Cost classification can be done in various ways depending on its nature and specific purpose. There are various types of costs classified into logical groupings. These groups are such that every item of cost can be classified. These classifications of costs make the cost information meaningful. It is of utmost importance to the management of a manufacturing concern. It is the first step toward their decision-making process relating to costs and costing.

Cost is a vague term and barely has any meaning until it is classified into logical groups. For example, if we know total expenses are $500 Million against $550 Million in revenue. What insight can we derive? Nothing. If we add one more piece of information, say $350 Million is a direct material cost, and $100 Million is a direct labor cost and other overheads. Now, the management can focus on direct material cost because that forms the major part of the total cost as far as cost control initiatives are concerned.

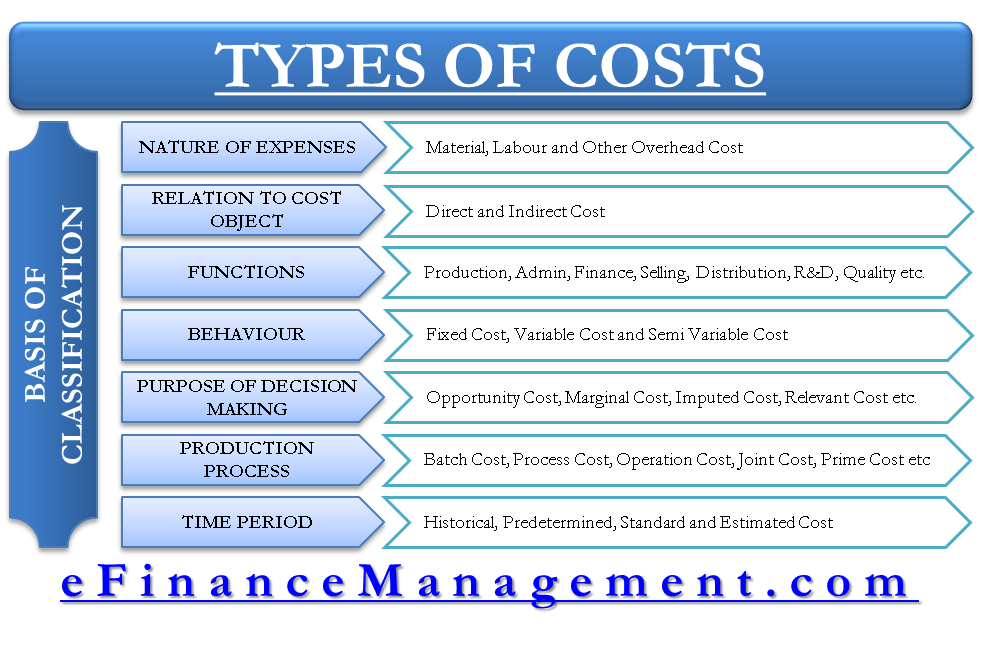

Basis of Classification for Types of Cost

There can be various bases on which classification of costs can be done. The following are the important ones we will discuss in brief.

Nature of Expense

By the nature of expenses, costs are classified into material, labor, and expenses.

Relation to Cost Object – Traceability

This classification is based on the relation of the cost element with the cost object. We get two types of costs based on traceability, viz. direct and indirect costs. The basis is the cause and effect relationship between the cost element and cost object or traceability of costs to its cost object.

Functions/Activities

Costs can also be classified into various functions/activities. Common types of costs based on the functional classification of costs are as follows:

- Production/manufacturing cost,

- Administration cost,

- Finance cost,

- Selling cost,

- Distribution cost,

- Inventoriable and period costs,

- Research and development costs,

- Quality costs, etc.

Behavior of Costs

The behavior of costs, here, is with respect to the change in volume. On this basis, costs are classified into fixed and variable costs and semi-variable costs. Fixed costs do not change with the volume change; variable costs do change. Semi-variable costs do not change up to a particular activity level; beyond that, they will change.

Must read Relationship of Direct & Indirect Costs with Fixed & Variable Costs

Purpose of Decision Making by Management

For decision-making purposes of management, costs can be classified into various types, such as

- Opportunity cost,

- Marginal cost,

- Differential/incremental cost,

- Relevant cost,

- Imputed cost,

- Replacement cost,

- Sunk cost,

- Normal/abnormal cost,

- Avoidable/unavoidable costs,

- Out of pocket costs,

- Explicit and implicit costs, etc.

Production Process

It’s an important classification for cost accounting of different manufacturing industries. Based on the production process of the industry, costs can be classified into the following:

- Batch cost

- Process cost

- Operation cost

- Operating cost

- Contract cost

- Joint cost

- Prime cost

- Factory cost or works cost

- Cost of production

- Cost of goods sold

Time Period

Based on a time period of assessment or any other specific purpose, costs can be classified into historical cost, pre-determined cost, standard cost, and estimated cost.

Quiz on Types of Costs and their Basis of classification

Keep up for your good work

What are the effect of classifying cost into fixed cost and variable cost

Sanjay your website is very insightful. you keep explanations simple and straightforward.

Discuss the Uses of both management accounting, cost accounting and financial accounting

Thank you for the explanations! Now I have better understanding on this topic.