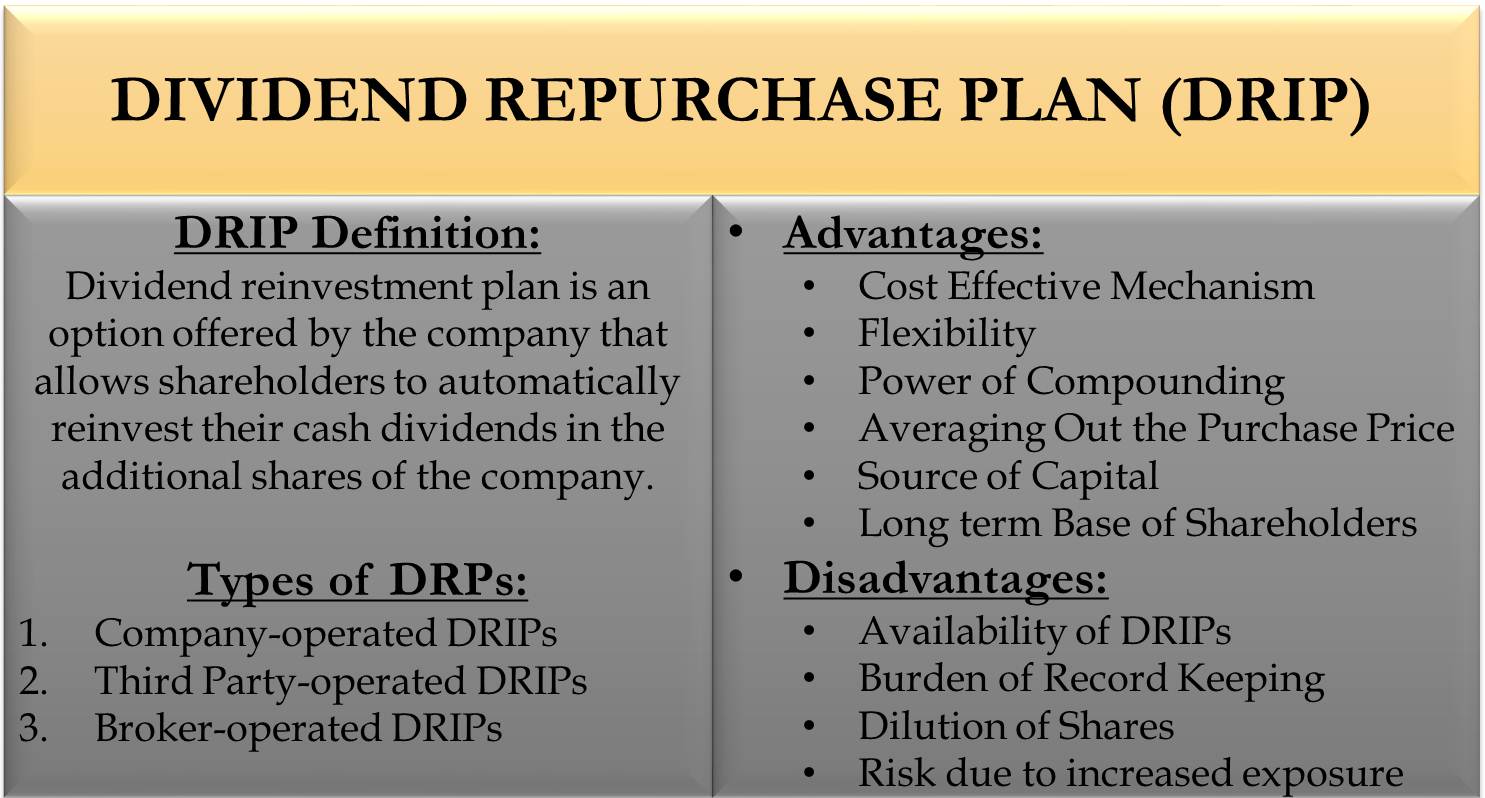

Dividend Reinvestment Plan: Definition

A dividend reinvestment plan (DRP or DRIP) is an option offered by the company that allows shareholders to automatically reinvest their cash dividends in the additional shares of the company. This plan offers the advantage of compounding earnings. Shareholders need to inform the company if they wish to be part of DRIP. The shareholder can choose to invest all or some parts of the cash dividend into additional shares under this plan.

