The Conservative approach is a risk-free strategy of working capital financing. A company adopting this strategy maintains a higher level of current assets and, therefore, higher working capital. The long-term sources of funds, such as equity, debentures, term loans, etc., finance the major part of the working capital. So, the risk associated with short-term financing abolishes greatly.

In the conservative approach, long-term financing sources finance fixed assets, permanent working capital, and a part of temporary working capital. Short-term financing sources only finance the remaining part. Thus, ensuring the primary objective of working capital management. The following equation explains:

Financing Strategy in Equation

Long Term Funds will Finance = Fixed Assets + Permanent Working Capital + Part of Temporary Working Capital.

Short Term Funds will Finance = Remaining Part of Temporary Working Capital.

Conservative Approach Diagram

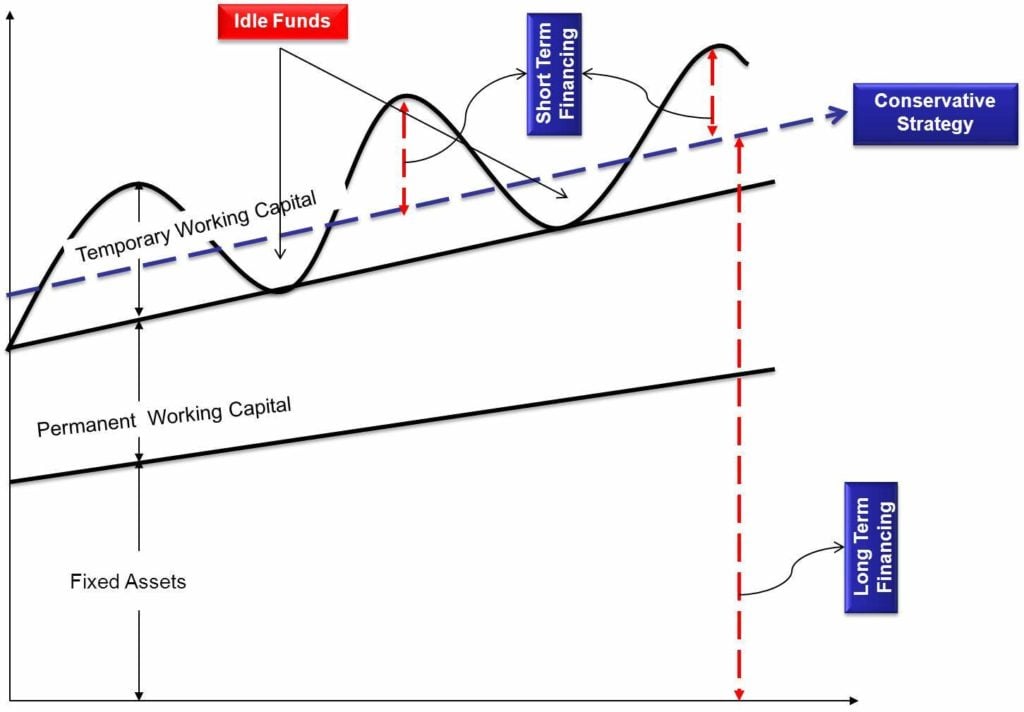

To explain the approach more clearly, let us use the following diagram. The dotted horizontal line indicates the point to which the long-term funds will be utilized. The dotted vertical lines indicate the sources of finance, and they are tagged as ‘long-term financing’ and ‘short term financing.’

We can easily make out that long-term funds are financing total fixed assets, total permanent assets, and a part of the temporary or seasonal working capital. Seasonal requirement or temporary working capital has peaks and troughs. The two areas of troughs below the long-term financing line indicate that idle long-term funds incur unnecessary interest costs.

Continue reading Maturity Matching or Hedging Approach and Aggressive Approach to Working Capital Financing.

Advantages of Conservative Strategy of Working Capital Financing

Smooth Operations with No Stoppages

In this strategy, the level of working capital and current assets (inventory, accounts receivables, and, most importantly, liquid cash or bank balance) is high. A higher inventory level absorbs the sudden spurt in product sales, production plans, any abnormal delay in procurement time, etc. This achieves a higher level of customer satisfaction and smooth operations of the company.

Higher levels of accounts receivables are due to flexible credit terms. This, in turn, attracts more customers and thereby higher sales. And, higher sales mean higher profits in normal circumstances.

No Insolvency Risk

The most important part and highly relevant to financing strategy is the higher cash and working capital levels. Higher working capital avoids the risk of refinancing, which exists in the case of financing by short-term sources of finance. It avoids the risk of refinancing and the risk of adverse change in the interest rate while getting the renewal of short-term loans. This is how the company avoids insolvency risk when it has sufficient capital to pay off any liability.

Disadvantages of Conservative Strategy of Working Capital Financing

Higher Interest Cost

This strategy employs long-term sources of finance, and hence there are all chances that the rate of interest will be high. The theory of term premium says that long-term funds have a higher interest rate than short-term funds because risk perception and uncertainty are high in the case of longer terms.

Idle Funds

Long-term loans cannot be paid off when wished and, if paid, cannot be easily availed back. As we noted in the diagram, the long-term funds remain unutilized in the times when a seasonal spurt in activity is not there. Idle funds have an opportunity cost of interest attached to it.

Higher Carrying Cost

A Higher level of inventory and debtors implies higher carrying and holding costs that directly impact profitability.

Inefficient Working Capital Management

If the firm’s margins are low for a particular year, a reasonable part of it will attribute to working capital management. In such a situation, the conservative approach to financing may be called with another name of ‘inefficient working capital management.’

Also, read about Different Approaches to Working Capital Financing Strategies.

Very nice… I got answer of my query. Thanku

Hello.

Amazing !