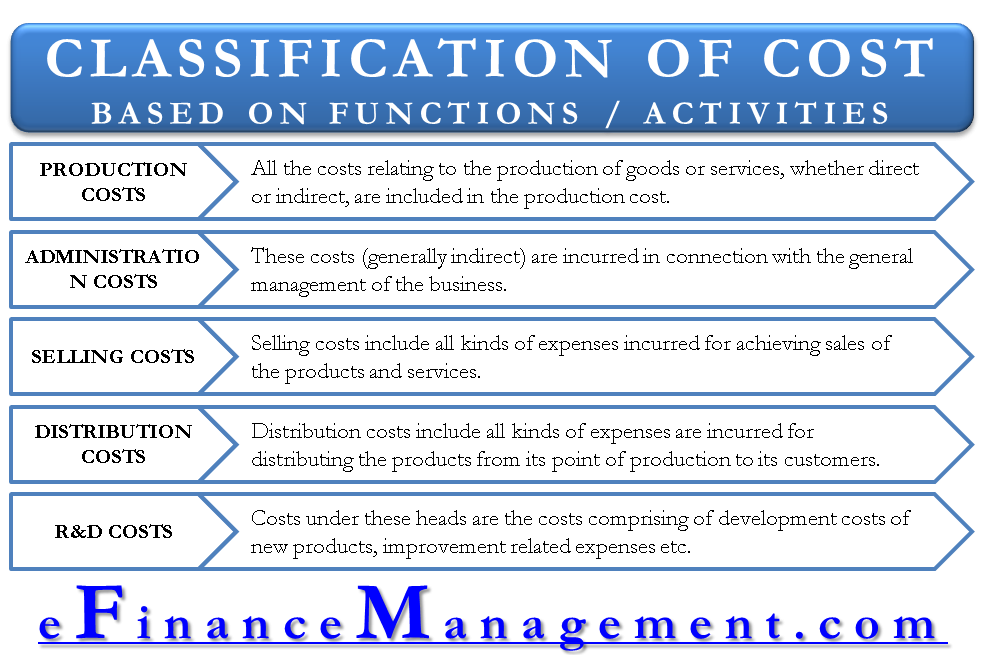

There is the various classification of costs. It could be based on nature, traceability, functions, behavior, purpose, production process, and costs period. In this post, we will discuss the classification of costs based on functions or activities in an organization. All the business costs can be classified into activities such as production costs, administration costs, selling costs, finance costs, distribution costs, research, and development costs. These are just the primary functions or activities in business, but there can be more detailed classification.

Functional Classification of Costs

We have classified costs into the following functions. The classification is not rigid, like the rule of law. Majorly, our classification is influenced by the value chain of a business. There could be a different and better way to classify costs. Most importantly, we should study the organization’s business model for such a classification. Then, we should design an appropriate classification for that organization—a classification that helps take management-related decisions, internal control of the organization, etc.

Production or Manufacturing Costs

All the costs relating to the production of goods or services, whether direct or indirect, variable or fixed, are included in the production cost. We can classify production costs into direct and indirect production costs.

Example of Direct Production Costs (also known as direct manufacturing costs)

- Direct Raw Material

- Direct Labor

- Other Direct Expenses such as job work charges relating to a particular product, etc.

Examples of Indirect Production Costs (also known as Production or Manufacturing Overheads)

- Salaries of Supervisors, Production Heads, Technical and Planning Staff, etc

- Quality control costs

- Other labor-related expenses

- Quality control

- Store expenses

- Depreciation of plant and machinery

- Repair and maintenance of factory building and plant & machinery

- Security expenses for the unit

- Labour welfare expenses like canteen expenses

- Insurance, etc.

In summary, we can say that all the costs that a firm incurs for producing goods are part of production or manufacturing costs. This is a critical cost classification. Most companies have a bigger chunk of total costs incurred here. Therefore, companies invest a lot of their time and energy to streamline these costs. They have a direct role to play in the sustainability of the company.

Also Read: Types of Costs and their Classification

Administration Costs

These costs are incurred in connection with the general management of the business. These usually are indirect costs and are also known as administrative overheads. Examples of such costs can be the following:

- Salaries of staff in general management

- Office-related expenses such as rent, rates, taxes, telephone, stationery, etc.

- Charges levied by the bank.

- Audit and legal fees

- Office-related depreciation etc.

This includes all those costs that are not related to product manufacturing but are unavoidable for the organization’s overall administration. These costs support the primary activity of production. Most organizations wish to keep these costs as low as possible. It is because the managers cannot link them directly to the profits of the company. For example, the contribution of an accountant towards the earnings of a particular year is challenging to judge.

Marketing or Selling Costs

Selling costs include all kinds of expenses incurred for achieving sales of the products and services. These are also considered indirect expenses are, known as selling overheads. Examples of such costs are as follows:

- Salaries of selling staff

- Commission, conveyance, discount, etc

- Product market research

- Royalty, etc

This function gets a lot of focus from management. This is a crucial function because if there are no sales, all other activities or functions are useless. Streamlining the selling function has fast and visible fruits for the management. For example, a slight change in the commission structure of the selling task force could lead to a lot of additional sales. Additional sales have a lot of advantages like control in stock levels, better capacity utilization, lower fixed costs per unit, etc.

Also Read: Cost Hierarchy – Meaning, Levels and Example

Distribution Costs

Distribution costs include all kinds of expenses are incurred for distributing the products from their point of production to their customers. Examples of distribution costs are as follows:

- Transportation costs

- Warehouse rents

- Commission to Distribution channel etc

This classification of cost is vital for customer satisfaction. A sound distribution system ensures timely and safe delivery of goods, reduces wastage in transportation, etc. Many businesses run through distribution channels. From selecting the distribution channel to deciding the commission structure comes under the purview of distribution management. Streamlining these costs could make the product cheaper for the customer. There are various strategies companies follow to optimize such costs.

Research and Development Costs

Costs under these heads are the costs comprising development costs of new products, improvement-related expenses, etc. These are not unavoidable costs. A company may wish not to spend even a penny on such costs. But, this would be a mistake. With current products and production lines, a company can sustain itself in the short run. With the technology change and consumer choices, it is crucial to innovate new products and continually streamline existing ones. Most companies try and allocate a budget for these costs every year.

Customer Service

These days after-sales service is a primary key supporting the marketing or selling function of the organization. We can notice that the consumer now requires not only a tension-free purchase but also its utilization. For example, servicing AC, Washing Machines, etc. Most importantly, the customers are ready to pay more for products of companies who have proved better customer service after selling the product also.

Conclusion

To conclude, classifying costs into functions could be different in different organizations. Therefore, a company can completely customize it based on its requirements. Once the classification is done, the strategy to manage and control that cost should be framed according to the classification.

Quiz on Classification of Costs based on Functions / Activities

This quiz will help you to take a quick test of what you have read here.

Thanks a lot.