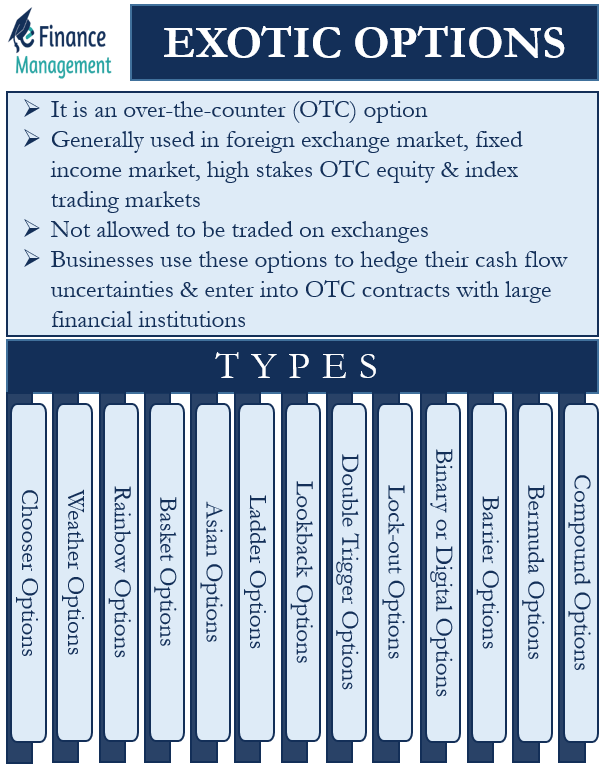

What are Exotic Options?

An exotic option is an over-the-counter (OTC) option that is more complex than commonly traded plain vanilla options in terms of the option behavior with respect to the underlying computation and timing of the payout and the terms of the customized contract. Due to their complex nature and high level of customization, exotic options are typically not permitted to be traded on exchanges and are instead utilized in markets such as foreign exchange, fixed income, and over-the-counter equity and index trading. These options are used by many businesses to hedge cash flow uncertainties. Moreover, they also enter into over-the-counter contracts with large financial institutions which can structure and price such products.

Types of Exotic Options

Let us learn about various types of exotic options:

Compound Options

Compound options, are basically options on options. It is also known as split-fee options. These give the holder a right to buy or sell another call or put option. The underlying call or put option is usually a plain vanilla option, which itself has a stock, index, or other linear instruments as its underlying. Compound options come in four variations.

- A Call on Call option gives the holder the right to buy a call option.

- A Call on Put option gives the holder the right to buy a put option.

- A Put on Call option gives the holder the right to sell a call option.

- A Put on Put option gives the holder the right to sell a put option.

Bermuda Options

Bermuda options behave somewhat like both the European and American options concerning their exercise. A Bermuda option can have more than one life. It can be exercised before expiry during the designated exercising windows. If it is not exercised during these windows, it can be exercised at expiry or expire worthlessly.

Barrier Options

The payoff of barrier options kicks in or vanishes when the underlying asset hits a pre-determined strike or barrier. Due to this property, the payoff of barrier options shows discrete jumps and falls instead of a smooth continuous line. Barrier options come in four variations.

- A call option with a knock-in barrier (up and in option). It pays out the difference between the market price and the strike price only when the underlying reaches a certain price that is more than the strike price.

- A call option with a knock-out barrier (up and out). It ceases to exist when a certain price is reached above the strike price, and it doesn’t come back to life even if the price falls below the barrier.

- A put option with a knock-in barrier (down and in option) pays off when the price falls below the strike price for a certain amount.

- A put option with a knock-out barrier (down and out option) ceases to exist when a certain price is reached below the strike price. And it doesn’t come back to life even if the price rises above the barrier.

Binary or Digital Options

As the name suggests, these options have only two payoffs, either zero or some pre-determined fixed payoff when a condition is satisfied. For example, a binary call option with a strike price of $10 pays $100 for any price above the strike price at expiry, while a put option with a strike price of $10 pays $100 for any price below the strike at expiry.

Lock-out Options

Lock-out options are types of exotic options that pay off if the value of the underlying asset doesn’t move beyond a certain value. Another variation can be a double lock-out option that pays only if the underlying asset’s value remains within a range of values.

Double Trigger Options

As the name suggests, a double-trigger option needs two conditions for the payoff to get triggered. The conditions can also depend on two unrelated events or instruments, which can alter the riskiness of the option.

Lookback Options

The payoff of a lookback option is a function of the current market price and the range of the price during a pre-specified lookback period of time. A lookback option can either have a floating strike or a fixed strike. A floating strike lookback option has its strike price determined at the time of expiry. While a fixed strike lookback option has its strike price fixed at the start.

Also Read: Put and Call Options

Ladder Options

A ladder option allows the holder to preserve the payoff during the movement of the underlying’s price. It will keep on increasing and preserve the payoff if the underlying is moving above the strike. And will eventually pay out a minimum preserved amount even if the underlying’s price falls below at the time of the expiry. A ladder put option will similarly preserve the payoff during the descent of the underlying price.

Asian Options

An Asian option has a payoff which is a function of the average market price of the underlying asset during the life of the option. It is also known as an average rate or average price option.

Payoff of Asian Call Option = Max (Average of Underlying’s Market Price-K,0)

Payoff of Asian Put Option = Max (K-Average of Underlying’s Market Price,0)

where K is the strike price of the option.

Basket Options

A basket option is written for the foreign exchange market. It gives the holder the right to receive two or more currencies instead of the payoff. The exchange rate can be pre-specified or the spot rate at the time of the settlement.

Rainbow Options

A rainbow option has a payoff that is dependent on the movement of two or more underlying assets. Even the payoff can be in a different form than the underlying, for example, getting shares of company A for an in-the-money rainbow call option on a stock of company B.

Weather Options

A weather option pays off when a pre-determined weather condition is met. Weather options can be used by weather-dependent businesses to hedge their cash flows during times of bad weather.

Chooser Options

A chooser option gives the holder a right to decide whether the option will be a call or put at a later date. So, if the stock moves up, the holder can decide it to be called, and if the stock moves down, the holder can decide it to be a put. It is essentially like having a long straddle that pays off during large movements (in any direction) of the underlying.

There can be many other customized types of exotic options that can be designed depending on the business needs.

Continue reading about various other types of Derivatives.

RELATED POSTS

- American vs European Option – All You Need to Know

- Put Options – Meaning, How it Works, Strategies, and More

- Purpose and Application of Options

- Call Options – Meaning, How it Works, Uses, and More

- What are Options in Trading – Types, Pros, Cons, and More

- In the Money and Out of the Money – All You Need to Know