What is Process Costing?

Process costing is a type of costing method. It is a subset of operation costing typically applicable to manufacturing entities mass-producing a homogeneous product. It is a GAAP-approved system of costing. Industries producing a standardized product wherein raw materials pass through multiple processes to obtain the final output are prime employers of the process costing technique.

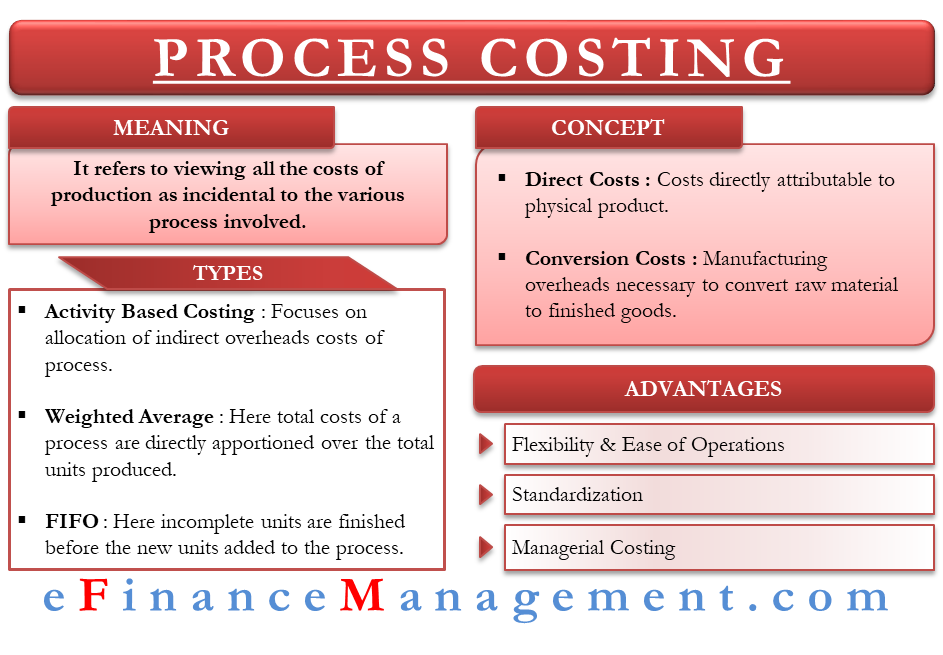

In other words, this costing refers to viewing all the costs of production as incidental to the various process involved. Both direct and indirect costs are charged to the process. These costs are then allocated over the total production volume to arrive at the per-unit cost.

To better understand this concept, it is worthwhile to learn about direct costs & conversion costs.

Direct Costs

Direct Costs are costs directly attributable to the physical product and mainly include raw material and labor. This is also referred to as Prime Costs.

Conversion Costs

Conversion Costs refer to the manufacturing overhead cost necessary to convert raw material to the finished product. They include the cost of utilities, indirect labor, and other non-specific costs used in the factory.

Also Read: Conversion Cost Calculator

For example, let us consider a simple example to understand the fundamentals of process costing.

Assume a textile unit having the following processes before reaching its final product. ‘

Yarn–> Knitting (P1) –> Dyeing (P2) –> Cotton

Process 1 (P1): Knitting

| Direct Costs | Raw Material: 10 spools of Yarn @ $20 per spool | $200 |

| Labor: 6-man hours at $5/ man-hour | $30 | |

| Conversion Costs | $170 | |

| Total Cost incurred in Process Knitting | $400 |

At the end of P1, the cost per spool of yarn is now $40. ($400/10)

Process 2: Dyeing

| Direct Costs | Raw Material: 10 spools of Yarn @ $40 (Brought Forward from P1) | $400 |

| Labor: 5-man hours at $4 / man-hour | $20 | |

| Conversion Costs | $180 | |

| Total Cost incurred in Process Dyeing | $600 |

At the end of P2, the finished product being dyed cotton emerges with a unit cost of $60 per spool ($600/10)

Advantages of Process Costing

Flexibility & Ease of Operations

The direct costs going into any process are readily available as the sum of raw material and labor. Also, indirect costs such as electricity, rentals, repairs, and depreciation can easily be mapped to a process. Several methods such as activity-based costing (ABC), absorption costing, and marginal costing exist to easily determine the cost consumed in each process.

