Operating Cycle

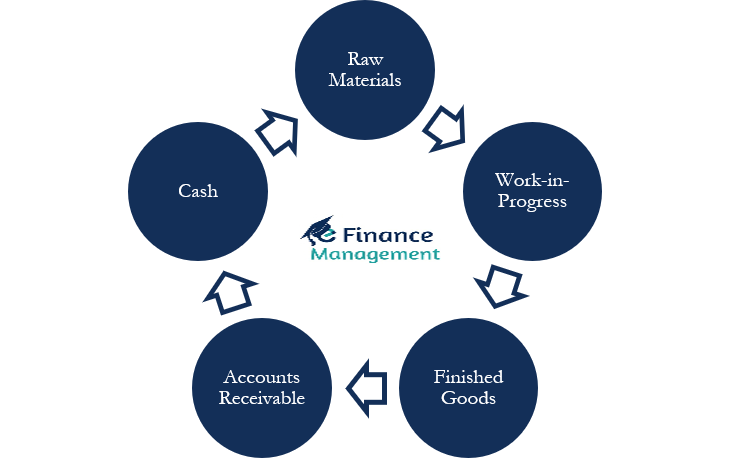

The operating cycle calculator calculates the period for the working capital requirement during which cash is converted back into cash. This process of converting cash to cash can be explained with the help of the following diagram.

Raw materials are purchased either on cash or credit and processed through two stages, that is, work-in-progress and finally finished goods. These finished goods are again sold either on cash or credit, and the cash realized from the accounts receivable is then used to pay off the accounts payable from which goods were purchased on credit. This process of conversion of raw materials into cash is the operating cycle.

Formula For Calculating Operating Cycle

In order to calculate the operating cycle, consider the following formula:

Operating Cycle = Inventory Holding Period + Accounts Receivable Period

where Inventory Holding Period = 365 / Inventory Turnover

and Inventory Turnover = COGS / Average Inventory

Accounts Receivable Period = 365 / Receivable Turnover

and Receivable Turnover = Credit Sales / Average Accounts Receivable

About the Calculator / Features

The Operating Cycle Calculator provides a quick result in one simple click to the user after he has inputted the following details into the calculator.

- Cost of goods sold (COGS)

- Average inventory

- Credit sales

- Average account receivable

Calculator

How to Calculate using Calculator

The user has to insert the following data into the calculator for an instant result of the operating cycle.

Cost of Goods Sold (COGS)

For calculating COGS, one has to consider a simple formula.

COGS = Opening inventory + Purchases made during the period – Closing inventory

Average Inventory

It is the average of opening and closing inventory.

Average Inventory = (Opening inventory + closing inventory) / 2

Credit Sales

It is the portion of total sales that are sold for credit to accounts receivables.

Average Accounts Receivables

It is the average of opening and closing account receivables.

Average Accounts Receivables = (opening receivables + closing receivables) / 2

Example of Operating Cycle

Let us try to understand the concept of the operating cycle with the help of an example.

Calculate the Operating Cycle of XYZ ltd. from the following data:

- Opening inventory = $115,000

- Closing inventory = $175,000

- Opening receivables = $87,500

- Closing receivables = $115,000

- COGS = $425,000

- Credit sales = 650,000

| Particulars | Opening Balance ($) | Closing balance ($) | Average ($) |

| Inventory | 115,000 | 175,000 | 145,000 |

| Receivables | 87,500 | 115,000 | 101,250 |

Inventory Turnover = 425,000 / 145,000 = 2.93

Inventory Holding Period = 365 / 2.93 = 124.57 days

Receivable Turnover = 650,000 / 101,250 = 6.42

Accounts Receivable period = 365 / 6.42 = 56.85 days

Therefore, Operating Cycle = 124.57 + 56.85 = 181.42 days

Interpretation of Operating Cycle

In the example above, the operating cycle period is 181.42 days, that is, approx. 182 days. This means that it will take 182 days to convert cash into cash again. For the efficient functioning of an organization, it is important that there is a smooth flow of operating cash flow to sustain this cycle. Else, there will be bottlenecks at production levels due to a cash flow crunch. And the company will not be able to operate efficiently and at the desired capacity. Moreover, the shortage of funds may also raise the cost of purchases, either stretching the credit period so suppliers will increase the cost or increase in the frequency of purchases leading to increased cost of raw material procurement.

Also Read: Operating and Cash Operating Cycle

Therefore, it is very essential that enough working capital is available to maintain the operating cycle. In the absence of this, the company may lose the market, reputation, and credentials, besides higher operating costs.

Cautions

A manager should always try to minimize the operating cycle period. There are various methods by which the inventory holding period can be reduced, and the most popular of all is JIT (Just In Time). Similarly, the receivable period can also be reduced by framing proper credit policies.