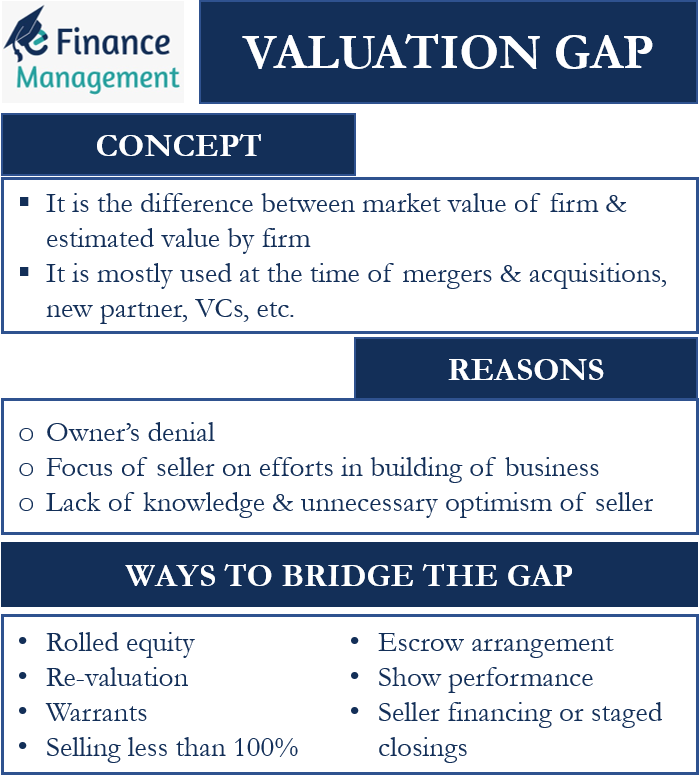

Valuation Gap, as the word suggests, is the difference between the market value of a firm and the value that the firm estimates it is worth, as also the value perceived by the new investor. One would normally come across this term during mergers and acquisitions, investments by a new partner, VCs, etc. And due to this perception gap several times, many deals fall apart even after reaching an advanced stage.

The owner or the seller may have a biased view of the firm and thus, of course, may value it more than the market value. On the other hand, the acquirer or the buyer may focus on the issues with the firm and thus, may not agree with the seller’s value estimate. Such differences (and more reasons) result in a valuation gap. Also, timing issues between the buyer and seller in the market may also result in such a gap.

In many cases, buyers and sellers do try to bridge the gap at the time of negotiations. They try to bridge the gap using various methods, such as rolled equity structures, earnouts, and vendor financing.

Reasons for Valuation Gap

Owner’s Perception & Denial

Many believe that a crucial reason for this gap is when the owner denies the existence of any such gap. The seller will not try to bridge the gap in such a case. So, in a way, a lack of knowledge and unnecessary optimism of the seller could result in such a gap. Same way, sometimes over the pessimistic attitude of the buyer also can result in such a gap.

Also Read: Process of Acquisition

Generally, the seller’s optimism shows up when they value the business, as well as are asked to come up with the expected growth rate. Or when the seller is asked about the performance of the company’s assets. Or the money that they are willing to part with following an exit.

Seller’s Efforts in Building Business

One more reason for the gap could be the focus of the seller on the efforts they undertook to build the business. Usually, a seller assumes that the new owner will continue to get the same benefits that they have got from the business. However, this may or may not be true in all cases. In some cases, the buyer has to align with the market dynamism and may need to go with new policies, new investments, etc. And all that may give a different result than the legacy.

Ways to Bridge Valuation Gap

There are many ways to bridge the valuation gap. Some of the most popular ones are detailed below:

Seller Financing or Staged Closings

In all businesses, negotiations and settlements are the most crucial way to clinch the deal and do business. Since here also, it is mostly a perception gap, which can be bridged or sorted out only by discussions. Hence, the most popular way to move ahead is to discuss and make a compromise by both parties to close the gap and conclude the deal.

Generally, the seller financing is through an earn-out. In this, the buyer makes an upfront payment and then gives the seller some time to get more capital as long as certain conditions are met. Such a method ensures that the seller has full confidence in the value they are expecting. Also, it benefits buyers as they pay the full price only after the business meets the expectations. Or the buyer has the option to pay the remaining amount in stages.

Rolled Equity

Such a method is helpful if the shares are valuable and the seller is confident in selling them. In such a situation, the seller buys some part of the shareholding once the sale of the business is over. This would mean that the seller will still have some control even after the sale. One important point from the perspective of the buyer is that the buyer should ensure that the stake seller retains or gets a minority one and not equal or substantial. This would ensure that the buyer enjoys full and unhindered control of the business.

Re-Valuation

As the word suggests, this is valuing the business again, but by an independent business valuer. It may happen that the seller does not take into account several aspects that may impact the valuation. Or the seller uses personal bias in the valuation. If such is the case, then to bridge the gap, parties may take the help of a professional business valuer to get the true value of the business. Based on the valuer’s report and business valuation, it becomes easier for both the parties to understand the perception of each other well, and that would lead to an amicable closure of the deal.

Warrants

Warrants are the type of options that give investors a right (not obligation) to buy the stock at a certain price in the future. The money that the company gets after an investor uses this option serves as a source of capital. Such a method ensures that the buyer agrees to the pre-exercise security valuation of the seller but on the condition that the buyer gets a warrant to acquire more shares as a hedge. Moreover, the buyer can use the warrants anytime when the firm fails to hit the set milestones. One crucial thing that the seller needs to determine in case of warrants is the exercise price.

Selling Less Than 100%

In this, the seller sells only a part of the firm. This shows that the seller has confidence in the business. Also, it allows the owner to take part in the future business activities of the firm.

Escrow Arrangement

In this case, both the parties agree on a certain value but are unsure of the financial impact of one or more identified risks with the business. For instance, a business may have a pending court case. Thus, it gets challenging to determine the liability that a business may incur due to the case.

One way to overcome this is the buyer agreeing to deposit some part of the final price into an escrow account. After the risk is settled, the buyer can make the balance payment, with or without any adjustments.

Show Performance

If there is a gap and the seller is confident in the business, then they may back out of the deal and work hard to grow the business organically. The growth would push up the market value, and the buyer would also acknowledge the value that the seller was asking for.

Final Words

Valuation Gap is common in mergers and acquisitions and may result in delays or even failure of the deal. Thus, it is crucial that parties work hard to bridge this gap to successfully complete the deal. One best way to bridge this gap (even before the negotiations start) is to have a deep understanding of the firm and its operations well before the deal. This would allow the owner to implement several strategies to boost the company’s value so that it meets the expectations. Bringing in an independent professional valuer also eases the job.

Frequently Asked Questions (FAQs)

It is the difference between the market value of a firm and the value that the firm estimates as its worth.

A crucial reason for the gap is when the owner’s perception. He denies the existence of any such gap.