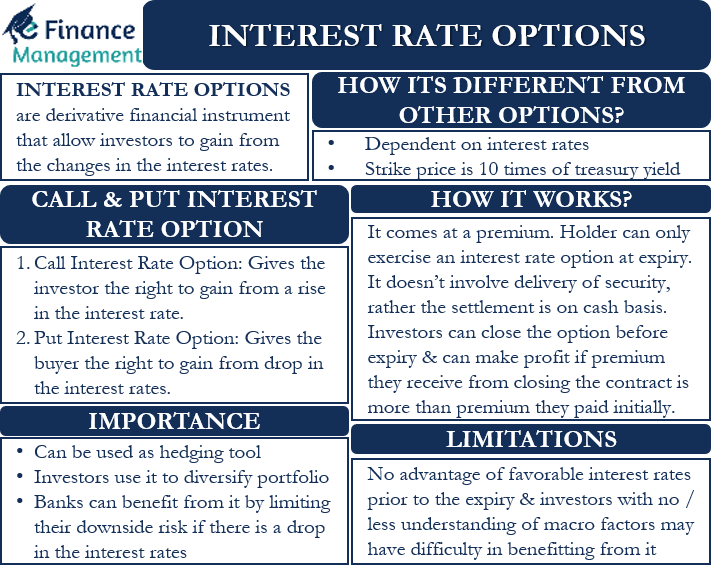

Interest Rate Options are a derivative financial instrument that allows an investor to gain from the changes in the interest rates. So, all these options or the underlying relation and dependence of the financial security or instrument is Interest Rates. And these are connected to interest-bearing financial products, such as treasury notes. Moreover, these options trade on exchanges, such as CME Group, and are also available OTC (over the counter).

How Its Different from Other Options?

An interest rate option works similarly to equity options, allowing buyers to speculate on the direction of the interest rate movement. There can be a put or a call interest rate option similar to equity options.

Depends on Interest Rates

Even though the interest rate option works like any other option, there is one big difference between it and other types of options. Most options depend on the underlying security. But, interest rate options depend on the actual rates. Moreover, Federal Reserve or any other authority can influence the interest rates. Thus, it is very important that investors in interest rate options have a good knowledge of the macroeconomic factors that can impact the interest rates.

Strike Price – 10x of Treasury Yield

Another major difference is of the strike price. In other options, the strike price is simple, and it is the price that one expects the underlying security to hit at expiry. However, in the interest rate option, you can not have interest rates as the strike price. So, in this case, the value of the option is ten times of the underlying treasury yield.

Also Read: Put and Call Options

For instance, if the underlying treasury yield is 5%, then the value of the option will be $50. And, if the yield moves to 5.5%, then the value of the option would rise to $55.

Interest Rate Options – How it Works?

Interest rate options are a very useful tool for lenders and borrowers during period of economic uncertainty. For instance, the buyer of the interest rate call option gets the right to pay a fixed interest rate and get a variable interest rate. Even institutions can use an interest rate option to hedge their risk.

Like other options, an interest rate option also comes at a premium, which is the cost of using the option. This premium amount depends upon a number of factors. These factors include the current market rate, strike rate, time left until expiry, volatility, and if it is a call or put option.

When it comes to exercising the option, a holder can only exercise an interest rate option at the expiry. Or, we can say that these options are European options. These options do not involve any delivery of securities; instead, their settlement is on a cash basis.

Investors, however, can close (not exercise) the interest rate option before the expiry. The buyer can close the option by selling it in the open market. An option seller can close their position by buying an equivalent option carrying the same strike price and expiry date.

Even by closing the contract before the expiry, investors can make a profit. They will make a profit if the premium they receive from closing the contract is more than the premium they paid initially.

Call and Put Interest Rate Options

As said above, there are two types of interest rate options – call and put. A call option gives the investor the right (not obligation) to gain from a rise in the interest rate. The holder of a call option will profit if the interest rate is above the strike rate at the time of the expiry. However, the holder will only make a profit if the interest rate at expiry is high enough to cover the premium cost as well.

In contrast, a put interest rate option gives the buyer the right (not obligation) to gain from the drop in the interest rates. The holder makes a profit if the interest rate drops below the strike rate and is enough to cover the premium cost as well. Such options are profitable when they are in the money.

Example of Interest Rate Options

Suppose Mr. A buys a call option with a strike price of $30 and an expiry date of July 31st. The underlying benchmark is the 30-year Treasury, and the premium is $1.

Now assume that by July 31st, the yield goes up, and the value of the option is $35. In this case, the net gain for Mr. A would be $4 ($35 – $30 – $1).

Now assume if the yield drop by July 31st and the value of the option is now $25. In this case, the call option will expire worthlessly. Mr. A would just lose the premium of $1. An option that expires worthless is usually out-of-the-money (OTM).

Importance

Investors can use the interest rate options as a hedging tool to protect themselves from the fluctuations in the interest rates. Or, they use it as a trading strategy to benefit from the directional movement in the interest rate. Moreover, investors can also use the interest rate option to enlarge or diversify their portfolios.

Banks can also benefit from the interest rate options as they generally have a large loan portfolio. By using the interest rate option, banks can limit or cap their downside risk if there is a drop in the interest rates.

Risk

Like any financial instrument, Interest rate options also carry some degree of risk. This risk, however, primarily depends upon the expiry date and the strike price of the option.

Separately, interest rate options can also prove risky for investors who do not know how to structure a trade or how these options work. Such investors can land in a position that is unprofitable and does not even hedge their risk.

Another thing that makes these options risky is their sensitivity to market volatility and fluctuations. Generally, the options that are in-the-money (ITM) at the time of purchase are very sensitive to movement in the price. This is because there is a high correlation between their strike price and the underlying futures price.

Limitations of Interest Rate Options

Following are the limitations of interest rate options:

- Since a holder can exercise this option only at the expiry, it takes away the flexibility element. Or, we can say that investors are unable to take advantage of favorable interest rates before the expiry. Investors, however, can cancel the contract by using an offsetting contract.

- Investors in an interest rate option must have a good understanding of the bond market. They must understand the inverse relation between the Treasury yields and bond prices.

- Also, investors having no or less understanding of the macro factors may find it difficult to benefit from the interest rate options.

Final Words

Interest rate options could prove very useful in limiting or hedging the risk of changes in the interest rate. However, to benefit from the interest rate option, it is crucial that investors know about and understand the macroeconomic indicators that can influence the interest rates.

RELATED POSTS

- Options on Futures – Meaning, How it Works, Importance, and More

- Swaption – Meaning, Features, Benefits, Types and More

- Purpose and Application of Options

- Receiver Swaption – Meaning, Pricing, Suitable For and More

- What are the Factors Affecting Option Pricing? How and Why?

- Derivatives Market – Types, Features, Participants and More