Financial Breakeven Point

A breakeven point is when a company is making no profit, no loss, or it is a threshold beyond which the company starts to make a profit. Financial Breakeven is also a similar concept but uses a different measure to arrive at that point.

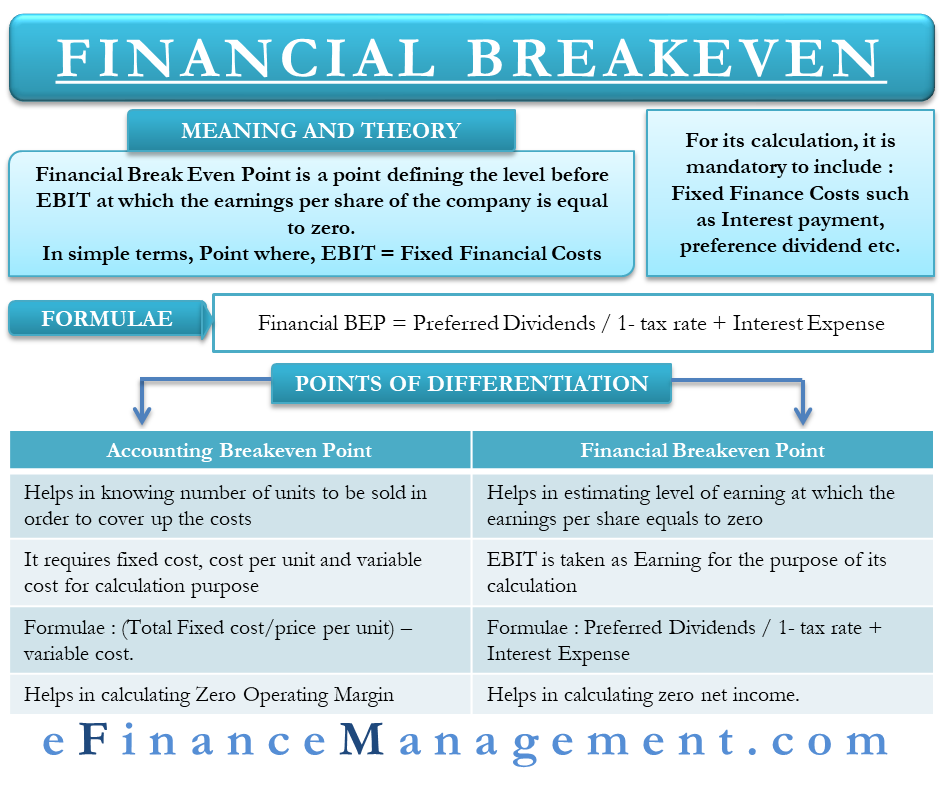

It is a point defining the level before the EBIT (earnings before interest and tax) at which the company’s earnings per share is equal to zero. Or, we can say it is the level of EBIT that equals the fixed financial costs for the company, such as interest on the debt, preference dividend, and more. Or we can also call it the minimum EBIT that a company should earn to meet its fixed commitments. Anything that a company earns beyond this level or point is the profit to the shareholders.

This concept of financial breakeven is quite different from the one we study in costing. Under costing, we calculate the number of units to be sold to reach a no-profit no-loss situation. While here, we calculate the EBIT level at which net income will be nil. However, both focus on covering fixed costs.

Financial risk related to investing in a company’s stock grows as the breakeven point increases. For calculating a financial breakeven point, it is mandatory to include Interest expenses and dividends on preference shares. On the other hand, one may or may not include common dividends.

Also Read: Financial Breakeven Calculator

Formula

One can express the relationship between EBIT and net income in the following way:

Net Income = EBIT x (1- Interest Expense) x (1-Tax rate) – Preferred Dividends

For the financial break-even point, we need the EBIT that could result in zero net income.

Therefore, 0 = EBIT x (1- Interest Expense) x (1- Tax Rate) – Preferred Dividends

Thereby, arranging the above situation, we get Financial Breakeven = Preferred Dividends / 1- tax rate + Interest Expense

You can also use our calculator – Financial Breakeven Calculator.

Examples of Financial Breakeven

Assume that a company has a 12% Preference Capital of $2,000,000 while its interest expense (@10%) equals $200,000. The tax rate under which the company falls is 30%. The company wants to calculate the EBIT for a project where it will be able to meet its fixed financial cost at least.

Total Preference Dividend = 240,000 (i.e., 2,000,000*12%)

Financial Breakeven = {240,000 / (1 – 0.30)} + 200,000 = 542,857.14

Now, assume that company requires additional funds ($360,000) for financing the project and it has three options to raise the funds.

Case 1: 100% equity

Case 2: Equally, through equity and debt

And, Case 3: Equally through equity, debt, and preference capital

Case 1: 100% Equity

The financial breakeven will remain the same in this case as there is no increase in the fixed financial cost of the company. Therefore, financial breakeven is equal to $542,857.14

Case 2: Equally through Equity & Debt

In this case, the amount of interest will increase by 18,000 (i.e., 360,000*50%*10%).

Financial Breakeven = {240,000 / (1 – 0.30)} + 200,000 + 18,000 = 560,857.14

Case 3: Equally through Equity, Debt & Preference Capital

Here, the amount of interest will increase by 12,000 (i.e., 360,000*10%/3) and the preference dividend will increase by 14,400 (360,000*12%/3)

Financial Breakeven = {(240,000+14,400)/ (1 – 0.30)} + 200,000 + 12,000 = 575,428.57

In cases 2 & 3, due to an increase in fixed financial cost, the EBIT has also increased to the extent of an increase in such costs. The company has to earn extra in order to reach this level of breakeven.

Accounting Breakeven Vs. Financial Breakeven

Accounting Breakeven is the simplest form of analysis to know the number of units that a company needs to sell in order to equal the cost. Every unit sold after the break-even unit will result in a profit for the company. Calculating the accounting break-even is easy as it requires fixed cost, cost per unit, and variable cost.

Also Read: Break Even Point

The formula for accounting breakeven is = (Total Fixed cost/price per unit) – variable cost. Firms targeting to achieve accounting breakeven strive toward selling the minimum number of units to cover the fixed cost.

Although similar in various aspects, financial breakeven deploys different measurements. As said above, it includes estimating the level of earnings for a firm at which the earnings per share equals to zero. For its calculation, we take EBIT as earnings.

There is one more difference between the financial break-even point and the operating or accounting break-even point. The latter calculates the unit sales that a firm needs to achieve for zero operating margins. On the other hand, financial break-even deals with the bottom line of the company’s income statement. Or, we can say the financial break-even point attempts to find EBIT that results in zero net income.

Final Words

Usually, organizations with a mixed capital structure calculate the financial break-even point. A firm has multiple options to raise funds, such as equity, preference, Bank loans, debentures, etc. Some of these instruments come with mandatory payment, meaning they are a fixed cost for the company.

In terms of priority, a business first pays out the interest on loans, then dividends on preference shares, and then uses the remaining for the equity shareholders and retained earnings. Therefore, understanding when the company will generate enough profit after covering fixed financial charges is very crucial. This is where financial breakeven steps in.

Thus, if a company is earning anything less than the fixed charges that it has to pay, then it would need to reassess the strategies. Financial breakeven also warns the companies against not beefing up their capital structure with too much debt (as shown in the example above). Instead, maintain a balance between debt and equity.

Quiz on Financial Breakeven

Let’s take a quick test on the topic you have read here.