What is an Indifference Point?

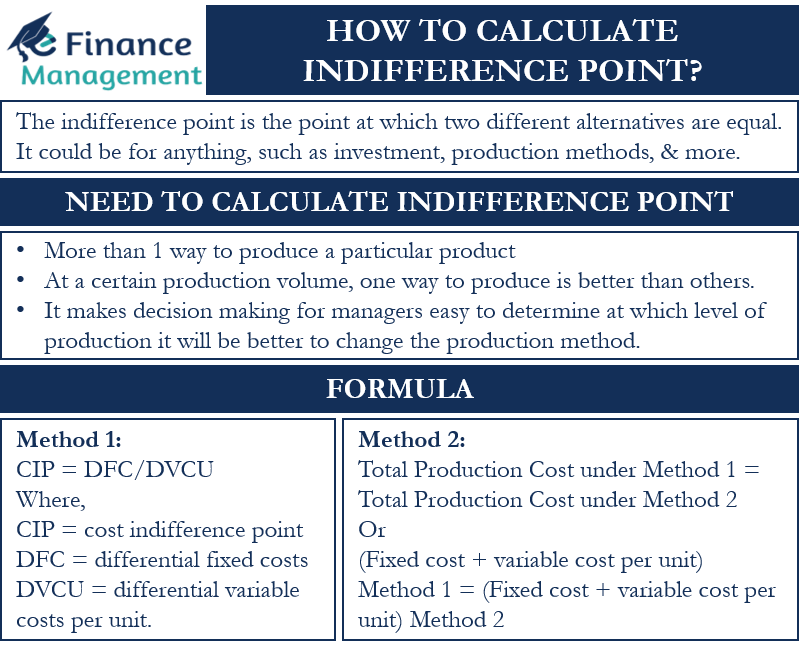

The indifference point, as the word suggests, is the point at which two different alternatives are equal. The indifference point could be for anything, such as investment, production methods, and more. But when we talk about the indifference point, we generally refer to the cost indifference point. It is the point or volume of production units at which the total cost and the profits are the same under two cost structures. Such a tool basically helps managers to select from varying cost structures. In this article, we will take a look at how to calculate an indifference point.

Before we detail how to calculate the indifference point, let’s understand why we need to calculate the indifference point.

Need to Calculate Indifference Point

A manufacturing company could have two or more ways to produce a particular product. It is possible that at a certain production volume, one way to produce is better than others. Thus, it is crucial for managers to determine at which level of production it will be better to change the production method. This level of production or point is the indifference point. It is because at this point the total cost under the methods is the same. And, at points above or below the indifference point, the total costs will vary.

The indifference point could seem similar to a breakeven point, but the two concepts are very different. As said above, the indifference point helps to calculate the production level where the total costs for two different production approaches are the same. On the other hand, the breakeven point tells the production or output level at which a firm is able to recover its total costs. We can also say that the breakeven point establishes a relation between sales and costs. And, the indifference point establishes the cost relation between two production methods.

How to Calculate Indifference Point?

There are two ways to calculate the indifference point. The first is using the differential method and the second is using equations.

Method 1

Under the first method, we use differential fixed costs and differential variable costs per unit to come up with the indifference point. We simply divide the differential fixed costs by the differential variable costs per unit to get the indifference point.

Following is the formula to calculate the indifference point:

CIP = DFC/DVCU

Where,

- CIP means the cost indifference point

- DFC means the differential fixed costs

- DVCU means the differential variable costs per unit.

Method 2

The second way to determine the indifference point is to set up cost equations where the two sides represent the total cost under each production method. Since the total cost is the same, as well as the selling price, the profit is the same under the two methods as well.

We set the two equations against each other to get the indifference point or the volume at which the two costing methods give the same result. It must be noted that at a volume below the indifference point, the production method with less fixed cost will give a higher profit. Similarly, at a volume above the indifference point, the production method with a higher fixed cost will give more profit.

Now let’s consider examples to understand how to calculate indifference point under the two methods.

How to Calculate Indifference Point – Examples

Example 1

First, let’s consider a simple example of the differential method.

Suppose Company A has come up with two methods of production. The first method has fixed costs of $200,000 and variable costs of $1,000 per unit. And, the second method has fixed costs of $100,000 and variable costs of $500 per unit.

Differential fixed costs = $200,000 – $100,000 = $100,000

Differential variable costs per unit = $1,000 – $500 = $500

Now, we need to put the values in the formula to get the indifference point.

CIP = DFC/DVCU = $100,000/$500 = 20 units

Example 2

Now let’s consider a simple example for the equation method.

Suppose production method 1 has a fixed cost of $40,000 and a variable cost of $7 per unit. And production method 2 has a fixed cost of $95,000 and a variable cost per unit of $4. Assume the selling price under both production methods is $10 per unit.

Also Read: Break Even Point

Under the equation method:

Total Production Cost under Method 1 = Total Production Cost under Method 2

or

(Fixed cost + variable cost) Method 1 = (Fixed cost + variable cost) Method 2

or

$40,000 + ($7 * X) = $95,000 + ($4 * X)

Now, we need to solve this equation for X, which is the volume at which the costs are the same.

$7X – $4X = $95,000 – $40,000

$3X = $55,000

X = 18,333 units

At 18,333 units, both production methods will have the same total cost. At volume below this, production method 1 will have a lower cost of production (and more profit) because it has a lower fixed cost. And, at volume above the indifference point, production method 2 will give more profit.

Final Words

Though the indifference point is a popular tool, the reality is that there is no one answer when it comes to selecting a cost structure. The decision about the cost structure depends primarily on the management’s approach towards risk and return.

ref

Scott, Michael & Antonsson, Erik. (2011). Chapter 10 USING INDIFFERENCE POINTS IN ENGINEERING DECISIONS.