What is a Zero Working Capital Approach?

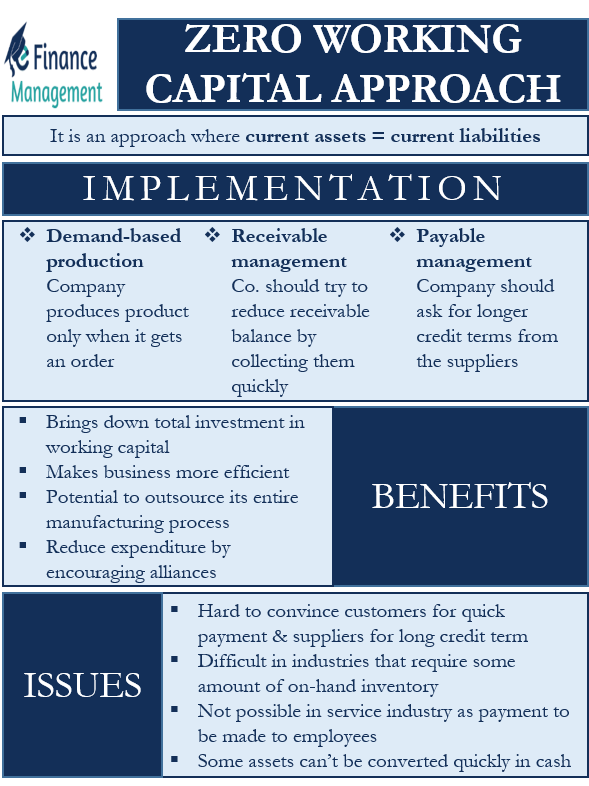

Zero Working Capital approach is a strategy that could help a business to magnify the return for the shareholders. It is an approach where the current assets equal the current liabilities. Or the current liabilities fully fund the current assets of a business. Thus, it enables a business to allot zero investment to the working capital.

So, a zero working capital is a scenario when:

Total Current Assets = Total Current Liabilities, or

Total Current Assets less Total Current Liabilities = Zero

Zero Working Capital Approach: Implementation

Let’s learn how to implement a zero working capital approach. A business can use the below ways to implement this approach:

Demand-based Production

Generally, inventory is the most significant current asset for a company. Thus, it is very important for a business to minimize inventory. This is where Demand-base production can help. It implies that a company produces a product only when it gets an order. So, the use of such a method helps to reduce the amount of inventory, as well as current assets significantly.

Receivable Management

It implies that the company should manage its receivables efficiently. In other words, we can say that the company should strive to reduce the receivable balance by collecting them quickly. The company should focus more on cash sales than credit sales. Moreover, the credit terms should also facilitate early payment from the customers.

Payable Management

Though the company needs to collect payment quickly from customers, it should ask for longer credit terms from the suppliers. This would help the company to reduce its current liabilities and use the extra cash to meet other current liabilities.

Benefits of Zero Working Capital Approach

A business that uses the zero working capital approach can get the following benefits:

- The biggest benefit is that it helps to bring down the total investment in the working capital. So, a business can use that money to increase the shareholder’s return, such as by investing in long-term assets.

- Such an approach makes business more efficient. A company can only implement this approach if it follows the “Just-in-time” methodology. This means ordering and receiving materials only when there is a need. Moreover, it helps the company adopt demand-based production and distribution system. Also, the use of this approach gives businesses the flexibility to modify their account receivables and payables terms so as to complement their “Just-in-time” methodology.

- A company that follows a zero working capital approach has the potential to outsource its entire manufacturing process. This, in turn, allows the company to save money on inventory maintenance, manufacturing facilities, and overheads.

- This approach helps to reduce expenditure by encouraging the company to forge an alliance with other companies for the betterment of its functional areas.

Issues with Zero Working Capital Approach

Though the zero working capital approach offers many benefits, it is tough to implement due to the following reasons:

- It could be hard to convince the customers, especially large ones, to make the payment early so that the company can pay off its liabilities in time.

- Convincing suppliers could also be a problem. Usually, the suppliers offer industry-standard credit terms. But asking them to offer more convenient terms, including longer payment terms, may not always work. Even if they agree, they will want higher prices for their supplies.

- Adopting demand-based production or just-in-time could be difficult in industries that require some amount of on-hand inventory.

- Such an approach may not be possible in the service industry. Though the service industry doesn’t have inventory, they have a large number of employees that they need to pay at the end of each month. Moreover, paying employees is important even if the company’s own billing cycle is longer than a month.

- We can’t easily and quickly convert some assets into cash. This could create a problem when any liability is due, and the company doesn’t have sufficient funds. So, having an extra asset is important to pay the liabilities on time.

Final Words

Though the zero working capital approach is an interesting concept, it isn’t practical in terms of implementation. Yet, a business must strive to reduce its investment in working capital. This would give the business at least some benefits (if not all) of the zero working capital approach.