Example of Dividend Reinvestment Plan

To understand DRIP with the help of an example, consider the following details of Company X:

| Particulars | Amount ($) |

|---|---|

| Dividend Per Share (DPS) | $5 / Share |

| Market Price Per Share (MPS) | $30 / Share |

| DRIP Participation | 100% |

| DRIP Discount | 2% |

Let’s say you hold 2,000 shares of company X. You have opted for 100% DRIP participation, so all of your cash dividends will be reinvested in additional shares of the company. Here, the total dividend received by you is $10,000 (i.e., $5 * 2,000). The market price of the share is $30/Share, and the company is offering a 2% discount on the market price for the purpose of reinvestment. So the price would be $29.4/Share.

Therefore, you will receive 340 shares ($10,000/$29.4) instead of receiving a dividend of $10,000. Your total holding would be 2,340 shares. The fractional amount forgone because of the rounding off will be carried forward to the next dividend payment (i.e., 10,000 – ($29.4*340) = $4)

Types of Dividend Reinvestment Plans

The following are the three types of dividend reinvestment plans:

Company-operated DRIPs

The company operates this plan by itself. It has a specific department that handles all the aspects of this plan. Shareholders can enter a DRIP by directly contacting this department.

Also Read: Dividend Per Share (DPS)

Third Party-operated DRIPs

The company might find managing the DRIP costly and time-consuming. So they use third parties or transfer agents to manage all the aspects related to DRIP.

Broker-operated DRIPs

There are some companies in the market that don’t have their own DRIP available. Some brokerage houses try to take advantage of this opportunity. They provide an option of DRIP on some shares to their clients. Brokers reinvest the dividends by buying shares from the open market. So, broker-operated DRIPs affect the market price, and shares received through this plan can be sold in the secondary market.

Advantages of Dividend Reinvestment Plan

The following are the advantages of dividend reinvestment plans:

Cost-Effective Mechanism

DRIP is a cost-effective method to accumulate shares as the company charges no brokerage or some brokerage to shareholders. Some companies also provide a discount on the market price, so shareholders will be able to buy more shares against the dividend income. The DRIP manager might take some initial setup fees, depending on the market. However, DRIP is more cost-effective in comparison to buying shares from the open market every time.

Flexibility

DRIPs are flexible in nature. They provide an option to invest small or large amounts in the plan. So small investors are also able to start investing with a small amount. Due to its flexibility and cost-effectiveness, small investors find it an attractive option.

Power of Compounding

Every time the company reinvests dividends, a shareholder gets additional shares in return. So, if a company increases dividends in the future, shareholders will receive more shares under DRIP. For a profitable company, this compounding effect increases the return potential from the investment. This is the power of compounding.

Averaging Out the Purchase Price

Over a long period, DRIP managers try to average out the buying price for the shareholders. When share prices increase, investors receive less number of shares for reinvesting dividends and vice versa. Using this system, shareholders’ buying price comes to an average level that is unaffected by fluctuations in the stock price.

Source of Capital

Company-operated DRIPs are a great source for the company to create more capital. The company will be able to raise this capital at a low cost because it is a direct transaction between shareholders and the company.

Long-term Base of Shareholders

Shareholders who have opted for DRIP will generally invest with a long-term vision of growth. So this will create a loyal base of shareholders for the company. These shareholders will generally not sell the shares when market prices fall, and they must be sold back to the company.

Disadvantages of Dividend Reinvestment Plan

The following are the disadvantages of dividend reinvestment plan:

Availability of DRIPs

One of the issues with DRIPs is that not all companies offer them. So, investors will have to opt for broker-operated DRIPs, which are costlier than company-operated DRIPs.

Burden of Record Keeping

Shares received through DRIPs are subject to capital gain tax. Shareholders opting for DRIP will have to keep a record of every transaction, the prices at which buying/selling was taking place, and capital gains/losses. For example, you held shares for 10 years, and the company paid dividends 20 times during that period. So maintaining all the data required by tax authorities for 20 transactions can be time-consuming and burdensome.

Dilution of Shares

Each time a company issues new shares against the dividend, the shareholdings get diluted. Shareholders not opting for DRIP will see their shareholding in dilution.

Risk due to Increased Exposure

DRIP will increase the exposure to one security in the portfolio. Unless a shareholder is very sure about the company’s growth prospects, they should not opt for DRIP. Shareholders should regularly analyze the company and its economic outlook. Based on that analysis, rebalance their portfolio by changing the amount of exposure to that company.