Standardization

As already mentioned, process costing comes into play in cases of bulk manufacture of homogeneous products. This standardization and uniformity enable quick computation of the per-unit costs. The prompt availability of cost breakdowns facilitates a fast analysis of margins, thus giving an edge in the presentation of quotations to potential buyers.

Managerial Control

With process costing, the management can have a view of the cost consumption at each stage of the process. This makes it easier to evaluate deviations in process costs and quickly call out on drop-in process efficiencies or a sharp rise in material prices. It provides a bird’s eye view of the entire production facility—periodic comparison of cost sheets and line item wise analysis fuel important managerial decisions. For example, a sudden increase in raw material prices may prompt a change in vendors. Drop-in electricity overheads may indicate power savings from the purchase of a new machine.

Types of Process Costing

Activity-Based Costing

ABC costing is more focused on the allocation of the indirect overhead cost of a process. It is a logical and straightforward method of overhead absorption. The costs are first assigned to the various activities involved in the production process. These costs are then allocated to the products depending upon the extent of activities employed in making that product. The underlying of ABC costing are cost drivers used to determine the basis of cost absorption. For example, the rent of a factory may be absorbed basis the area occupied by each machine.

For example, consider the below table of overheads and their corresponding drivers.

| Overhead Cost | Spend | Cost Driver |

| Rental | $1500 | Square Foot |

| Repairmen Fees | $100 | Man-hour per Process |

| Electricity | $400 | Machine Hours |

| Total | $2000 |

| Cost Drivers | Knitting (P1) | $ | Dyeing (P2) | $ | Total |

| Area occupied | 200 sq. feet | $600 [1500*(200/500)] | 300 sq. feet | $900 [1500*(300/500)] | 500 sq. feet |

| Repairs Man Hours | 50 man-hours | $50 [100*(50/100)] | 50 man-hours | $50 [100*(50/100)] | 100 Man hours |

| Machine Hours | 30 | $240 [400*(30/50)] | 20 | $160 [400*(20/50)] | 50 machine- hours |

| Total | $890 | $1110 | $2000 |

Weighted Average

This is the simplest method of process costing, wherein the total costs of a process are directly apportioned over the total units produced. The only pre-requisite to exercise this system of process costing is to have a count of inventory and determine the manufacturing overhead consumed by a process.

Consider the below subset of a process as a part of a larger manufacturing process:

| Units | Direct Material | Direct Labor | Overheads | ||

| Costs in Opening WIP | 300 | $1800 | $1200 | $1500 | |

| Cost incurred during Month | 3200 | $24000 | $19600 | $18500 | |

| Total Costs | 3500 | $25800 | $20800 | $20000 | $66600 |

The cost per unit is, therefore, $19.03 ($66600/3500)

FIFO-First in First Out

FIFO method of process costing gives priority to units that were introduced in the process from the last period and remain unfinished. The incomplete units are assumed to be finished before the new units are added to the process.

This process makes use of the concept of Equivalent units. Equivalent units are nothing but the proportionate number of finished units considering the amount of labor and overheads already absorbed by the finished units.

This method is slightly more complex since it may not always be feasible to compute the degree of completion in the case of unfinished goods.

| Direct Material | Direct Material | Direct Labor | Direct Labor | Overheads | Overheads | ||

| % Completion | Equivalent Units | % Completion | Equivalent Units | % Completion | Equivalent Units | ||

| Opening WIP | 200 | 0.4 | 80 | 0.6 | 120 | 1 | 200 |

| Units completed during the month | 1200 | 1 | 1200 | 1 | 1200 | 1 | 1200 |

| Total Units Completed | 1280 | 1320 | 1400 |

| Direct Material | Direct Labor | Overheads | |

| Total Process Cost | $3840 | $2640 | $2800 |

| Equivalent Units | 1280 | 1320 | 1400 |

| Cost per Unit | $3 | $2 | $2 |

The total cost per unit at the end of the process is, therefore (3+2+2) $7.