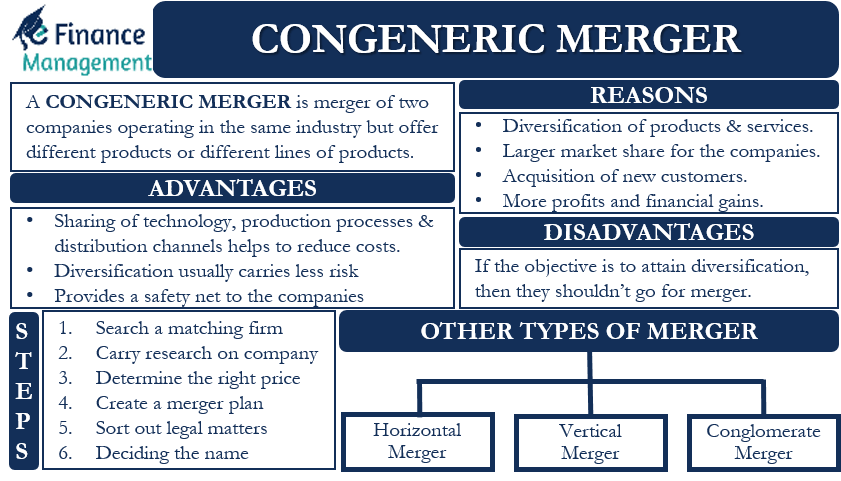

A Congeneric Merger is one of the important types of a merger in the corporate world. Such a merger involves the merger of two companies that operate in the same industry but offer different products or different lines of products. Though these companies do not offer the same products, they may have in common technology, production processes, and/or distribution channels. We also call this merger Concentric Merger.

This type of merger is an important growth strategy that allows companies to boost their revenue through diversification. The primary objective of this merger is to extend the product line by using the product and customer base of the two companies.

In a merger where there is an extension of a product line, we call it a product extension merger. And, if the objective of the merger is to extend the market, then we call the merger a market extension merger.

Congeneric Merger – Reasons

Following are primary reasons why companies go for a concentric merger:

Diversification

Since the companies in this merger offer different products, it results in the diversification of the products and services.

Bigger Market Share

Diversification or extension of the product line eventually leads to a larger market share for the companies.

New Customers

Offering more products and services, as well as operating in more regions, leads to the acquisition of new customers.

Financial Gain

All the above three objectives result in more profits and financial gains. Also, sharing of technology and distribution channels leads to financial gains and savings.

Examples of Congeneric Merger

Following are the real-world examples of congeneric mergers:

The formation of Citigroup in 1998 is one such example. This was formed following the merger of Citicorp and Travelers Group. Both these firms used to operate in the same industry; however, product offerings were different for both these firms. Before the merger and formation of Citi Group, Citicorp was in the traditional banking services and credit card offering. And though Travelers was in the same industry but was offering insurance and brokerage services.

The 2002 merger of Broadcom and Mobilink Telecom is also a good example of this type of merger. The two firms were part of the electronic industry but were offering different products.

The acquisition of Vitamin Water by Coke in the year 2007 gave the latter an even stronger foothold in the Beverage industry.

Another similar example is of the year 2002, the merger of Nextlink and Concentric. Both the firms were part of the same telecommunication industry. However, Netflix was into providing broadband services on optical fiber cable and wireless broadband. At the same time, the other firm was into internet solutions for small and medium firms. This merger leads to the creation of an entity offering varying services to small and medium-sized firms, internet to broadband.

One of the biggest examples of a congeneric merger is the $100 billion deal between Heinz and Kraft in 2015. At the time, Kraft was a major producer of mayonnaise, cheese, and more. And Heinz was the bigger producer of pasta sauce, meat sauce, and frozen appetizers. The merger between the two resulted in the creation of one of the biggest companies in the food industry, Kraft-Heinz.

Also Read: Conglomerate Merger

Pros and Cons of Congeneric Merger

These are the advantages of a concentric merger:

- The sharing of technology, production processes, and distribution channels helps to reduce costs. It also leads to economies of scale.

