Utility in economics refers to the satisfaction a consumer gets from consuming a single unit of a product. Similarly, Total Utility (TU) means the total satisfaction that a consumer receives after consuming a given amount of a product.

We can measure TU in terms of relative units called utils (a measure of utility). Also, we can analyze TU for one unit or of multiple units. For instance, we can analyze the TU for one pizza slice or TU from the entire pizza.

Importance of Total Utility

Economists use the TU concept to study consumer preferences and decision-making. Basically, TU tells the total happiness that a product or service gives to a consumer. In general, a consumer always wants to maximize satisfaction but in the most affordable way. We call this the Rational Choice Theory.

People have scarce resources, but they always aim to maximize satisfaction after consuming a product or service. So, TU can help users to allocate resources in a way to maximize utility.

A point to note is that to maximize the utility, the marginal utility of the money that a user spends on buying the good or service must be the same or more than the marginal utility that a user gets from consuming that unit of a product or service.

For instance, a user gets an option to buy from two products that cost the same, and neither of the product is more important than the other. Or, we can say both options offer the same utility. In this case, the user will select the product that provides the maximum utility for the money.

Relation between Marginal Utility and Total Utility

Marginal Utility is the satisfaction that a consumer gets after consuming an additional unit of a good or service. So, we can say that the TU is the sum of the marginal utilities of all the units. Thus, there is a close relationship between the marginal and total utility.

So, we can use marginal utility to calculate the TU for a user. For instance, TU at any point (say n) will be MU1 + MU2 + MU3……MUn. MU here is the marginal utility.

Also Read: Law of Diminishing Marginal Utility

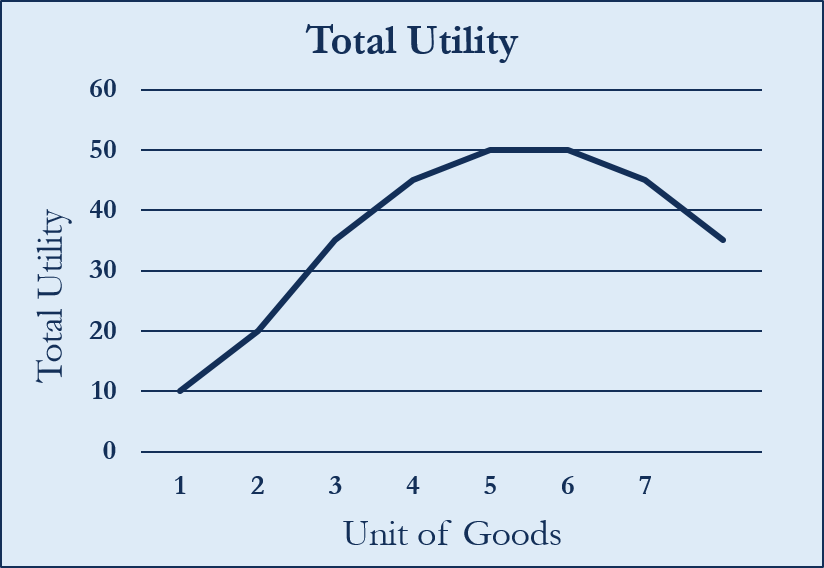

If the marginal utility of an item is positive, it means the total utility will increase. Generally, marginal utility starts to decline after consuming every successive unit of a good or service. TU, on the other hand, starts to drop after the marginal utility becomes negative.

For example, the first scoop of ice cream would give you the most satisfaction. Even the second scoop will provide satisfaction, but the satisfaction would likely be lower than the first one. It is likely that after the fourth scoop, you don’t want to eat more ice cream.

So, this is when the marginal utility is zero. With the fifth scoop, the marginal utility will be negative, and the total utility will start to drop. The above example also explains the law of diminishing marginal utility as well.

Example

Let’s consider an example to understand the relation between the TU and marginal utility.

| Units | Total Utility | Marginal Utility |

|---|---|---|

| 0 | 0 | |

| 1 | 5 | 5 |

| 2 | 7 | 2 |

| 3 | 8 | 1 |

| 4 | 8 | 0 |

| 5 | 5 | -3 |

The above table shows the number of units, total utility, and the marginal utility of a product for Mr. A. The first unit gives a utility of 5. Since it is the first unit, the marginal and total utilities are the same. The marginal utility starts to drop after the first unit, but the TU keeps increasing because the MU is positive.

After the fourth unit, marginal utility turns negative, implying Mr. A doesn’t want to consume more units. So, this is when TU starts to drop.

We can use the above table to understand the TU formula as well. If we want to get the TU for three units, then using the above formula, it will be MU1 + MU2 + MU3 or 5 + 2 + 1 = 8.

Final Words

Total utility refers to the total satisfaction that a user gets from consuming single or all units of a product or service. TU and marginal utility have a close relation and, thus, are very useful in studying consumer buying behavior. Studying consumer buying behavior, in turn, assists in predicting demand for goods and services in an economy.

RELATED POSTS

- Why Must Marginal Utility be Equal to Price?

- Law of Equi Marginal Utility – Meaning, Assumptions, and Importance

- Marginal Benefit – Meaning, Importance And More

- Ordinal Utility – Meaning and Assumptions

- Types of Utility – Form, Time, Place, Possession, and Other Utilities

- Cardinal Utility – Meaning, Assumptions, Advantages, and Disadvantages