Decoding Packing Credit

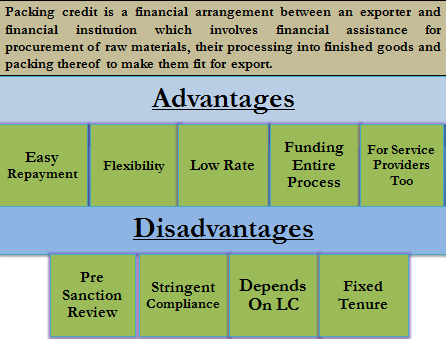

Packing credit is a financial arrangement between an exporter and a financial institution. It is a pre-shipment credit. As the name suggests, pre-shipment credit involves financial assistance for the procurement of raw materials, their processing into finished goods, and packing thereof to make them fit for export.

Packing credit offers many advantages and disadvantages. Let us see them below.

Advantages of Packing Credit

You will find a list of the advantages associated with Packing Credit that I have provided.

Easy Repayment

Financial institutions extend packing credit against confirmed export orders or letters of credit issued by the bank of the overseas buyer. Hence, the proceeds of the export orders are first utilized in repaying the loan. It makes the loan totally liquid in its nature as the repayment schedule is inherent in the completion of the export order.

Flexibility

Packing credit comes with great flexibility. Banks can provide funds in the home currency and convertible foreign currency (E.g., Dollar, Pound, and Euro). Financial institutions also allow exporters to repay debts with the proceeds of another export order. They are commercially exchangeable, and the other export order is from the same importing country.

Low Rate of Interest

Every country wants its exports to grow and be more competitive in international markets. It cannot be made possible until finances are available to export houses at a nominal interest rate. Financial costs are included in the cost of the product. Hence, countries have made policies that allow exporters to take packing credit at a concessional rate that is lower than the prime lending rate.

Funds for Entire Process

Banks extend packing credit for the entire process, including the procurement of raw materials, their conversion into finished goods, storage in warehouses, and packaging. In other words, packing credit absorbs all the manufacturing costs and other costs, making the goods fit for export. Hence it’s a full-time credit that can be expended for any purpose, which leads to the export of goods. The quantum of advance is based on the FOB value of the export/letter of credit minus a certain margin.

For Service Providers Too

Banks do not limit the availability of packing credit to the exporter of goods only. Even an exporter of service needs finance before supplying his services. It may require funds in the form of the cost of training personnel, procuring additional input services and goods necessary for delivering export services, etc. Hence a service provider can also avail of packing credit.

Disadvantages of Packing Credit

Listed below are the disadvantages of packing credit.

Extensive Pre Sanction Review

Banks perform an extensive pre-sanction review on the exporter and the importer. They assess from the past records whether the exporter is bonafide and whether it has the required license to export or not etc. They further evaluate other parameters like the product’s profitability and importing country’s stability (both politically and economically). The whole process turns out to be very tedious for the borrower at times.

Stringent Compliance

Taking an advance is relatively easier than complying with the follow-up conditions. Financial lenders ask for stringent compliance like submitting regular stock statements, physical verification of stock, and status reports. Such regular compliance adds to the administrative burden on the borrower and disrupts normal operations.

Also Read: Import and Export Letter of Credit

Dependence on LC

The whole mechanism of packing credit relies on the letter of credit issued by the importer’s banker. It sometimes turns out that the bankers are not ready to offer a letter of credit to new importers. Thus, if any bona fide importer fails to get the letter of credit from their bank, then this whole process will fail.

Fixed Tenure

Financial institutions provide packing credit generally for a period of 180 days plus a one-time extension of 90 days. The specific duration and extension policies may vary among different financial institutions and depending on the circumstances of the export transaction. Under the credit period, the bank assumes that the exporter would be able to realize his export proceeds and repay his debts to the bank. However, under many external circumstances, the exporter fails to do so. Thus, the exporter has to repay the loan with a penal interest rate.

Collateral Requirements

Financial institutions typically require collateral or security to grant Packing Credit. This can pose a challenge for exporters, especially small and medium-sized enterprises (SMEs), who may struggle to meet the collateral requirements.

Conclusion

Although packing credit is easily available to the seller/exporter, there is a problem with complying with strict provisions too. The seller can avail of finance easily and meet his further production needs. But this process of availing credit also requires regular verification of reports and statements. In a nutshell, the seller must consider all the disadvantages involved before procurement of credit from the institution.

Frequently Asked Question (FAQs)

In case of a delay in shipment, it is possible for the exporter to repay the Export Packing Credit (EPC) by taking an advance from the overseas buyer. This situation can arise when there is a delay in the shipment of goods, and the exporter needs to repay the EPC before the export proceeds are received. If the exporter has a good relationship with the overseas buyer and the buyer agrees to provide an advance payment, the exporter can utilize this advance payment to repay the EPC.

Exporters who have a valid export order, necessary licenses, and a satisfactory credit history are generally eligible for Packing Credit. Eligibility criteria may vary among financial institutions.

To apply for Packing Credit, you can approach a bank or financial institution that offers export finance services. They will guide you through the application process, which typically involves providing necessary documentation and meeting their eligibility criteria.

No, Packing Credit specifically caters to the financial needs of exporters during the pre-shipment phase. For post-shipment activities, different forms of financing, such as post-shipment credit or export bill discounting, may be available.

Excellent, plain, simple objective explanation. Covers all sides of the matter. Congratulations from Brazil Mr. Sanjay Bulaki Borad. Thank you very much.

Clear explanation..but one thing I wanted to know that in case of delay in shipment, can the EPC be repaid by taking advance from the overseas buyer