- Generally, diversification is not without risk. However, in this type of merger, since the two companies operate in the same sector, diversification usually carries less risk, and implementation becomes easier.

- Since this diversification extends the products and product lines, it provides a safety net to the companies. This means that if one product is not doing well, then the company would still have chances to up its revenue through other product lines / regions / geographies / customers and so on.

Talking about the disadvantage, there are not many. The only disadvantage is that since both companies operate in the same industry, the scale of diversification is very limited. Though this is not actually a disadvantage, instead is a limitation. So, if the objective of the company is to attain greater diversification, then they should not go for this type of merger.

Process or Steps for Successful Congeneric Merger

A firm needs to follow the below steps to execute a successful concentric merger:

Search a Matching Firm

A company planning for a merger must first decide the type of company it wants to work with. To get an answer to this question, it is important to understand why in the first place does; a company wants a merger. For instance, the objective could be product expansion or market extension, or sharing competencies or technologies. Depending on what a company is looking for, it must work on finding the right company.

Carry Research on the Company

Now that we know an option (or options), we must not immediately decide on merging with that company. Instead, we must try to find out in-depth details and analysis about that company as much as possible. This could be for its strength, weaknesses, debt, management, how they do business, how it works, and more.

We can request the financial details, business plans, and more to get the information. Moreover, we can also conduct meetings with the executives to get in-depth information on the company.

Determine the Right Price

Now that we are 100% sure of the company we want to merge with or acquire, we need to finalize the price we want to pay for it. Along with coming up with monetary compensation, we may also need to come up with good reasons to convince the other company’s management and shareholders for the offered price.

Create a Merger Plan

A merger just is not about buying the other company. Just paying for the company will not result in success. Instead, the acquiring company must have a proper merger plan to integrate the other company. Among other things, a merger plan should include the following questions:

- What roles will need to be assigned to the executives of the other company?

- How much compensation shall we give to those executives?

- Do we want to make any changes in the operations and operating style of that other company? And if so, what will be those changes, and what is the process of introducing the changes?

- How much freedom will we be giving to the existing management of the other company?

Sort Out Legal Matters

In a merger and acquisition, legal matters could ruin the plans. Thus, it is vital that we have a very good attorney and an accountant at our side. We must talk with the attorney to cover all the loopholes and the legalities to ensure that the merger goes out smoothly without any legal hassles.

Deciding on the Name

Yes, this is very important. Once we sort all the technicalities for the merger, we also need to decide whether we want to keep the old name or get a new name. Usually, a new name is preferable if the two companies are not popular or have not been performing well. And, if one of the companies has a good reputation in the market, then it is preferable to use that name. Moreover, if both companies have a good reputation, then having a new name that is a combination of the two names is a good strategy.

Other Types of Mergers

Apart from the Congeneric Merger, there are three more types of mergers. These are:

Horizontal Merger

Such a merger involves two firms (possibly rivals) operating in the same industry. The objective of this merger is to extend the market share and enjoy the benefits of two strong competitors becoming one.

Vertical Merger

This merger involves the acquisition of a company in the same industry but operating in a different part of the supply chain. Such a merger gives the acquiring company better control over the supply chain and results in savings.

Conglomerate Merger

It refers to the merger of unrelated firms. Diversification is the primary objective for undergoing such a merger.

Final Words

A congeneric merger is one of the best ways for two different firms to attain success together. Moreover, this merger is less risky as well as it belongs to the same industry. However, like with any other merger, this merger could fail to give results if the execution is not right. For successful execution, it is crucial to have clear communication, proper plans, objective alignment, and due diligence beforehand.

Frequently Asked Questions (FAQs)

A congeneric merger means the merger of two companies operating in the same industry but engaged in different lines of products.

A merger where there is an extension of a product line is a product extension merger. While if the objective of the merger is to extend the market, it is a market extension merger.

1. Increase in revenue through diversification

2. Larger market share for the companies

3. Operation expansion in more regions

4. Acquisition of new customers

5. Sharing of distribution channels for financial gains & savings