Just Say No Defense: Definition

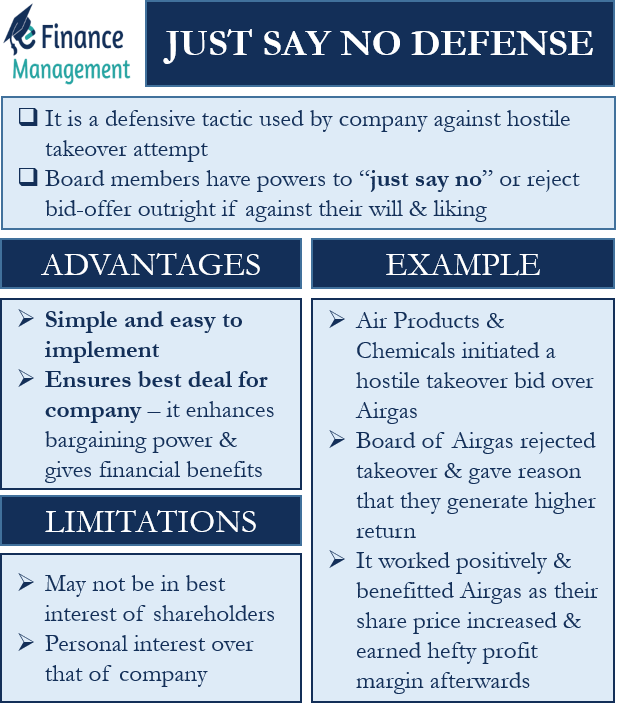

“Just Say No” defense is a defensive tactic used by a company against a hostile takeover attempt. The Board members have the power to “just say no” or reject a bid-offer outright if it is against their will and liking. In simple words, it is merely saying no to a takeover bid attempt. This defensive bid is more of a delaying tactic on the part of the management. It sometimes helps to extract a higher bid price from the acquirer. However, this tactic can prove futile if the Board members become adamant about using it even if the acquirer is offering a significant premium from the current market price of its shares. Also, the Board may use this tactic forcibly against the will of its shareholders.

Advantages of the “Just Say No” Defense

Simple and Easy to Implement

“Just Say No” defense is the simplest and easiest tactic to apply in case of a hostile takeover attempt. The Board has to simply assess the pros and cons of the acquisition proposal and its feasibility. If the bid is not good for the company, they can easily use this defense and reject it outright.

Ensures Best deal for Company

“Just Say No” defense ensures that the board closes on the best deal for the company and its shareholders. They can simply say no and reject the takeover bid if they feel that it is not in the best interests of the company. Also, this defense enhances the bargaining power of the management. It helps to put pressure on the acquirer to raise the offer price. The Board can also approach some other interested party and offer to complete the deal at the offer price of their liking. This can prove to be a financially beneficial proposition for the shareholders.

Limitations of the “Just Say No” Defense

It May not be in Best Interest of Shareholders

“Just Say No” defense tactic may not prove right and is always in the best interest of the shareholders. The Board has the power to say no or reject a takeover bid attempt even if the acquiring party is offering a significant or a decent premium over the current market price of the stock. The Board’s vested interest, their inept analysis of the proposal, and many such reasons may lead to the conclusion that the Board may not like the proposal. Or they may simply reject a bid just because they have some other long-term plan for the company in their mind. This may sometimes result in a loss to the shareholders. A good and financially advantageous proposition for the shareholders can be turned down by the Board.

Personal Interest over that of the Company

The Board may use the “Just Say No” defense and turn down a takeover bid just to promote their interests. Once a takeover attempt goes through, the board will have to work under the new owner. They may not like the owner and simply say no to the deal. The Board members may have anxiety about losing their job once the takeover is complete. This can also motivate them to use the “Just Say No” defense, even if it is for the good of the company and its shareholders.

Example of “Just Say No” Defense

Air Products & Chemicals initiated a hostile takeover bid over Airgas in the year 2010. The Board of Airgas used the “Just Say No” defense to reject the takeover offer at $70 per share in cash. The valuation of Airgas was estimated to be close to $6 billion as per the bid-offer.

The board of Airgas justified saying no to the offer by putting forward the point that their company has generated far higher returns than the acquiring company. Therefore, the deal did not offer the best price and was not in the best interests of the company and the shareholders.

However, the deal price did offer a 38% premium over the market price of the shares of Airgas on the offer day. The offer price was also at an 18% premium over the stock’s 52-week high. Here the question arose: The takeover bid may have benefited the shareholders. It would have made the shareholders richer, and the Board should have said a yes.

Also Read: Hostile Takeover

Air Products & Chemicals had a rationale for their higher bid offer too. They had a long-term view that combining the two companies would result in cost synergies. The two companies can grow at a higher percentage rate than any of them individually.

The “Just Say No” defense in this deal did work positively for the shareholders of Airgas eventually. As mentioned above, as one of the benefits of this type of defense, using this defense raised the offer price of Air Products & Chemicals. They eventually had to agree to pay $143 in cash for every share of the company in the year 2015. Hence, the shareholders benefitted by a hefty margin of $73 per share.

RELATED POSTS

- White Squire Defence – Definition, Advantages, Disadvantages, and Example

- Takeovers

- Poison Pill: Meaning, Pros & Cons, Types, Examples, and More

- Pac Man Defense – Meaning, Pros, Cons, and Example

- Bear Hug – Meaning, Bear Hug Letter, Advantages, Disadvantages, and Example

- White Knight – All You Need To Know