The share buyback, also known as a share repurchase, is an action to buy back the shares from the shareholders. This transaction involves two:

- Company

- Shareholders

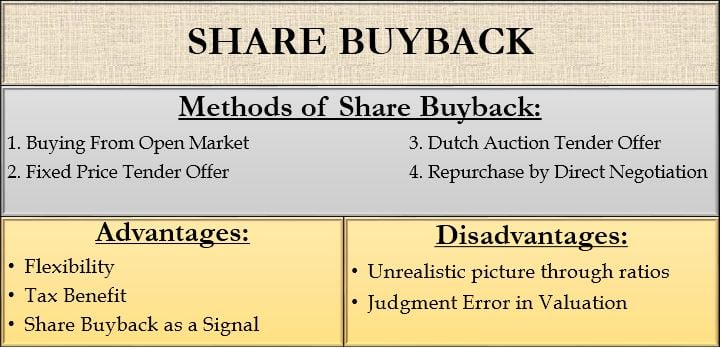

The company buys back the shares from the interested shareholders by offering them cash. There are many methods of share buyback. Also, there are certain advantages of share buyback and disadvantages too. We will discuss them here.

Methods of Share Buyback

Buying from Open Market

In this method of share buyback, the company buys its own stocks from the market. This transaction happens through the company’s brokers. This repurchase program takes place for a longer period of time as the company needs to buy back large blocks of shares. After the announcement, the company is under no obligation to conduct the repurchase program. The company has the option to cancel it. Also, it can make changes in the repurchase program according to the company’s situation and needs. Effective implementation of this method can prove to be very cost-effective.

Fixed Price Tender Offer

In this method, the company makes an offer to buy a fixed number of shares at a fixed price to its shareholders. The company offers a price that is above its current market price. The shareholders have the option to sell back or hold the shares. Interested shareholders submit the number of shares they are willing to sell back to the company. If the total number of shares exceeds the shares requirement of the company, such buyback will take place on a pro-rata basis. This method is quick to conduct, but it can be costlier than buying shares back from the open market.

Dutch Auction Tender Offer

This is very similar to a fixed-price tender offer. Instead of specifying a fixed price, the company offers a range of prices to the shareholders. The minimum price is above the current market price. For example, a stock is currently trading at $100. The company offers to buy back 2 million shares within the range of $101 to $103. Investors will bid the no. of shares and the minimum price they want to sell the shares. The company will start qualifying bids from $101 and move to higher prices until the requirement of a fixed number of shares is fulfilled. If at $102, the requirement of 2 million shares is fulfilled, every qualified bidder is paid $102. Bids above $102 will be rejected. If total bidding at $101 and $102 exceeds the requirement of shares, then share buyback happens on a pro-rata basis.

Repurchase by Direct Negotiation

In this method, the company approaches only those shareholders who have a large block of shares. The company pays a premium above the current market price to them. This is a more logical approach as the company can directly negotiate with larger shareholders.

Buyback Programs

A company may also implement a buyback program, which outlines the details and parameters of the share repurchase. The company sets specific guidelines, such as the maximum number of shares to be repurchased, the duration of the program, and the price range at which the shares will be bought. Buyback programs provide flexibility for the company to repurchase shares over an extended period of time, depending on market conditions.

Accelerated Share Repurchase (ASR)

An ASR is a method where a company enters into an agreement with an investment bank to repurchase a large block of its shares in a short period. The investment bank typically borrows the shares from shareholders or uses its own inventory to provide the shares to the company upfront. The company pays for the shares in advance, and the investment bank buys back shares in the open market over time to replace the borrowed shares.

Advantages of Share Buyback

Flexibility

The share buyback is flexible in nature. The share repurchase program is conducted for an extended period, unlike cash dividends that need to be paid immediately. Also, the company is under no compulsion to conduct the repurchase program. It can cancel it or modify it according to their needs. The shareholders are also under no compulsion to sell back the shares. They can choose to hold the shares if they want to.

Tax Benefit

Some countries have lower capital gain tax rates than the dividend tax rates. Compared to dividends, share repurchases can be more tax-efficient for shareholders. When a company repurchases shares, shareholders who sell their shares may be subject to capital gains tax, which is typically lower than the tax on dividends. This can be advantageous for shareholders, especially those in higher tax brackets.

Enhanced Shareholder Value

By reducing the number of shares outstanding, share repurchases can increase earnings per share (EPS), which may lead to an increase in the stock price. This can benefit shareholders, as it enhances shareholder value and can be a positive signal about the company’s prospects.

Share Buyback as a Signal

The share buyback is generally a positive signal because the company perceives its shares to be undervalued, and it has confidence in its growth prospects. There could also be a possibility that the company does not have profitable reinvestment opportunities, so they are buying back the shares. This could be a negative signal for growth investors. Investors can analyze this action and its purpose to understand where the company is heading to. The idea here is that actions speak louder than words.

Better Financial Ratios

A decrement in the number of shares will lead to higher ratios such as EPS, DPS, ROE, etc. since the profit will remain unaffected. Therefore, this will result in increased profitability per share.

Disadvantages of Share Buyback

Judgment Error in Valuation

Though management has better access to information about the company, there are chances that they also can make mistakes about valuing the company. If the buyback is undertaken to support the undervaluation, but the company overestimates the future prospect, this mistake will make the whole buyback process futile.

Unrealistic Picture through Ratios

Share buyback boosts some ratios like EPS, ROA, ROE, etc. This increase in ratios is not because of the increase in profitability but due to a decrease in outstanding shares. It is not an organic growth in profit. Hence, the buyback will show an optimistic picture that is away from the company’s economic reality.

Misallocation of Capital

Share repurchases may be criticized if a company chooses to buy back shares instead of investing in research and development, capital expenditures, or other growth initiatives. If a company lacks suitable investment opportunities, share repurchases can be a reasonable choice. However, if done excessively, it may hinder long-term growth potential.

Debt Increase

Companies that fund share repurchases through debt can increase their leverage, which may lead to increased interest expenses and financial risk. Overleveraged companies may face difficulties in servicing their debt obligations, particularly during economic downturns.

Perception of Lack of Investment Opportunities

Share repurchases may be seen as a signal that a company lacks attractive investment opportunities or is unable to generate sufficient organic growth. This perception can negatively affect investor confidence in the company’s future prospects.

Conclusion: Methods of Buyback

Along with the various methods of share buyback, this process has its own advantages and disadvantages too. Each method has a different level of flexibility regarding modification in terms. A company is under no obligation to buy back shares. It may cancel such an offer anytime after the announcement, making buybacks more attractive.

Excellent

best explanation ever